The crypto industry is not new to the activities of scammers, creating projects with false promises of high and fast yield. Founders have carted away millions of dollars belonging to investors, with FBI notices offering bounties for information regarding their whereabouts.

A 23-year-old self-acclaimed “crypto king” is facing allegations regarding $35M collected from investors. The money is nowhere to be found, and creditors scramble to uncover where it all went.

Who is Aiden Pleterski, the “Crypto King?”

Aiden Pleterski is the founder of AP Private Equity Limited, a company developed to handle crypto and foreign exchange investments.

According to PR articles, he is said to have found crypto as a way to buy and sell items and jumped on the opportunity to buy Bitcoin while the price was relatively low.

He worked with Compass Group Canada, employing his knowledge of cryptocurrency in cyber security, and worked with high-profile individuals like Tim Hortons. He eventually quit his job and started his company, AP Private Equity Limited.

Investor Claims She Gave Him $50,000 “Based on Trust.”

According to Diane Moore, a grandmother who invested $60,000 initially set aside for her grandchildren’s education, the company was responsible for trading on behalf of investors.

The agreement she had with the accused was a 70-30% split on capital gains. Pleterski was to take the lesser percentage from the yield on capital. He also promised her- in the investment contract that if there were any losses, the initial investment would be paid back in full. The capital yield was around 10% to 20%, coming in bi-weekly.

According to Moore, the agreement had been made based on trust, as she knew the “crypto king” through someone she had been friends with for years.

“The whole thing was based on trust,” Moore explained. “What Aiden has done, I think, is awful — and I don’t know how he can live with himself. I don’t know if he was ever really trading, or was this his plan, and it was just the story to get me in along with other people?”

Altogether, Aiden Pleterski owes over 140 investors, with 29 claiming they owned about $13 million each in the bankruptcy case.

The Missing Funds

Two McLarens, two BMWs, and a Lamborghini were among the $2 million worth of assets seized from Pleterski as concerned parties tried to gather the stolen funds. But, the assets on the ground barely make up for the millions of dollars investors handed over to his company.

According to Norman Groot, founder of Investigation Counsel PC and fraud recovery lawyer, the crypto king enjoyed a lavish lifestyle.

“This guy had a large lifestyle burn rate, but it doesn’t account for the amount of money that’s missing,” Groot told CBC Toronto. “What’s difficult with this particular case is that Pleterski was taking in a lot of cash — and how do you trace cash?” he added.

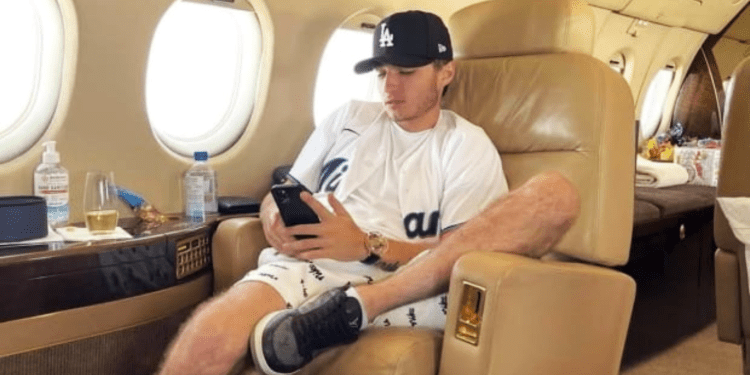

In addition, he owned 11 vehicles, had leased four other luxury cars, rented a $45,000 lakefront mansion, and did not shy away from flying private jets. His Instagram account clearly showed how the 23-year-old did not hold back on luxury.

Pleterski’s Lawyer Responds To Accusations

According to Micheal Simaan, the claims against his client, Aiden Pleterski, have been wildly exaggerated. He added that the “crypto king” never solicited money but was given by individuals who saw how much he made for himself.

When questioned by creditors, Pleterski claimed he had lost most of the money entrusted in his care due to margin calls and bad trades. But no records of his finances, indebtedness, or payments were provided.

While the bankruptcy case is the only chance of recovering the funds, Norman Groot explains that the more time that goes by, “the less likely there’s a recovery of evidence and less likely there’s a recovery of money.”