- Sei Network focuses on high-performance financial infrastructure rather than chasing short-term narratives.

- The upcoming Giga upgrade could significantly improve throughput, finality, and EVM performance.

- $SEI tokenomics favor long-term builders, with gradual vesting and value tied to future network usage.

If you only follow what’s trending, you usually miss what’s quietly taking shape. Crypto loves speed, but it’s brutal to shallow thinking. Plenty of chains talk about performance. Very few stop to explain the trade-offs behind it. Sei Network lives right in that gap. It isn’t loud on social media, it isn’t chasing whatever narrative is hot this week, and that’s exactly why it’s easy to overlook.

Sei focuses on solving a narrow problem, and it does so with intent. That makes it boring to some, and risky to misunderstand. This isn’t about hype or buying signals. It’s about understanding what Sei actually is, where it fits, and why builders seem more interested than speculators right now. Sometimes seeing the map early matters more than racing down the road.

What Sei Network Actually Is

Sei Network is a Layer 1 blockchain built with financial use cases in mind. More precisely, it provides infrastructure for financial applications, trading platforms especially. That’s the core. Still, it’s not limited to just one corner of crypto. You’ll also find gaming, NFTs, and activity across sectors like RWAs, AI, DePIN, DeSci, and of course DeFi.

The project comes from Sei Labs, founded in 2021 by Jay Jog, Jeff Feng, and Dan Edleback. Mainnet went live on August 15, 2023, alongside the $SEI token launch. That moment didn’t go smoothly. The airdrop was widely criticized, with even top wallets receiving only around $90 to $150. Not exactly the way to win friends.

Since then though, things have shifted. Sei quietly rebuilt momentum and became harder to ignore. What they’ve built is best described as purpose-built. Sei hasn’t changed its narrative to chase attention, and it hasn’t leaned into memes. Instead, it’s aimed at institutional-grade reliability, which tends to attract builders who care about performance more than price action.

Originally, Sei launched within the Cosmos ecosystem while remaining EVM compatible from day one. By June 2025, the team made the call to go fully EVM-only. Most activity was already happening there anyway. SIP-3 finalized that move through governance, and the network is now close to completing its full EVM transition.

How Sei Network Works Under the Hood

Think of Sei as a high-speed financial highway. It’s designed specifically for trading-focused applications. As a Layer 1, dApps run directly on Sei, not on a secondary layer. The goal is simple: speed, scalability, and low fees.

Sei often calls itself the fastest Layer 1, now reframed as the fastest EVM chain. In real-time transaction data, though, it doesn’t quite top the charts yet. According to Chainspect, it barely breaks into the top ten for live TPS. That doesn’t mean it’s slow, just that the “fastest” claim is still aspirational. For now.

That’s where Giga comes in.

Giga, the Big Bet

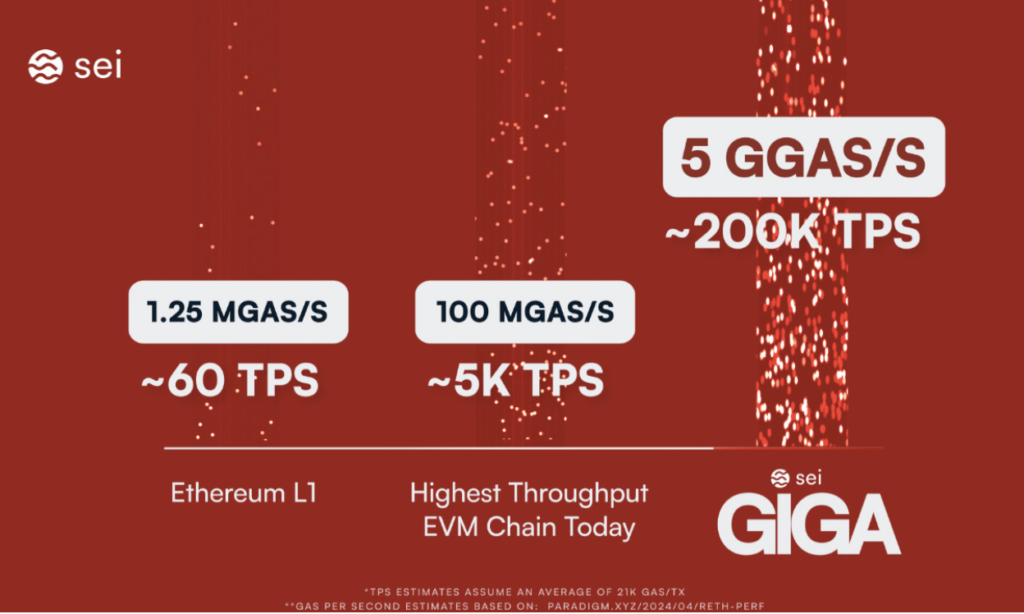

Giga is Sei’s major architectural upgrade, and it’s a big one. The aim is to radically increase performance using advanced techniques like parallel block proposals, multi-proposer consensus, and asynchronous execution. In simple terms, multiple validators can build blocks at the same time, transactions process in parallel, and bottlenecks shrink.

The roadmap and whitepaper are already out, and Giga is currently live on devnet. The long-term targets are ambitious: 5 gigagas throughput, sub-400ms finality, and over 200,000 TPS for high-performance EVM apps, a figure already hit in testing. There’s no confirmed launch date yet, but Q1 2026 is often mentioned. If Giga delivers, it could redefine what Sei is capable of.

Where Sei Is Placing Its Bets

Sei is positioning itself aggressively in the RWA space, a market already worth around $19 billion. Partnerships with major players like Securitize underline that strategy. At the same time, the network is targeting the AI agent economy, a sector with estimates reaching $200 billion. The idea is to offer machine-speed payment rails for agent-to-agent transactions.

Gaming is another strong point. In Q3 2025 alone, Sei recorded 116 million transactions, up 138% quarter-over-quarter, with an average of over 800,000 daily addresses. That’s not theoretical usage, it’s live activity.

$SEI Tokenomics in Plain Terms

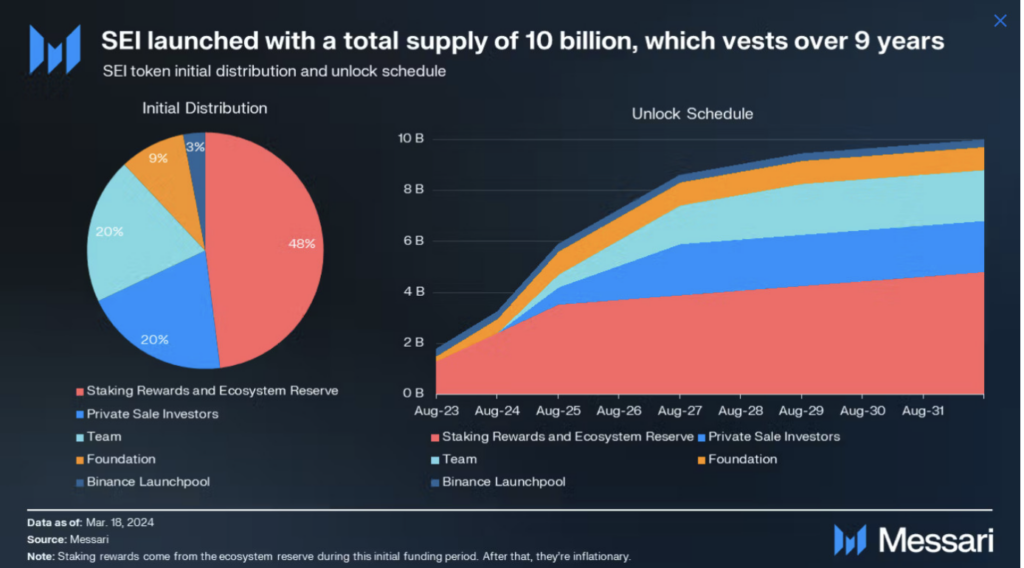

The $SEI token has a maximum supply of 10 billion. Roughly 65% is already circulating, which isn’t extreme. The vesting schedule stretches over nine years, with monthly unlocks on the 15th. The next unlock, on January 15, 2026, will release about 55.6 million tokens, roughly $6.1 million at current prices.

This long vesting reduces sudden supply shocks, and inflation tapers over time, which is healthy. There’s no aggressive burn mechanism, though, so long-term value capture depends on actual usage, not scarcity games. The token is used for network fees, governance, and trading fees on Sei-based markets. Solid fundamentals, but nothing designed for short-term fireworks.

The Bottom Line

Sei Network has real potential. It’s active in finance-heavy sectors like RWAs and agentic payments, and it’s shown strong usage in gaming. If the Giga upgrade lands as promised, it could be transformative. Still, a lot rides on that launch, and that carries risk.

Devnet results look promising, but the $SEI token itself has been drifting lower since late 2024. So the setup is clear. The vision is there. The infrastructure is close. Now it’s about execution. At some point, delivery has to catch up with design.