- Monero dropped 8.5% in 24 hours after months of strong outperformance.

- The pullback likely reflects profit-taking and fading privacy-coin momentum.

- Broader risk-off sentiment makes a quick rebound less likely.

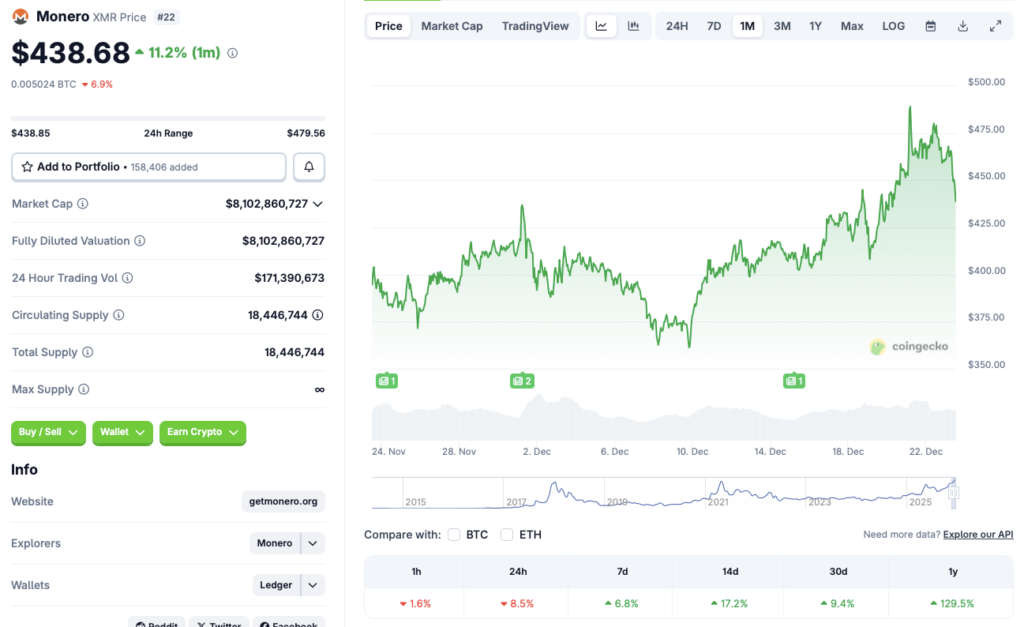

Monero spent the last few months doing what very few cryptocurrencies managed to do, moving higher while the rest of the market bled. That divergence has now hit a pause. Over the last 24 hours, XMR has suffered a sharp pullback, snapping a streak that had placed it among the strongest performers of this cycle. According to CoinGecko data, Monero is down 8.5% on the daily chart, a notable shift after weeks of strength.

A Rally That Finally Needed to Breathe

Despite the sudden dip, Monero’s broader performance still stands out. XMR remains up 6.8% on the weekly timeframe, 17.2% over the last 14 days, 9.4% over the past month, and an eye-catching 129.5% since December 2024. That kind of run rarely goes uninterrupted. The latest drop appears less like panic selling and more like a classic cooldown after an extended surge.

Privacy-focused coins, including Monero and Zcash, had followed a unique trajectory while the wider market struggled. Increased interest in privacy tokens likely fueled the rally, but that narrative now seems to be losing momentum, at least temporarily.

Profit-Taking Meets Market Gravity

One likely explanation for today’s move is profit-taking. After such aggressive gains, some holders are locking in returns, especially as broader crypto sentiment remains fragile. Bitcoin has failed to regain strength since October, and as BTC stalls, altcoins often struggle to hold independent momentum.

XMR attempted to resist that gravity longer than most, but the latest move suggests it is finally being pulled back into alignment with the broader market trend.

A Tough Environment for a Quick Rebound

Looking ahead, a near-term rebound appears uncertain. Investors continue to favor a risk-off approach, with capital flowing into traditional safe havens like gold and silver, both of which have been setting new highs. In that environment, even assets with strong narratives can struggle to sustain rallies.

The sharp daily drop may also mark the early stages of a trend reversal for Monero, especially if selling pressure continues over the next few sessions. For now, XMR’s impressive run is still intact on higher timeframes, but the market is clearly reassessing how much upside remains.