- Shayne Coplan teased a potential POLY token, hinting it could rank among top cryptocurrencies.

- ICE committed $2B to Polymarket at a $9B valuation, cementing institutional confidence.

- A POLY token could drive governance, incentives, and user rewards, similar to dYdX’s model.

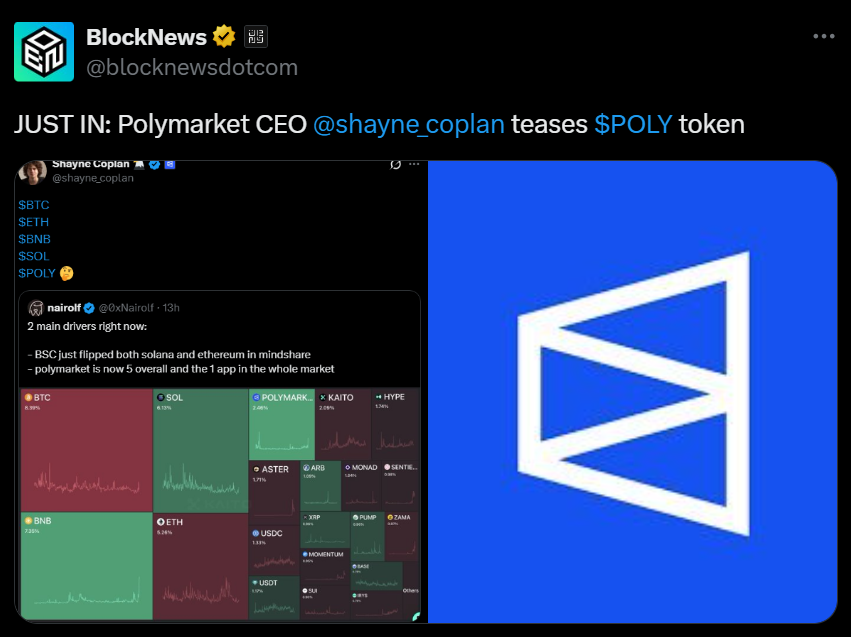

Shayne Coplan, founder of Polymarket and recently dubbed the “youngest self-made billionaire” by Bloomberg, dropped a cryptic hint on X about the possible launch of a native POLY token. His post compared POLY alongside Bitcoin, Ethereum, Binance Coin, and Solana, sparking speculation that Polymarket’s token could one day join the ranks of the largest cryptocurrencies by market cap.

This isn’t the first time the platform has teased a token launch. In late 2024, the official Polymarket account briefly posted “we predict future drops,” leading to speculation about user rewards and token incentives. With a growing track record of hints, the latest message from Coplan adds fresh weight to the idea that POLY is closer to reality.

Major Institutional Backing Fuels Confidence

The timing of the teaser comes just after Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, pledged a $2 billion investment in Polymarket at a post-money valuation of $9 billion. ICE’s endorsement signals that prediction markets are moving from niche experiments into mainstream financial infrastructure.

Earlier the same day, Coplan revealed that Polymarket had quietly closed two additional funding rounds over the last two years, including a $150 million raise in 2025 led by Founders Fund at a $1.2 billion valuation. The funding history shows a steep growth trajectory, now punctuated by one of the biggest institutional bets on a crypto-native platform.

Why a POLY Token Matters

If launched, a POLY token could become central to Polymarket’s ecosystem, powering governance, incentives, and user rewards. The model would mirror other decentralized trading protocols like dYdX, which introduced token-based governance and liquidity programs ahead of its breakout growth.

Speculation is mounting that the SEC filing from Polymarket’s parent company, Blockratize, in September — which referenced “other warrants” — may have been an early step toward such a launch. That strategy would align with how many protocols structure pre-launch token rights for investors and insiders.

Polymarket’s Rising Influence

Since its 2020 debut, Polymarket has handled nearly $19 billion in cumulative trading volume, establishing itself as the world’s most recognized prediction platform. From political outcomes to crypto price bets, the platform has become a magnet for both retail and institutional users. With ICE now in its corner and POLY on the horizon, Polymarket appears set to evolve from a speculative playground into a heavyweight of digital finance.

Final Thoughts

A POLY token launch could reshape Polymarket’s trajectory, adding another layer of growth to a platform already flush with institutional support. With a $9 billion valuation and billions in cumulative trades, the stage is set for POLY to join the next wave of top-tier tokens — if and when Coplan and his team make the move.