- Movement Network is launching a $38M buyback of MOVE tokens after a market maker breached its liquidity agreement.

- The buyback will happen on Binance over three months, with tokens moved to the Strategic Reserve.

- Movement recently launched its Public Mainnet Beta and has secured over $250M in total value locked.

Things just got messy over at Movement Network. After finding out one of its market makers went off script—dumping MOVE tokens without providing the liquidity they’d agreed to—the foundation is now scrambling to set things right.

In a blog post on March 24, Movement Network said that Binance actually tipped them off earlier this month. The unnamed market maker had apparently been unloading large amounts of MOVE, all while skipping out on their end of the deal to support the MOVE/USDT trading pair with proper liquidity.

The kicker? Movement had no idea it was happening. As soon as they found out, they cut ties with the market maker and started working with Binance to clean up the mess.

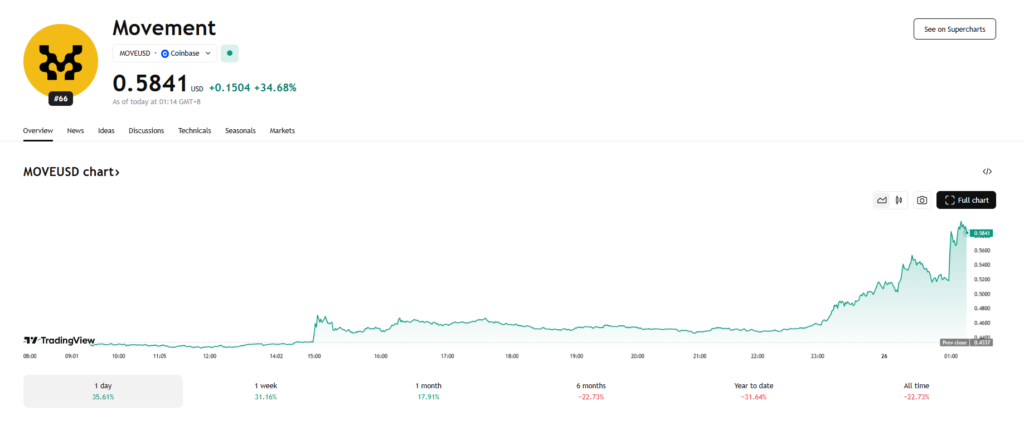

Now, using $38 million in recovered USDT, they’re launching a buyback program. The foundation plans to repurchase MOVE tokens off the open market over the next three months, all of it happening on Binance. As they buy, the tokens will be gradually sent to their Strategic Reserve, removing them from circulation for now.

A Little Background on Movement

If you’re not familiar, Movement Network is a modular blockchain platform that lets developers spin up high-speed MoveVM rollups—basically tech that helps tie together the Move language and Ethereum Virtual Machine (EVM) ecosystems.

They’ve got a bridge to Ethereum, and the network claims it can handle over 160,000 transactions per second. Not too shabby.

On March 10, they rolled out their Public Mainnet Beta, letting anyone deploy dApps permissionlessly. To solve the dreaded “cold start” problem (new chains with little liquidity or activity), they launched Cornucopia—a liquidity bootstrapping program that’s helped the network rack up over $250 million in total value locked.

And with a market cap of around $1.1 billion, this is no small player. Backers include Polychain Capital, Binance Labs, and—kind of surprisingly—Donald Trump’s World Liberty Financial, which, according to Arkham, holds $3.42 million worth of MOVE.

What’s Next?

With the buyback kicking off and the market maker out of the picture, Movement’s hoping to restore some confidence. It’s a bold move (pun not intended), but one they probably had to make.

This space moves fast, and with more institutional players sniffing around, a misstep like this can get out of hand real quick if not handled properly.