A new report by the Bank for International Settlements (BIS) reveals that the total exposure by global banks to cryptocurrencies is still relatively small.

The report represents the findings of a study by the BIS’s Global banking regulation standard Basel Committee which collected digital asset data from 19 banks – 16 Group 1 banks and three Group 2 banks. Ten of these banks were from “the Americas, seven from Europe, and two from the rest of the world.” The study was based on crypto-asset data provided by the banks at the end of 2021.

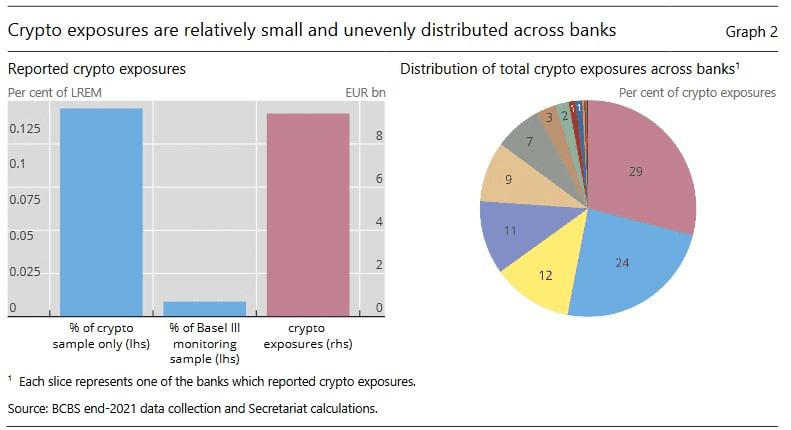

The findings reveal that the 19 largest financial institutions hold about €9.4 billion ($9.23 billion) worth of crypto, which equates to 0.14% exposure.

To put this figure into context, the Basel Committee considered these financial institutions’ size and expansion levels. It estimated the global crypto exposure to be around 0.01%, after including Group 3 banks. The report noted, “A small proportion of banks reported crypto exposures at the end-2021.”

With that in mind, the committee also observed the exponential growth rate of the crypto space and acknowledged that it was difficult to estimate the real exposure rate. The report states:

“As the crypto asset market is fast evolving, it is difficult to ascertain whether some banks have under- or over-reported their exposures to crypto assets and the extent to which they have consistently applied the same approach to classifying any exposures. As such, while they help provide a broad indication of banks’ crypto asset activity, they should be interpreted cautiously.”

Bitcoin Dominates Cryptoassets Banks Are Exposed To

The report analyzed exposure distribution according to overall exposure by reporting banks, the types of crypto assets, and the activity of exposure. Concerning the first category, the findings show that crypto asset exposure is unevenly distributed across reporting banks, with digital assets belonging to the ten Americas banks comprising around one-third of the total €9.4 billion. In addition, two banks make up “more than half of overall crypto-asset exposures, and four more banks make up just below 40% of the remaining directions.

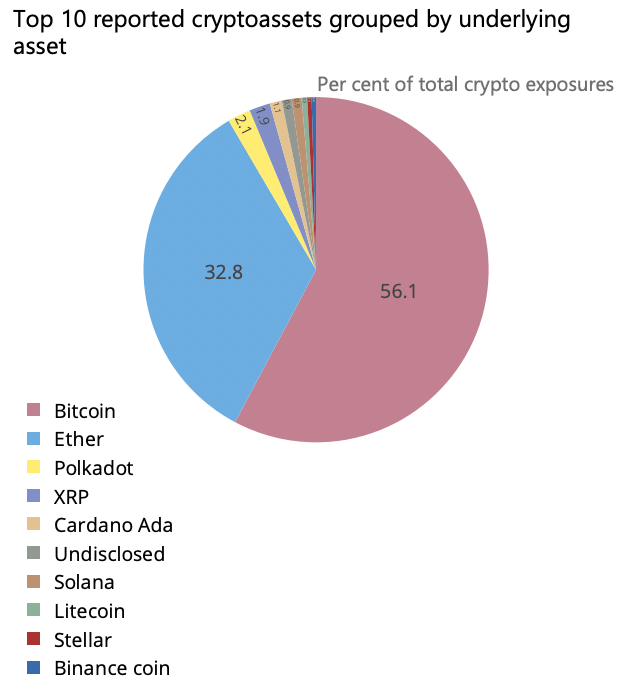

Regarding token exposure distribution, the report states that Bitcoin (BTC) and Ethereum (ETH) are the main assets to which the top global banks are exposed. Amongst all 19 institutions, Bitcoin exposure is at 31%, and Ethereum’s is at 22%. The data also revealed “a multitude of instruments.”

With Bitcoin or Ethereum as underlying assets making up the third and fourth most held assets. This type of exposure was 25% for Bitcoin-based tokens and 10% for Ethereum-based ones. Together, Bitcoin and Ethereum make up nearly 90% of reported vulnerabilities.

When Bitcoin and Bitcoin-based tokens are calculated, exposure to Bitcoin alone stood at 56.1%.

Other cryptocurrencies global financial institutions are exposed to include Ripple (XRP) as the third most exposed coin with 2%. In comparison, Cardano (ADA) and Solana (SOL) come fourth and fifth with 1% each. Litecoin (LTC) and Stellar (XLM) rank sixth and seventh with 0.4% each.

According to the report, banks also reported holding the USD Coin (USDC) stablecoin and other tokenized assets in smaller amounts.

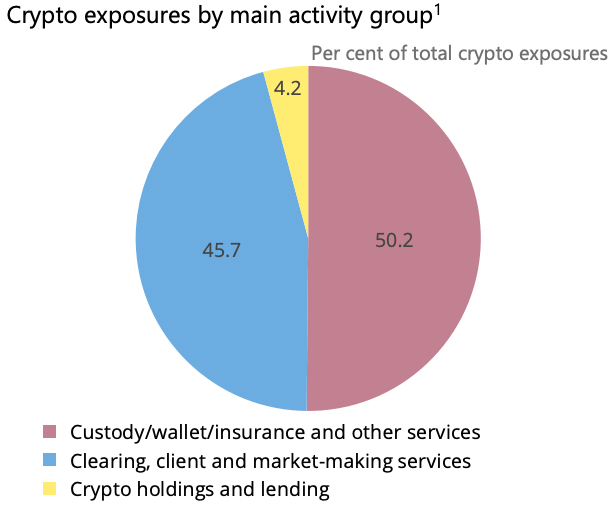

The report also found that “exposures span a variety of activities which directly or indirectly expose banks to crypto assets.” The exposure activities refer to crypto-related functions offered by the participating banks, with crypto holdings and lending, Clearing, client and market-making services, and custody/wallet/insurance services coming up as the top three functions.

Custody/wallet/insurance and other services include all custody, wallet, and insurance services for digital assets used to facilitate client activity, such as self-directed or manager-directed trading. This turned out to be the most dominant activity making up 50.2% of exposure activities.

Clearing, client, and market-making services refer to all trading activities on client accounts, ICOs, clearing derivatives and futures, and issuing securities with underlying digital assets. This makes up 46% of crypto-functions banks are involved in.

The category of crypto holdings and lending involves:

- Holding and investing in crypto assets.

- Lending to entities.

- Issuing crypto assets backed by assets on the bank’s balance sheet.

These functions make up only 4% of financial institutions’ activities.

Overall, the data by BSI shows that crypto adoption amongst banking institutions is still shallow. The reason could be a lack of clear regulations from governments worldwide that make it difficult for financial institutions to go all in on crypto assets. Hopefully, this will change as the IMF calls for “comprehensive, collaborative and coordinated” regulation of the crypto space.