- Pepe Coin popped on $500M volume, but the rally quickly lost steam—raising breakout doubts.

- Whale activity is drying up, and unrealized profits are stacking—both signs of short-term caution.

- The $0.0000095 level is key; hold it and PEPE could double… lose it, and a drop to $0.0000079 might follow.

Pepe Coin’s back in the spotlight—kind of outta nowhere, too. After looking pretty dead in the water, it suddenly exploded with a $500 million surge in trading volume late Monday. And just like that, traders started piling in again, chasing a quick 10% pop and whispering about a new uptrend.

So, what sparked the hype? Global tensions between Iran and Israel cooled down a bit, and traders clearly felt more risk-hungry. Plus, all that tariff war noise coming out of the U.S. is finally dying down. There’s even talk of smoother deals brewing with China, the EU, and India. For now, it seems meme coin season might not be completely over.

Wait, That Pump Reversed—Fast

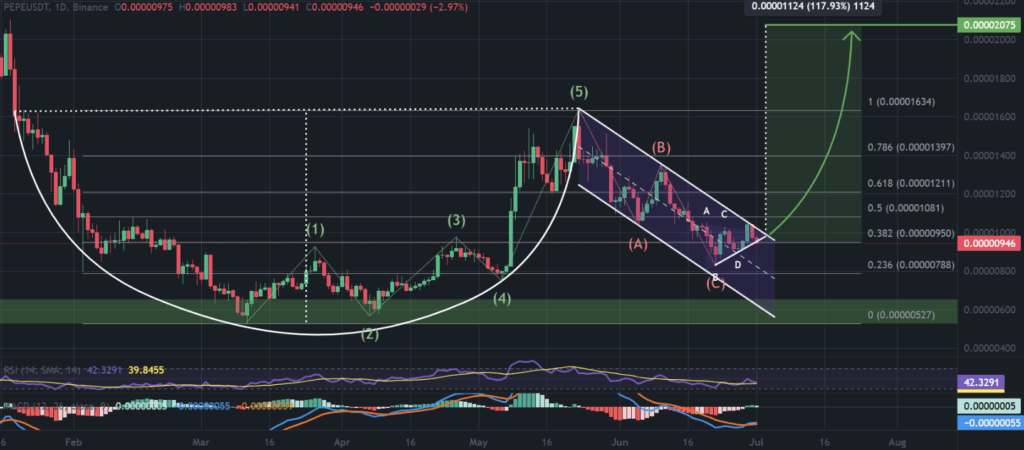

But here’s the weird part: the rally didn’t stick. PEPE’s price shot up… and then just flopped right back to around $0.0000095, right where it started. It’s like the market took a deep breath—and then forgot why it was excited in the first place.

A quick peek at the RSI shows it sprinted from oversold (near 30) to overbought territory (around 70) in just a few hours. But the follow-through? Eh, not great. It retraced fast, signaling that the conviction behind that spike might’ve been shaky.

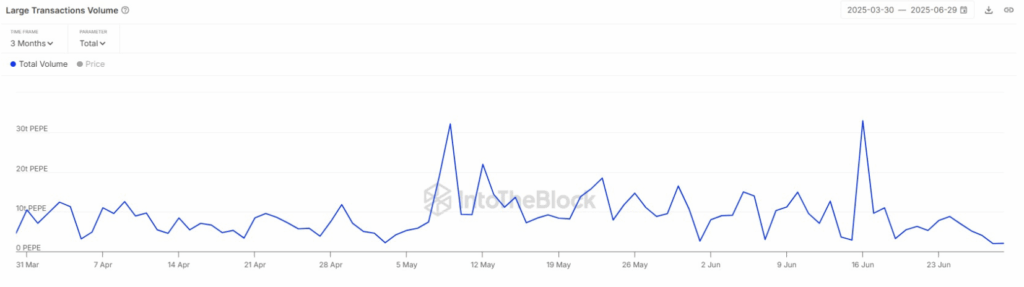

According to IntoTheBlock, large whale transactions (we’re talking $100K+ trades) dropped like a rock—from 32.9 trillion PEPE three weeks ago to just 2.06 trillion now. That’s a 93% drop. Looks like the big guys are on the sidelines, maybe waiting for another dip to scoop more bags.

Lots of Paper Gains = Caution?

And here’s another thing—Santiment data shows that the profit-to-loss ratio for PEPE just hit 2.55. For every $1 in the red, traders are sitting on $2.55 in green. That’s a lot of unrealized profit. Which means? Folks could start cashing out real soon. That kind of setup often triggers a sell-off wave, especially if the bulls can’t push higher.

What’s Next for Pepe?

Technically speaking, PEPE’s at a pretty big crossroads. It’s re-testing the $0.0000095 zone, which just so happens to line up with the rim of a classic cup-and-handle pattern that’s been forming over six months. It’s a make-or-break moment. Hold the line, and bulls might be in business.

MACD just flashed a golden cross over the weekend, which is usually an early sign of an uptrend heating up. The RSI’s also trying to recover—hovering below neutral, but climbing. So yeah, some bullish signals are there, but nothing’s screaming breakout just yet.

If things go right and that cup-and-handle breakout plays out, price could shoot up to around $0.000020. That’d be a 117% gain from current levels. But if PEPE loses its footing at $0.0000095? Next major support’s down near $0.0000079. That could mean a deeper pullback’s on the table.