- Canary Capital’s spot XRP ETF (XRPC) officially began trading on Nasdaq today.

- Institutional appetite is rising, with multiple XRP ETFs now listed on DTCC.

- XRP price reaction is muted, but analysts see potential for a breakout toward $5 by year-end.

The long-awaited moment has arrived: the first U.S. spot XRP ETF is officially live. Canary Capital’s Nasdaq XRP ETF received regulatory approval on November 12, 2025, and began trading today under the ticker XRPC. With a 0.5% annual fee and full compatibility with traditional brokerage accounts, the fund gives investors direct exposure to XRP without having to custody the asset themselves. This marks a major turning point after years of regulatory debate surrounding Ripple and its token.

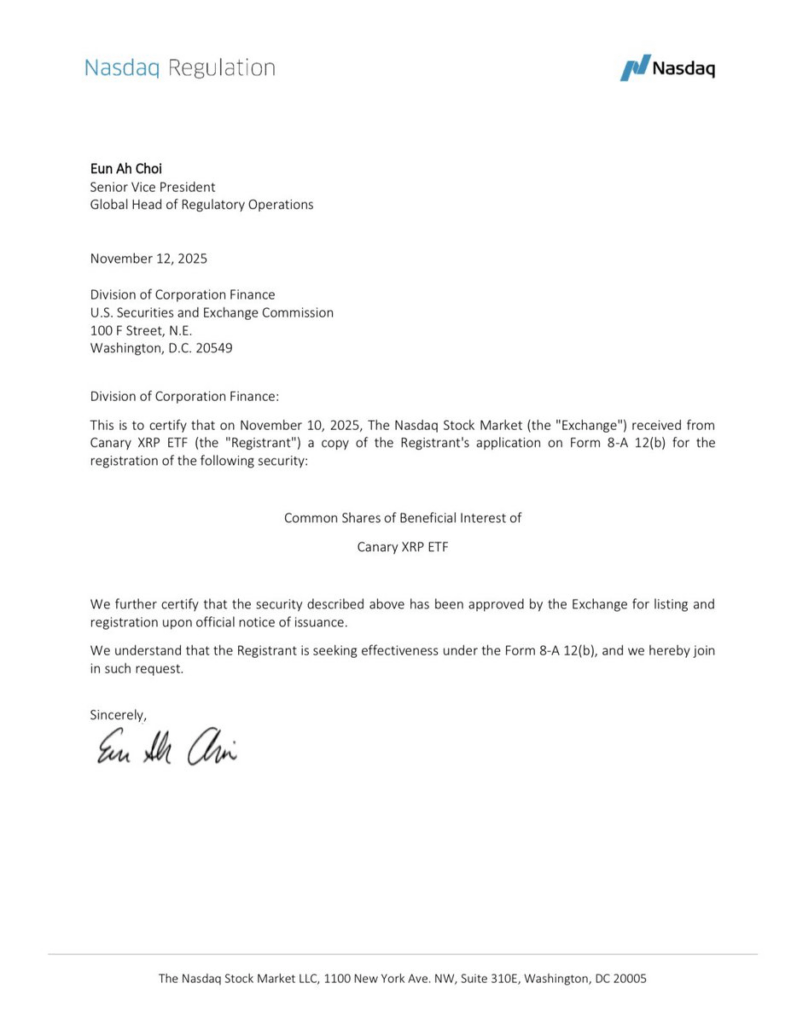

How Canary Capital Secured XRP ETF Approval

Canary Capital leveraged the automatic approval pathway under Section 8(a) of the Securities Act of 1933. After filing Form 8-A, the 20-day window passed without objections from the SEC. Nasdaq Regulation then issued formal certification, confirming that the ETF met listing requirements and would be registered upon official notice of issuance. This cleared the final hurdle and opened the door for today’s XRPC debut — the first spot XRP ETF on any U.S. exchange.

Institutional Momentum Builds Around XRP

The launch follows months of accelerating demand for XRP investment products. Futures-based ETFs already signaled strong interest, with the REX-Osprey product surpassing $100 million in AUM shortly after its September debut. Now, with eleven XRP ETFs appearing on the DTCC website — including filings from Bitwise, Franklin Templeton, CoinShares, and 21Shares — institutions are clearly positioning for broader XRP integration into traditional markets. The XRPC ETF tracks the XRP-USD CCIXber Reference Rate, providing regulated exposure through Nasdaq’s trading infrastructure.

Market Reaction and What Comes Next for XRP

The launch generated mixed on-chain signals. Glassnode reported over 216 million XRP leaving exchanges in the week before approval — normally a bullish sign of long-term accumulation. Yet whale holdings dipped by roughly 10 million XRP in the two days leading up to the ETF launch, suggesting some profit-taking. XRP traded around $2.39, down 0.4% after certification. Analysts remain cautiously optimistic, with some projecting a move toward $5 by late 2025, supported by expected ETF inflows and historically low exchange supply. Traders are watching resistance near $2.88 and support around $2.31, while futures open interest has dropped to its lowest levels of the year — a sign of reduced leverage ahead of today’s debut.