- Morgan Stanley filed S-1 applications for spot Bitcoin and spot Solana ETFs.

- The Bitcoin trust will be passive, while the Solana fund plans to include staking rewards.

- The bank continues to expand its crypto footprint across wealth management and brokerage services.

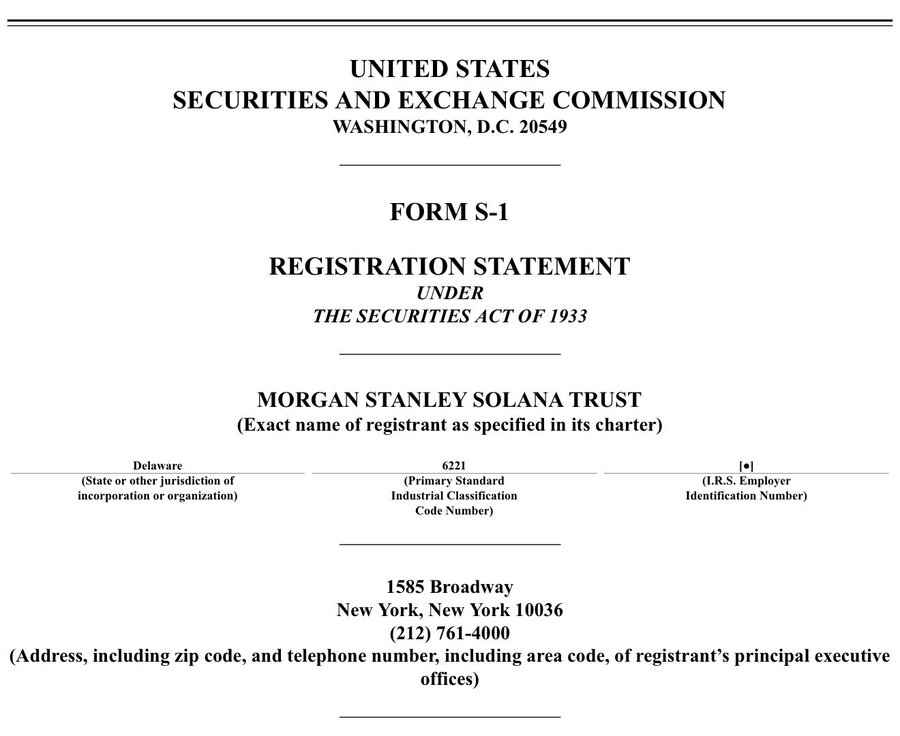

Morgan Stanley Investment Management, which oversees roughly $1.8 trillion in assets, has officially filed S-1 applications with the US Securities and Exchange Commission to launch spot Bitcoin and spot Solana ETFs. The move signals a deeper commitment from one of Wall Street’s largest firms as crypto continues inching closer to the core of traditional finance. If approved, these products would give investors direct exposure to two of the most widely followed digital assets without needing to hold them directly.

A Passive Bitcoin ETF Built for Simplicity

The proposed Morgan Stanley Bitcoin Trust is designed to be straightforward by design. It would hold Bitcoin directly and track pricing based on trading activity across major spot exchanges, functioning as a passive investment vehicle with no leverage or derivatives involved. The structure mirrors what institutions tend to prefer — clean exposure, transparent pricing, and fewer moving parts. For conservative investors testing crypto waters, that simplicity may be exactly the point.

A Staked Solana ETF Adds a Yield Component

The Solana product takes a slightly different approach. While it would track SOL’s price performance, the trust also plans to stake a portion of its holdings, allowing staking rewards to flow into the fund’s net asset value. That introduces a yield element that Bitcoin ETFs don’t offer, potentially making the Solana trust more attractive to investors looking for both price exposure and passive returns. It also reflects growing comfort with on-chain mechanics inside regulated products, which is a notable shift.

Morgan Stanley’s Expanding Crypto Strategy

This isn’t Morgan Stanley’s first step into digital assets. The firm was the first major US bank to allow its financial advisors to proactively pitch Bitcoin ETFs to clients, a move that set the tone for wider adoption across wealth management. Beyond ETFs, the bank has also signaled plans to expand crypto services through its E*Trade brokerage platform. Internally, Morgan Stanley’s Global Investment Committee has advised clients to allocate between 2% and 4% of their portfolios to crypto, framing the asset class as a maturing speculative investment often compared to digital gold.