- Powell says rate hikes are not anyone’s base case after the third cut of 2025.

- His tone eased fears of a hawkish message or an early end to cuts.

- Markets now shift attention to early-2026 policy signals.

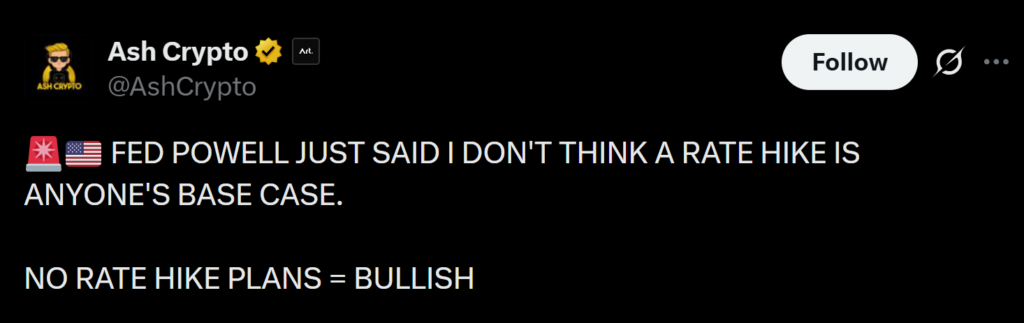

Federal Reserve Chair Jerome Powell made it clear on Wednesday that he does not see further rate hikes as a realistic possibility. Following the Fed’s third rate cut of the year, Powell said he hasn’t heard anyone suggesting hikes should return to the conversation. His comments were aimed at easing concerns that the central bank might unexpectedly tighten policy again if inflation flares up.

Markets Look for Soothing Signals After the Cut

The reassurance was timely, given that many traders feared Powell would deliver a hawkish message hinting that rate cuts could soon pause. Instead, he emphasized that the focus remains on staying data dependent and monitoring the pace of labor-market softening. His tone helped calm the initial caution that circulated ahead of his press conference following the policy decision.

Fed Remains Focused on Data as 2026 Approaches

Powell reiterated that the inflation outlook has improved enough to justify this week’s move, though the committee remains wary of declaring victory. With unemployment gradually rising and growth losing some momentum, officials are walking a careful line as they head into 2026. Powell’s message suggests that while more cuts are not guaranteed, the era of unexpected rate hikes is effectively over.

Investors Shift to What Comes Next

The chair’s comments leave markets in a more balanced position, with investors now weighing the possibility of additional easing early next year. Risk assets, including crypto, reacted with muted volatility as traders digested the softer-than-expected tone. The next key moment arrives in January at the first FOMC meeting of 2026, when the outlook for further easing should become clearer.