- MicroStrategy now holds 331,200 Bitcoin worth over $30 billion after its latest purchase of 51,780 BTC for $4.6 billion

- The article looks back at MicroStrategy’s five largest Bitcoin purchases, ranked by the amount of BTC acquired

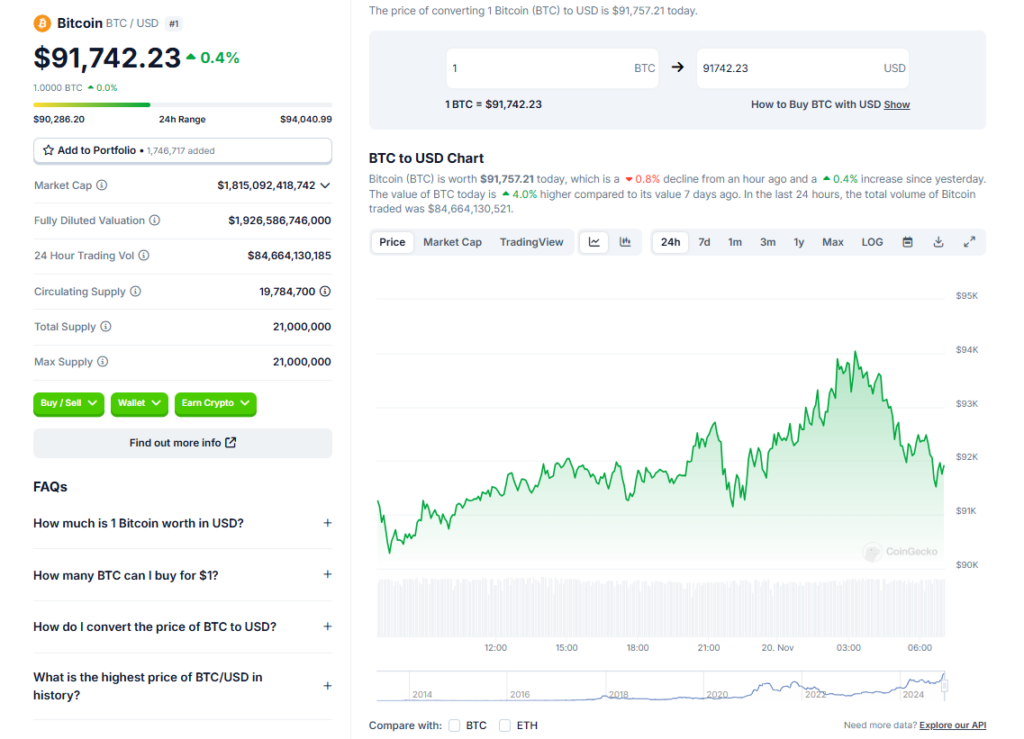

- The largest purchase of 51,780 BTC on November 18, 2024 initially caused a dip in Bitcoin’s price, but it later rebounded and hit a new all-time high above $94,000 the next day

MicroStrategy, fronted by outspoken Bitcoin bull and Executive Chairman Michael Saylor, added to its sizable Bitcoin holdings Monday with the purchase of 51,780 BTC (or $4.6 billion worth). The purchase is the latest—and largest—in a string of Bitcoin purchases dating back to 2020 when MicroStrategy and Saylor made the strategic decision to allocate capital to the leading cryptocurrency to maximize long-term value for shareholders.

Since that time, the business intelligence firm has reshaped itself into a Bitcoin development company and pioneered the crypto treasury reserve asset model that others have copied. It has also amassed more than 133,200 Bitcoin, making it the largest corporate treasury reserve holder of the asset. That’s more than $30 billion worth as of this writing.

MicroStrategy’s Latest Massive Bitcoin Purchase

MicroStrategy, a software firm founded by Michael Saylor, disclosed Monday morning that it has bought another 51,780 Bitcoin at an average price of $88,627, totaling $4.6 billion, according to an SEC filing. As he always does, the company’s Executive Chairman Saylor boasted about the purchase on Twitter by noting that the company’s holdings now total 133,200 Bitcoin.

The software company’s Bitcoin stash was acquired for $16.5 billion in total, but thanks to the recent price rally it’s now worth over $30 billion. MicroStrategy’s latest purchase brought its holdings to 133,200 BTC, more than $30 billion worth at the current price.

A Look Back at MicroStrategy’s 5 Biggest Bitcoin Buys

Here’s a look back at MicroStrategy’s five largest Bitcoin purchases to date—ranked by amount of BTC not the US dollar value—and their immediate impacts on the price of Bitcoin, marked from the time of Saylor’s announcements via social media:

- 51,780 BTC – Nov 18, 2024

- Average price: $88,627

- Total spend: $4.6 billion

- 29,646 BTC – Dec 21, 2020

- Average price: $21,925

- Total spend: $650 million

- 27,200 BTC – Nov 11, 2024

- Average price: $74,463

- Total spend: $2.03 billion

- 21,454 BTC – Aug 11, 2020

- Average price: $11,652

- Total spend: $250 million

- 19,452 BTC – Feb 24, 2021

- Average price: $52,765

- Total spend: $1.026 billion

Conclusion

MicroStrategy continues to aggressively accumulate Bitcoin, boosting its corporate treasury reserves of the asset. With Bitcoin’s price on the rise, the value of its holdings has ballooned to over $30 billion. It will be interesting to see if MicroStrategy continues this strategy and if other major corporations follow its lead.