- MON jumped 19% after a delayed but hyped airdrop, rising from $0.025 to about $0.042.

- Debate around low float and high FDV continues, though trading volume exploded across major exchanges.

- Despite mixed reactions from airdrop recipients, some traders — including Arthur Hayes — expect more upside.

Monad’s native token finally caught some air on Tuesday, jumping after the long-anticipated airdrop that, honestly, left a bunch of speculators feeling a little underwhelmed at first. The token, used for everything from paying gas fees to securing the network by staking, traded around $0.042 — roughly a 19% climb from the day before, according to CoinGecko. That might not sound wild in a bull phase, but considering MON launched at $0.025 during its public sale on Monday, the bounce put it up nearly 68% from its starting point. Earlier in the day it even tagged $0.045 before cooling a bit, which was enough to wake up anyone who expected a sluggish debut.

Market cools, but MON climbs through the noise

What makes the move interesting is that broader crypto prices weren’t exactly helping. The market slipped back into its slow, almost sleepy pattern after some green flashes on Monday. Bitcoin gave back gains and slid 1.8% to $87,199, while Ethereum drifted to $2,939 — down about 0.6% over the previous day. Against that backdrop, MON’s rise looked more like a token swimming upstream. Some traders were puzzled that its price matched the public sale so closely at launch, especially since the sale happened on Coinbase’s new platform for fresh tokens. Others argued that the market simply priced the asset efficiently, like the system was finally doing what it’s supposed to.

Speculators debate the price while whales smell opportunity

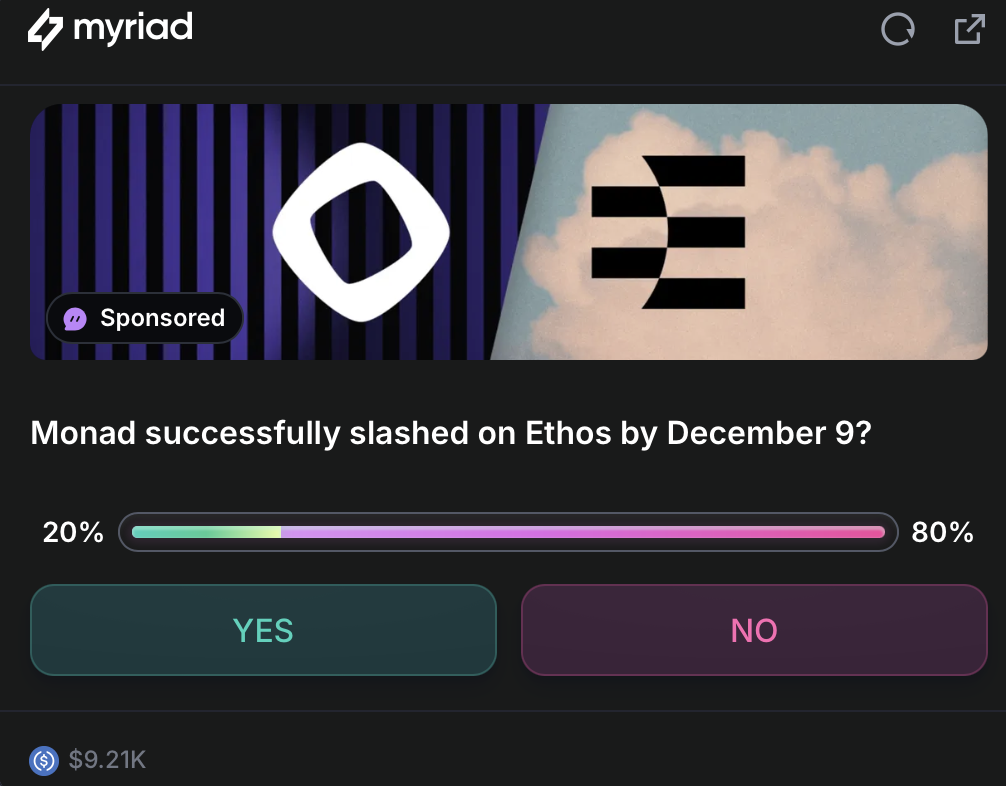

Monad positions itself as a high-performance L1 that handles transactions in parallel, similar to Solana or Sei, aiming to solve the usual network bottlenecks. Still, a few folks pointed out the low circulating supply — around 10% of total MON is actually out in the market — which can fuel sharper moves in either direction. BitMEX co-founder Arthur Hayes, in typical Arthur style, brushed off the criticism and tossed out a $10 price target, saying animal spirits were creeping back into crypto. He even joked, “low float, high FDV, useless L1… but obvi I aped,” reminding everyone that bull markets don’t always follow logic.

Airdrop reactions turn mixed as traders lock in small wins

Airdrops usually reward early adopters, tossing free tokens to users and builders who supported the ecosystem. But many recipients flipped their MON almost immediately to lock in whatever gains they could. One trader, who goes by NikkiSixx7 on X, said they “don’t regret” selling their stack at $0.031 on Monday, even though it’d be worth around $445 today. Their airdrop gave them 10,600 MON in total — about $238 at their sell price — and they argued the team “gave almost nothing” to community members, so offloading felt fair. It’s the kind of reaction you see often with new tokens: fast hands, quick profits, no looking back.

MON volume explodes across major exchanges

While sentiment stayed mixed, trading volume definitely didn’t hesitate. In the last 24 hours, MON racked up around $400 million in volume on Upbit — the South Korean exchange that often becomes a hotspot for fresh listings. Coinbase followed with $233 million in trades, and Bybit added another $160 million. That kind of volume, especially for a token that’s barely been live, signals heavy curiosity or maybe just short-term chaos, depending on how you look at it. Either way, the market’s watching closely now, waiting to see if MON’s early spike is just an airdrop aftershock or something with longer legs. Here is where the next move starts to take shape.