- The SEC has requested a temporary restraining order to freeze Binance assets.

- Only assets hosted on the affiliate Binance.US platform would be frozen.

- Binance has a limited window to transfer customer funds if assets are frozen.

Following the lawsuit, the SEC is now seeking a temporary restraining order to freeze all assets on Binance.US and halt the activities of Binance subsidiaries BAM Management U.S. Holdings Inc. and BAM Trading Services Inc., collectively known as “BAM.” The regulatory body accuses Binance and BAM of engaging in various violative conduct, including disregard for U.S. laws and evasion of regulatory oversight.

The SEC’s motion highlights Binance’s alleged deceptive practices and paints a picture of a company operating outside compliance boundaries. The accusations include artificially inflating trading volumes, diverting customer funds, failure to enforce restrictions on U.S. customers, and misleading investors about its market surveillance controls.

Binance’s Reaction

While the SEC’s action primarily targets Binance’s U.S. affiliate, Binance.US, the implications for the broader Binance ecosystem are substantial. However, if the SEC were granted a temporary restraining order, only US-based assets would be frozen.

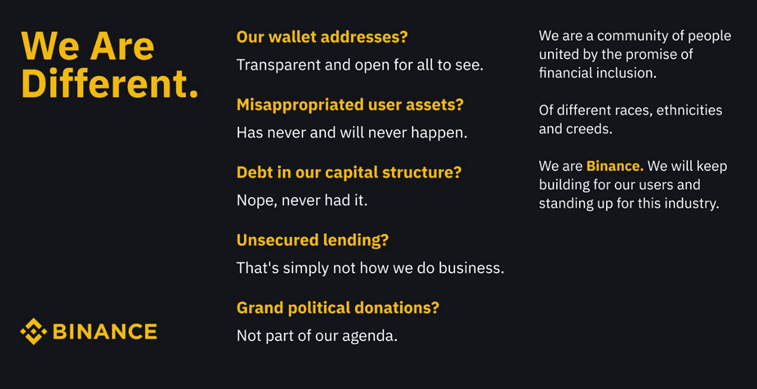

In response to the lawsuit, Binance.US reassured its users that their assets would remain secure, asserting that normal operations for deposits and withdrawals would continue without interruption. The platform also expressed its intention to defend itself against the SEC’s allegations, stressing that the regulatory actions were unfounded.

Simultaneously, the SEC seeks to freeze the assets associated with BAM Management and BAM Trading, citing concerns about the custody and control of customer assets. The regulatory body raises the issue of entities connected to Changpeng Zhao, Binance’s CEO, potentially having privileged access to funds belonging to Binance.US customers. The SEC argues that freezing these assets is vital to protect customer funds and prevent the dissipation of funds, given Binance’s history of non-compliance and evasive actions.

What can Binance do?

If the SEC’s requests are granted, Binance would have a limited timeframe to ensure that only Binance.US can access customer funds, followed by transferring all customer assets to new wallets exclusively accessible by Binance.U.S.

Binance.US has promptly responded to the developments, assuring users of the ongoing security of their assets and stating that their legal team has addressed the SEC’s concerns regarding fund safety. The regulatory scrutiny has also highlighted Binance’s historical need for formal policies for handling crypto assets, casting doubt on the proper custody of customer assets.

Conclusion

The SEC’s lawsuit against Binance and its efforts to freeze BAM Management’s assets demonstrate the increasing regulatory pressure faced by prominent players in the cryptocurrency industry. As the legal proceedings unfold, Binance and its affiliates are expected to mount a robust defense, stressing the safety of user assets and reiterating their commitment to compliance with regulatory requirements.