Polkadot was trading in a third consecutive daily trading session after rising 12% over the last three days. Polkadot is following the performance of other coins in the crypto market, most of which have been flashing green since the week’s opening.

Overall, the bullish sentiment in the market has pushed the total cryptocurrency market capitalization up 2.7% in the past 24 hours to cross the $1 trillion mark earlier today. The crypto market’s value now stands at $1.05 trillion, according to data from Coingecko.

Will the current positive sentiment bolster Pokadot bulls in the market to propel DOT higher?

Polkadot Bulls Eye A Return To $10

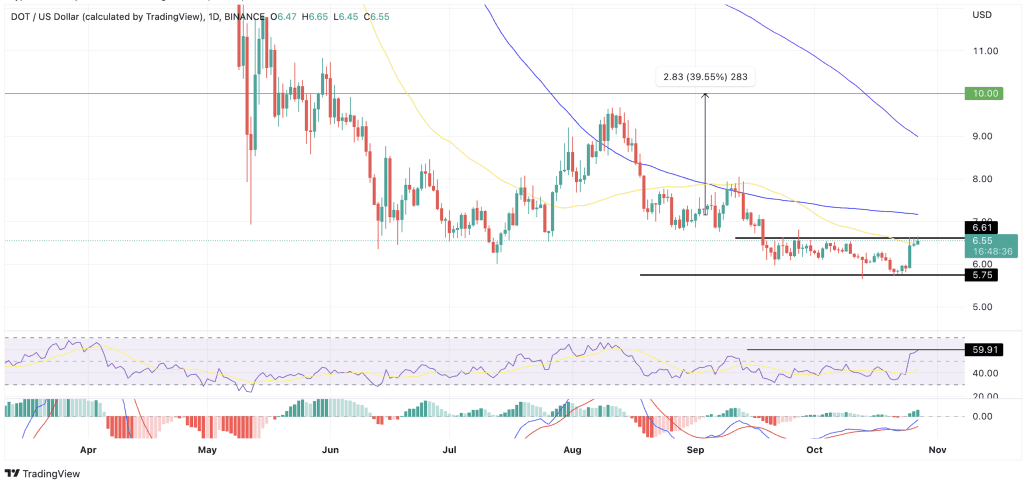

Polkadot had been locked in a downtrend that saw the Layer-2 token drop from highs of $9.68 to $6 between August 13 and September 21. Since then, the price has been trading between $5.75 and $6.61, as shown in the chart below. At the time of writing, DOT was exchanging hands at $6.55.

It is important to note that even though Polkadot’s price was still teetering within this range, the recent upsurge had seen it flip the 50-day simple moving average (SMA), which sat at $6.43 back to support. The price must hold above this crucial support to sustain the recovery.

As such, a daily candlestick close above the 50-day SMA would bolster the buyers who could run for the $7.0 psychological level or the 100-day SMA currently at $7.17. Beyond that, DOT could climb to tag the $8.05 range high and later the $9.0 resistance level, embraced by the 200-day SMA.

Such a move would provide robust support for the 12th-ranked altcoin by market cap, with the next logical move being an ascent to $10. This would bring the total gains to 39.55%.

Apart from flipping the 50-day SMA into the support, the upward movement of the relative strength index (RSI) signaled strength amongst the bulls. This trend-following oscillating indicator had crossed the midline into the positive region to 60, suggesting that the bulls had taken control of the price.

Also supporting Polkado’s bullish outlook was the upward-facing Moving Average Convergence Divergence (MACD) Indicator, showing that the market had flipped in favor of the upside. Additionally, the MACD sent a buy signal on Monday when the MACD line (blue) crossed above the signal line (orange), further adding credibility to DOT’s positive outlook. Polkadot’s recovery will gain more traction once the MACD crosses the zero into the positive region.

The Flipside

On the downside, if Polkadot’s price turns down from the current level, it would signal a lack of strength amongst the buyers, and the recent uptick could be a bull trap. If this happens, DOT may drop first toward the support level at $6.0 and later toward the $5.75 area in the short term.

Traders could expect Polkadot to accumulate here, allowing buyers to take a breather and regroup before staging a comeback.

Polkadot Founder Gavin Wood Resigns As CEO

On October 11, Polkadot co-founder Gavin Wood stepped down from his role as CEO of blockchain infrastructure company Parity Technologies, the company behind the Polkadot network and the DOT cryptocurrency. The announcement indicated that Wood would be replaced by fellow Parity Technologies co-founder Björn Wagner, who would take over as the new CEO.

Wood said in a Twitter post:

“I’m happy to announce that Parity co-founder Björn Wagner will step up to the role of company CEO while I retain the title of Chief Architect. “

This means Wood would leave the company. He will continue to maintain his position as a majority shareholder and be involved in community design and creating products that will help Polkadot achieve its Web3 and crypto mission.