- MicroStrategy acquired 15,350 additional Bitcoin between December 9 and 15, spending around $1.5 billion in cash

- The latest purchase brings MicroStrategy’s total Bitcoin holdings to 439,000 BTC, bought at an aggregate price of $2.71 billion or an average of $61,725 per BTC

- MicroStrategy’s stock will be added to the Nasdaq-100 Index before the market opens on December 23, fueling a rally in its share price

MicroStrategy, a prominent Bitcoin corporate holder, has recently added 15,350 BTC to its holdings, investing approximately $1.5 billion. The acquisition was made between December 9 and 15, marking an increase in the company’s total Bitcoin reserves.

MicroStrategy’s Latest Bitcoin Purchase and its Impact on Total Holdings

MicroStrategy sealed the deal for the latest Bitcoin purchase at an average price of $100,386 per BTC. These funds were raised through the issuance and sale of shares under a convertible notes sales agreement. This move has expanded MicroStrategy’s and its subsidiaries’ total Bitcoin holdings to 439,000 BTC, valued at approximately $4.56 billion. The average purchase price of these holdings stands at $61,725 per BTC, and the total investment sums up to $27.1 billion.

MicroStrategy’s Bitcoin Performance and Future Acquisition Plans

MicroStrategy’s founder, Michael Saylor, highlighted the impressive performance of the company’s Bitcoin investments, noting a 464% yield quarter-to-date and a 724% yield year-to-date. Interestingly, this latest Bitcoin acquisition comes after Saylor’s statement that he would continue buying Bitcoin even if the price exceeded $100,000. He further added that he wouldn’t hesitate to invest $1 billion daily in Bitcoin, even if the price reached $1 million per coin

MicroStrategy’s Forthcoming Entry into the NASDAQ 100

MicroStrategy’s aggressive Bitcoin buying strategy coincides with a surge in its share price, which has seen a 490% increase year-to-date. On December 14, NASDAQ announced that MicroStrategy’s stock would be included in the NASDAQ-100 Index, which tracks the performance of the 100 largest non-financial companies listed on the NASDAQ stock exchange. This announcement has sparked a further rise in MicroStrategy’s stock price.

Conclusion

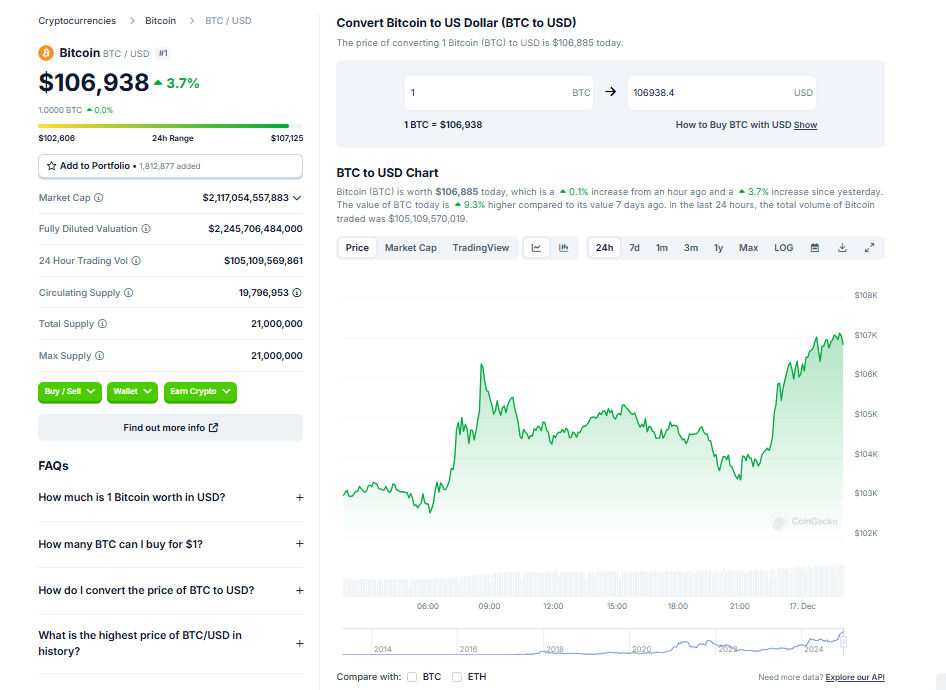

MicroStrategy’s bold moves in the Bitcoin market underscore its confidence in the cryptocurrency’s potential. As the company prepares to join the NASDAQ-100 Index, the future seems promising for this Bitcoin giant. With Bitcoin trading at around $103,941, up by approximately 1.3% over the past 24 hours, MicroStrategy’s Bitcoin strategy appears to be paying off handsomely.