- Whales holding between 100,000 and 1,000,000,000 XRPs have been accumulating the token since March 7.

- Transaction volume on the Ripple network has been increasing consistently over the past week, signaling rising activity on the blockchain.

- The crypt community favors Ripple’s win in the ongoing case against the SEC as XRP readies for a 15% leap to $0.52.

XRP is trading at $0.45, 34.58% above the January 31 opening and 20% up over the last seven days. The international payments token leaped 32% from $0.37 on March 21 to a high of $0.49 on March 23. This came as several experts and industry leaders supported Ripple Labs, the company behind XRP, in their long-standing legal battle with the U.S. Securities and Exchange Commission (SEC).

Additionally, large investors’ technical setup and accumulation support XRPs bullish outlook. Where is XRP headed next?

Whales are Accumulating XRP

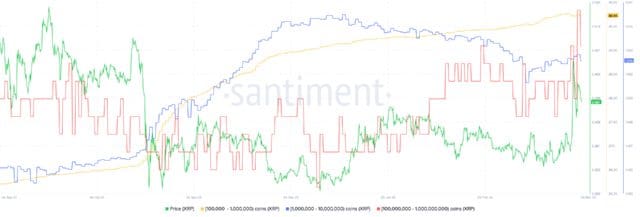

According to data from Santiment, a crypto data and market behavior analysis firm, large wallets hold between 100,000 and 1 billion XRP tokens. The data also reveals that these investors have accumulated the cross-border remittances token since March 7.

The chart below reveals that wallets holding 100K – 1M coins, 1M – 10M coins, and 10M – 1B coins have increased their XRP holdings over the last 14 days.

Whale accumulation is generally considered a bullish sign for an asset as it points to increasing investor confidence in the project. As more investors continue buying XRP in large numbers, its price is set to increase.

This is also revealed in the transaction volume on the XRP network, which has been increasing consistently over the past week, signaling rising activity on the Ripple blockchain.

This rising activity on the XRP network is represented by the rise in daily active addresses (see chart above), adding credence to XRP’s bullish potential. After the spike observed on March 19, Daily Active Addresses (24h) on the XRP network have climbed consistently, pointing to higher utility and relevance of the chain among users.

Also supporting the bullish narrative for XRP is Ripple’s support from industry leaders and experts for the blockchain company’s win in the lawsuit against the SEC. In December 2020, the regulator filed a case against Ripple, its CEO Bradley Garlinghouse, and Executive Chairman Christian Larsen, alleging that they “raised over $1.3 billion through an unregistered, ongoing digital asset securities offering.”

Ripple has recently received a lot of support from the crypto community on Twitter, who are favoring its win against the agency. One of the most significant support came from the CEO of Messari, Ryan Selkis, who said in a Twitter post that even though he criticized Ripple in the past, he was now “more aligned with them than ever before.” Ryan added:

“Ripple should win the overreaching XRP-SEC case, and the XRP Ledger should be allowed to compete fairly on digital payments infra globally.”

XRP Price Prepares For A 15% Rise To $0.52

XRP price action has led to the appearance of a symmetrical triangle on the four-hour chart (see below). This projects a 15% move in either direction.

The Relative Strength Index (RSI) and the moving averages pointed upward. The price strength at 60 suggested that the uptrend was strong in the shorter time frame. In addition, the Moving Average Convergence Divergence (MACD) indicator has begun tipping to the upside. Its position above the zero line in the positive region suggested that the market sentiment favored the upside.

These technical indicators implied that the path with the least resistance for the payments token was northward. As such, a daily candlestick close above the triangle’s resistance line at $0.46 would mean the bulls are strong enough to sustain the uptrend.

The first barrier could emerge from the $0.48 and $0.5 psychological levels. Above that, the XRP price may rise to reach the bullish target of the technical formation at $0.5285. This would bring the total gains to 15.56%.

XRP/USD Four-hour Chart

On the downside, XRP may turn away from the current level, with the first line of defense emerging from the triangle’s support line of $0.445. Losing this foothold would see XRP drop below the moving averages toward the bearish target of the symmetrical triangle at $0.38.