- Peter Schiff claims Strategy underperformed by investing heavily in Bitcoin.

- Analysts argue Schiff’s calculations ignore the timing of BTC purchases.

- Bitcoin has outperformed gold over the past five years despite stock volatility.

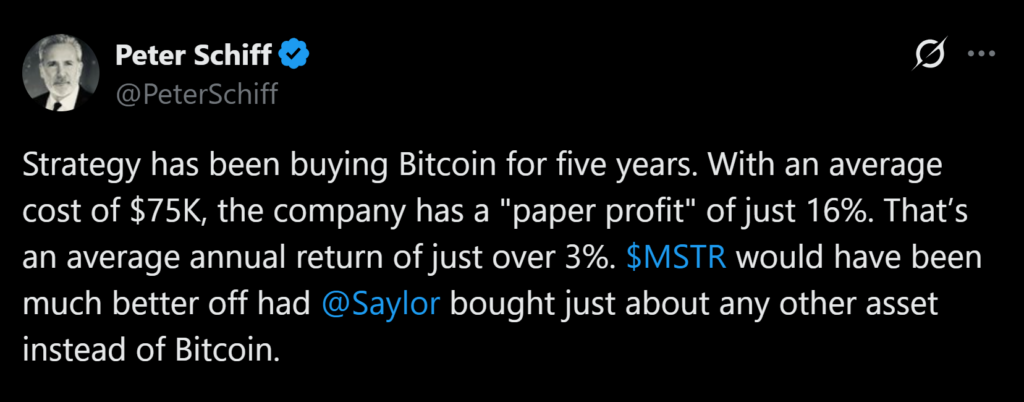

Bitcoin treasury firm Strategy has once again found itself at the center of debate after longtime Bitcoin critic Peter Schiff argued the company would have delivered stronger returns by avoiding BTC altogether. In a recent post on X, Schiff claimed that Strategy’s Bitcoin strategy produced underwhelming results when viewed through a traditional performance lens. The comments quickly stirred backlash across the crypto community.

Schiff Questions Strategy’s Bitcoin Returns

According to Schiff, Strategy’s average Bitcoin purchase price sits near $75,000, leaving the firm with a paper gain of just 16% after five years of accumulation. He framed that outcome as an annualized return slightly above 3%, arguing the capital could have performed better in other asset classes. Schiff’s critique comes as Strategy’s stock has struggled this year, reinforcing his broader skepticism toward Bitcoin-focused balance sheets.

Critics Push Back on the Math

Market participants were quick to challenge Schiff’s assumptions. Analyst Willy Woo pointed out that Schiff treated all of Strategy’s Bitcoin purchases as if they occurred at the same time, ignoring the staggered nature of the buys. That approach, Woo argued, significantly distorts actual performance. Venture capitalist Revaz Shmertz echoed the criticism, saying Schiff’s comparison failed to reflect how investment returns are properly calculated over time.

Strategy Keeps Accumulating Bitcoin

Despite the criticism, Strategy continues to double down on its Bitcoin strategy. The firm announced a new purchase of 1,229 BTC earlier today, bringing total holdings to roughly 672,497 Bitcoin. At the same time, Strategy boosted its cash reserves to $2.2 billion, a move aimed at ensuring it can meet financial obligations for several years without needing to sell any Bitcoin holdings.

Stock Performance vs. Bitcoin’s Long-Term Trend

Strategy’s stock has taken a hit in 2025, down about 46% year to date, according to Yahoo Finance. Often viewed as a leveraged proxy for Bitcoin, MSTR has suffered alongside broader volatility in crypto-linked equities. Still, Bitcoin itself tells a different story. TradingView data shows BTC has surged roughly 219% over the past five years, rising from around $27,400 to approximately $87,700 as of December 30. Over the same period, gold — Schiff’s preferred asset — gained a little more than 130%.