- Bitcoin treasury firms risk entering a “death spiral” if BTC prices fall and they lose MNAV premiums

- Most are equity-financed for now, softening the potential fallout from future declines

- Only firms with bold leadership and strong execution are expected to weather future bear markets

Turns out, stacking Bitcoin on the balance sheet isn’t a free ticket to moon territory. According to a new report from venture capital group Breed, most BTC treasury companies—those firms holding Bitcoin as a core asset—might be headed straight for a “death spiral.” That’s especially true for the ones trading close to their net asset value (NAV), which basically means their stock price mirrors the value of their holdings minus what they owe.

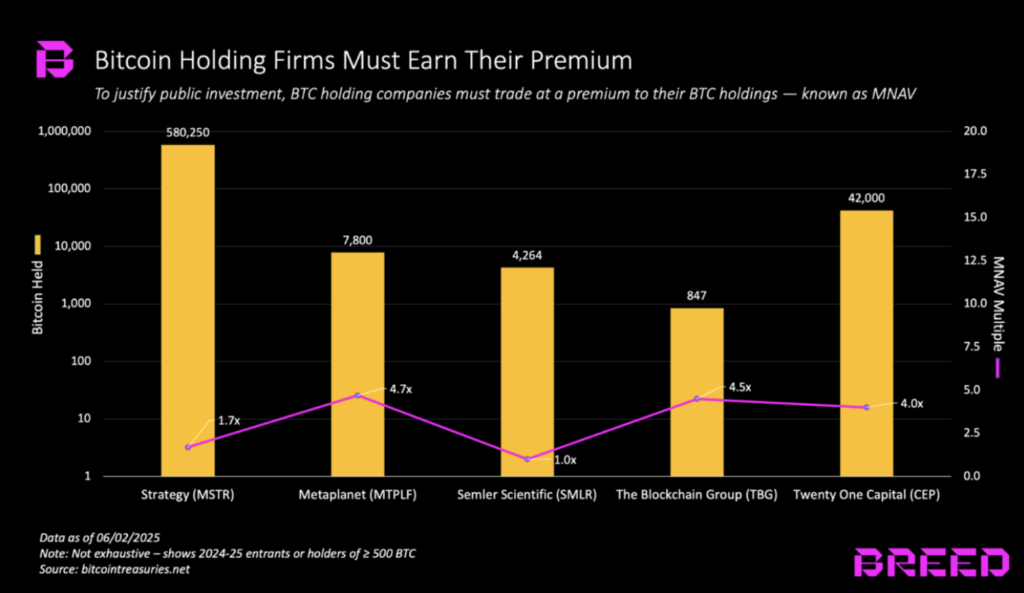

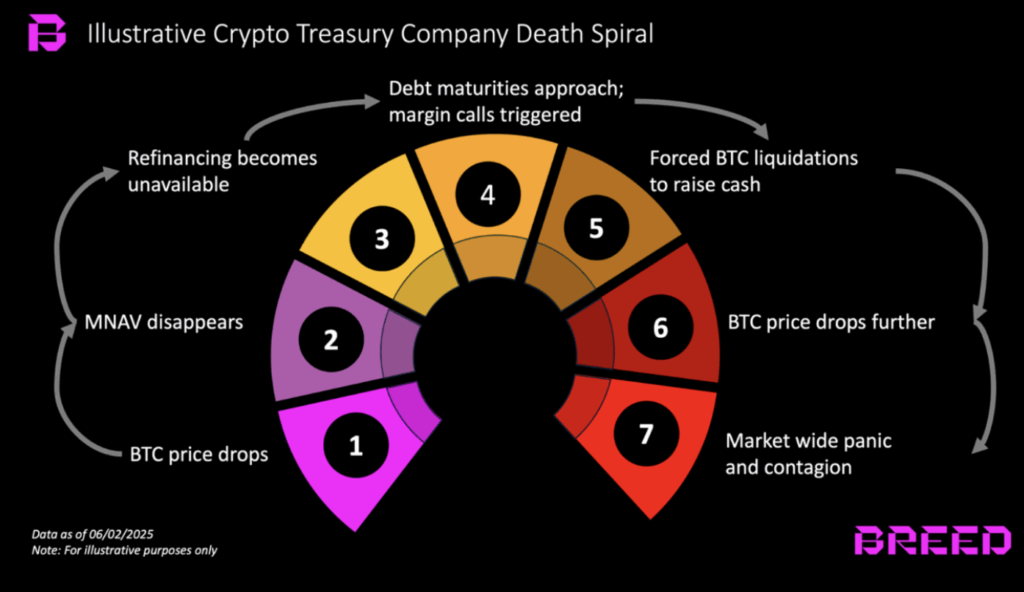

The real make-or-break factor? Their ability to maintain something called an MNAV—market cap multiple over net asset value. Without it, well… things unravel fast. Breed outlines seven stages of decay, starting when Bitcoin’s price drops, dragging MNAV down with it. Suddenly, these companies start looking shaky to investors, and access to fresh capital dries up.

When BTC Drops, the Spiral Starts

Here’s how it spirals: lower MNAV makes it harder to secure debt or raise funds. As debt maturities close in, firms get margin called, and they’re forced to dump BTC into an already-weakened market. That selling pressure sinks BTC further, and weaker firms either collapse or get scooped up by healthier ones. The cycle could ripple out, even setting off the next bear market if things get bad enough.

But Breed says it won’t affect everyone. Companies with visionary leadership, sharp execution, and clever strategies could actually grow their Bitcoin per share through the chaos. These are the survivors. Everyone else? Might be toast.

Equity vs. Debt: The Cushion That Might Save the Day

Here’s the (somewhat) good news: most of these treasury players aren’t gambling with borrowed cash—yet. They’re financing BTC buys with equity, not debt. That adds a buffer. If things go south, there’s no margin call panic selling. But if debt starts becoming the go-to option? That’s when the real mess could start.

The authors of the report think equity-heavy strategies will help contain any fallout, at least for now. Still, that could shift quickly if more companies decide to leverage up in hopes of juicing returns.

Treasury Trend Took Off Thanks to Saylor

The whole idea of turning your balance sheet into a Bitcoin vault? That really kicked off when Michael Saylor’s company, Strategy (yep, that’s the name), went all in back in 2020. His move sparked a broader wave of corporate Bitcoin adoption. Fast forward to now: over 250 organizations—including ETFs, pension funds, and even government outfits—are holding BTC, according to BitcoinTreasuries data.

But just like in every gold rush, only a few prospectors come out rich. The rest? Well, they get wiped out in the dust cloud.