- PEPE’s back above $5B market cap after bottoming at $2.65B in March; price up 2% in 24 hrs.

- Broke major downtrend on July 10, aiming for $0.000016; breakout confirmed… for now.

- Whales are locking in profits; NVT suggests price may be overheated. Watch closely.

PEPE’s been creeping up again. Not a moonshot, but the memecoin managed a 2% gain in the last 24 hours. More notably, it clawed its way back over the $5 billion market cap—a solid recovery from that rough dip in March when it bottomed out at $2.65B, its lowest this year.

Since then, it’s been a slow grind upward. No fireworks, just consistent reclaiming of its turf. And yeah, people are noticing.

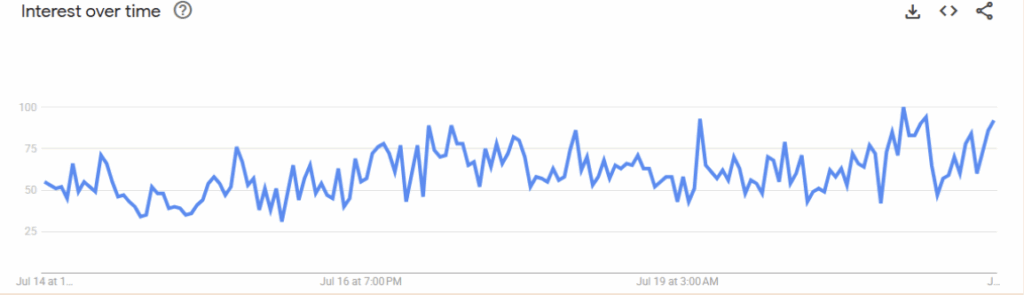

Google Searches Hint at Growing Hype

If you take Google Trends seriously (and for memecoins, maybe you should), then PEPE’s spike in interest is telling. It jumped to 92%, up from a sleepy 42%, showing that folks are poking around again—probably wondering if they missed the bottom.

Interest is pretty much everything in the memecoin game. When the crowd talks, price usually listens. Dogecoin’s a perfect example—it’s sitting at 65 and climbing too. So this isn’t a PEPE-only thing; there’s something bubbling across the whole space.

That said, spikes in interest can also mean we’re near a short-term top. It’s a weird paradox—people get excited right before it all cools off. Still, PEPE did just break a pretty stubborn downtrend, and that could change the story entirely.

Breakout or Fakeout?

PEPE’s been stuck under a nasty bear market trendline since it peaked back on December 9, 2024. But that wall finally cracked on July 10. The price retested the breakout five days later—and held.

Since hitting rock bottom at $0.00000568 in March, PEPE’s now aiming for $0.000016. If it clears that, we could see another run toward last year’s highs.

But hey, no guarantees. If the price slips back under that trendline, the breakout might’ve been a head fake. Still, volume’s shifted in favor of the bulls, and that’s not nothing.

Mixed Signals from Whales and Metrics

So here’s where it gets messy. Whales are acting twitchy. James Wynn—well-known in crypto circles—just closed his PEPE and ETH longs for a cool $538.5K profit. Then, he flipped to a 10x long on Dogecoin. That move alone makes some folks nervous—maybe he sees a PEPE cooldown incoming?

Also, IntoTheBlock’s NVT ratio is sitting at 43.21, and it dropped 30.9% in the last 24 hours. That usually means the price is running hotter than its actual network value. Not a disaster, but something to watch.

PEPE still holds tight correlations with the big boys—0.92 with BTC and 0.95 with ETH. And wallet-wise? There are 431,290 addresses currently holding bags. That’s not a ghost town.