On Friday, legislators in New York passed a bill to ban bitcoin mining operations that depend upon the proof-of-work process. The measure is now heading to Governor Kathy Hochul, who could either sign it or veto it.

If signed by the Govenor, it would make New York the first state in the country to ban blockchain technology infrastructure. It will likely also have a domino effect, setting the precedent for the type of attitude other states might adopt towards blockchain technology. The U.S. currently is the leader in market volume across the world, accounting for 38% of the world’s miners.

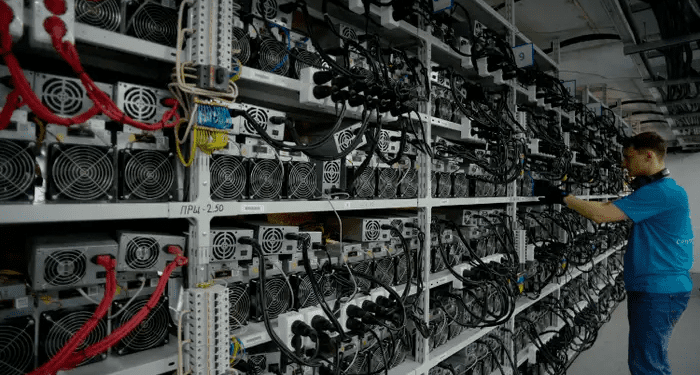

The bill, which earlier this year passed the State Assembly before going to the State Senate, is trying to initiate a two-year moratorium (a temporary prohibition of) for mining operations that depend on the proof-of-work (PoW) validation method. The proof-of-work system currently requires lots of gear and tons of energy to function, which has proven hurtful to the environment. Although, note that Ethereum is converting their PoW system to proof to PoS, proof-of-stake, which is less energy intensive and requires no physical infrastructure to function.

Boring told CNBC, “This is a significant setback for the state and will stifle its future as a leader in technology and global financial services. More importantly, this decision will eliminate critical union jobs and further disenfranchise financial access to the many underbanked populations living in the Empire State.”

This belief is also shared by Galxay Digital’s Amando Fabiano: “New York is setting a bad precedent that other states could follow.”

The law would be effective immediately if the governor approves and signs it off.

A Ripple Effect

The effects on banning certain crypto mining processes could have a number of effects.

Many experts believe that an exodus of crypto miners could result in jobs and tax dollars leaving the state because of the economic impact they currently have. It is believed that this industry helps to drive many vendors consisting of engineers, construction workers, and electricians.

Boring has said,

“There are many labor unions who are against this bill because it could have dire economic consequences. (…) Bitcoin mining operations are providing high-paying and high-grade, great jobs for local communities. One of our members, their average pay is $80,000 a year.”

The company also points out that New York is a leader when it comes to the state’s legislation, so if this bill is passed it could have a ripple effect across the country.

Zhang, Foundry’s SVP of Mining strategy, says, “Other blue states often follow the lead of New York state and this would be giving them an easy template to replicate.”

“Sure, the network will be fine — it survived a nation-state attack from China last summer — but the implications for where the technology will scale and develop in the future are massive,” continued Zhang.

On the other hand, some others in the industry believe that the conversation relating to the effects of the law are being overblow.

Darin Feinstein, veteran Bitcoin miner, believes New York has always been generally hostile towards the crypto mining business.

“There’s no reason to go into a region that doesn’t want you,” said Feinstein. “Bitcoin miners are really a data center business, and the data center needs to locate in jurisdictions that want to have data centers within their borders…If you’re going to ignore that, then you have to deal with the consequences of conducting business in a region that doesn’t want your business.”

Feinstein and other miners point out that there are plenty of friendlier Feinstein, amongst other miners, believe that other states have more accommodating jurisdictions and attitudes towards the industry, like North Carolina, North Dakota, Wyoming, Texas, and Georgia, as they have all become major mining destinations.

Texas, for example, has crypto-friendly lawmakers, a deregulated power grid with real-time spot pricing, and access to significant excess renewable energy, as well as stranded or flared natural gas. The state’s regulatory friendliness toward miners also makes the industry very predictable, according to Alex Brammer of Luxor Mining, a cryptocurrency pool built for advanced miners.

“It is a very attractive environment for miners to deploy large amounts of capital in,” he said. “The sheer number of land deals and power purchase agreements that are in various stages of negotiation is enormous.”

The White House

The Biden Administraion is devising its own policies that target crypto mining. Their aim is to mitage energy consumption and emissions.

The White House Office of Science and Technology Policy is examining the connections between distributed ledger technology and energy transitions, the potential for these technologies to impede or advance efforts to tackle climate change at home and abroad, and the impacts these technologies have on the environment, according to Dr. Costa Samaras, who is the principal assistant director for energy.

The effort is one of the deliverables spelled out in the president’s executive order that was issued in March.

Samaras told CNBC that the White House is specifically examining the role these technologies might play in accounting for greenhouse gas emissions, as well as potentially supporting the buildout of a clean electricity grid.

They’re also “taking a look at the implications for energy policy, including how cryptocurrencies can affect grid management and reliability.”

It is unclear whether these recommendations, which are due in September, will culminate in federal law on proof-of-work mining. For now, states are calling the shots.