- Arthur Hayes predicts MON could fall 99%, criticizing its high FDV and weak tokenomics despite strong tech claims.

- Monad’s co-founder disputes the bearish outlook but faces mounting concerns over inflation and unlock schedules.

- Heavy whale liquidations and a drop below launch price suggest worsening sentiment and further downside risk.

Monad has become one of the most talked-about new arrivals in crypto, especially after its Coinbase ICO pulled in a staggering $269 million in record time. But the excitement hasn’t lasted long. Concerns about MON’s sustainability are growing fast, and the token has already slipped 24% shortly after launch. The hype cycle that pushed it into the spotlight is now giving way to deeper questions about its long-term viability.

Arthur Hayes Makes a Bold Call: MON Could Drop 99%

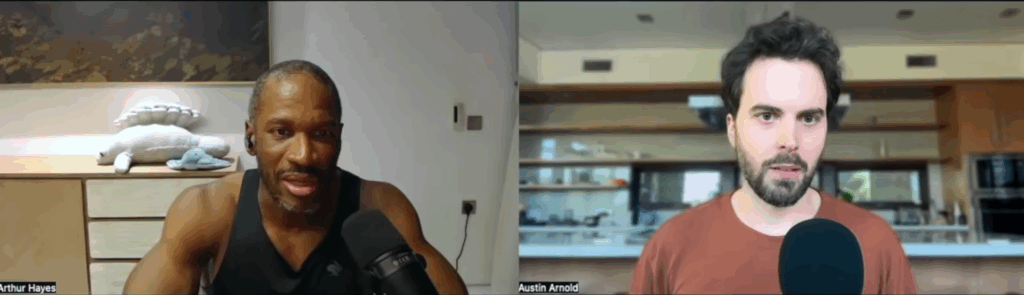

In a recent interview with Altcoin Daily, BitMEX co-founder Arthur Hayes didn’t hold back. He argued that nearly every Layer 1 token will eventually trend toward zero — except Bitcoin, Solana, and Ethereum. Monad, he said, is no different. Despite its flashy ICO, Hayes believes MON could collapse by up to 99%, calling it “another high-FDV, low-float VC coin” with insiders holding too much control. He warned that once locked tokens begin unlocking, those insiders will offload heavily, crushing the market further. His comments followed his announcement on Nov. 25 that he had fully exited his MON position.

Monad Co-Founder Responds but Tokenomics Concerns Persist

Monad co-founder Keone Hon pushed back, emphasizing the project’s strong technical foundation and innovative breakthroughs. Hayes, however, dismissed the tech entirely, insisting that tokenomics — not engineering — will determine MON’s fate. He criticized the roughly 1% monthly inflation driven by staking rewards and challenged the team to explain how they plan to maintain price stability under such conditions. Hayes also argued that only real, sustained network usage can support MON during future token unlocks, and even encouraged a full unlock to allow genuine price discovery. Critics quickly noted that Hayes’ own firm, Maelstrom, holds locked tokens in other early-stage projects, which may color his perspective.

Whale Liquidations Intensify Downward Pressure

The situation has been even more brutal for whales. As MON fell below its launch price of $0.0288, several major holders were hit with heavy losses. Two whales alone reportedly lost a combined $3.23 million within 24 hours on Hyperliquid. With whales controlling a large share of MON’s liquidity, this level of pain usually signals deeper bearish momentum. Retail investors often get caught in the fallout when whales unwind, and if the sentiment doesn’t shift, MON could be staring down even harsher declines in the days ahead.