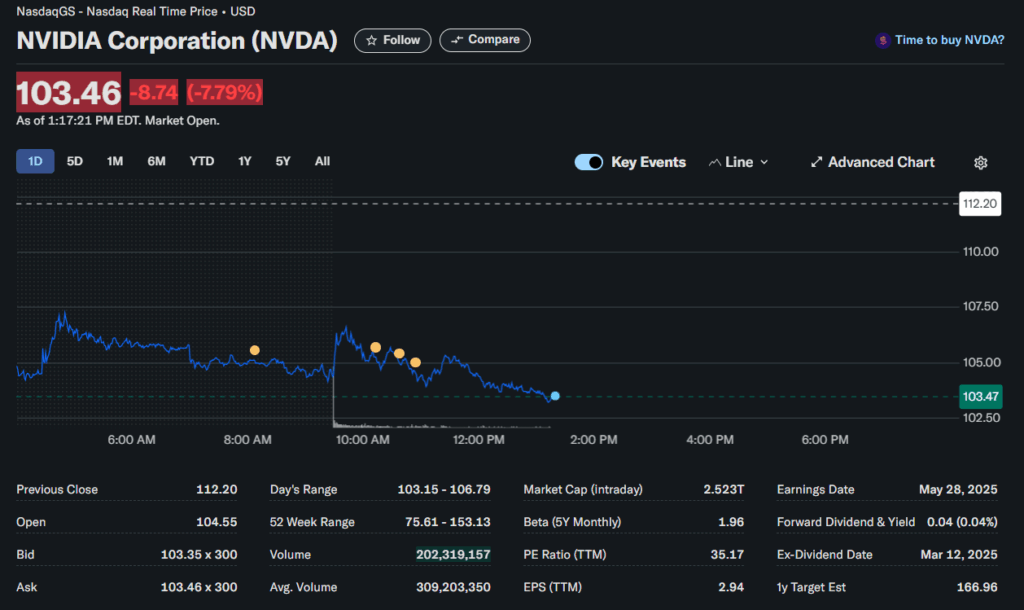

- Nvidia stock dropped 7% after revealing a $5.5B hit from new U.S. export restrictions on its H20 chips to China.

- Analysts say the ban could cost Nvidia up to $10B in revenue, as unsold chips now face uncertain futures.

- Other chipmakers like AMD, Intel, and Qualcomm also saw stock dips as the broader market reacted to the surprise crackdown.

So, Nvidia’s stock just took a nasty nosedive—dropping as much as 7% midday Wednesday—after the company revealed it’s getting walloped with a $5.5 billion charge thanks to fresh U.S. export restrictions on its H20 chips bound for China. The move caught just about everyone off guard.

Surprise Curbs and an Even Bigger Blow

Late Tuesday, Nvidia filed notice that the U.S. government would now require a special license for H20 chips, those custom-made for the Chinese market. Thing is, such licenses have basically never been approved. According to Jefferies’ Blayne Curtis, it’s basically a hard stop—an outright ban under the hood.

But that’s just the start. Jefferies says Nvidia might lose $10 billion in revenue in the coming quarters. Why? A big chunk of that $5.5B write-down is for already-made chips, not future orders—meaning these chips are now, well, kinda worthless.

A Flip from the Trump Dinner?

What’s making this sting more is the timing. Just weeks ago, reports suggested the Trump administration might back off the ban after a dinner with Nvidia CEO Jensen Huang. Now? Nope. Total 180. Huang, by the way, had just given a big speech at GTC in March, talking up new AI tech.

Some analysts like Bernstein’s Stacy Rasgon think this ban just doesn’t add up. The H20 chips aren’t even the most powerful ones out there—he says it practically hands the Chinese AI market over to Huawei.

Market Feels the Shockwaves

The chip sector wasn’t spared. AMD dropped nearly 7% too, saying they’ll take an $800 million hit from similar export rules. Intel and Qualcomm slid, and the Nasdaq tech index got pulled down more than 2%. It’s a ripple effect.

And it’s not just H20. Nvidia’s been rolling out custom chips like the A800, L20, and L2 since 2022 to comply with shifting rules. China, meanwhile, made up around 13% of Nvidia’s revenue last fiscal year.

Oh, and DeepSeek—an AI startup in China—previously trained its latest model using banned H800s. It made waves when folks realized they pulled it off with a lot less than what OpenAI used.

What’s Next?

The wild card here is the Biden-era “AI Diffusion” rule, set to kick in May 15. Nvidia’s pushing hard to get it scrapped, calling it misguided. Republican lawmakers even fired off a letter to Commerce Secretary Howard Lutnick asking for the same.

Meanwhile, Nvidia just pledged to invest up to $500 billion in U.S. AI infrastructure over the next four years. Maybe part PR, part backup plan.

But for now? It’s clear: the chip war’s heating up again—and Nvidia’s stuck in the middle of it.