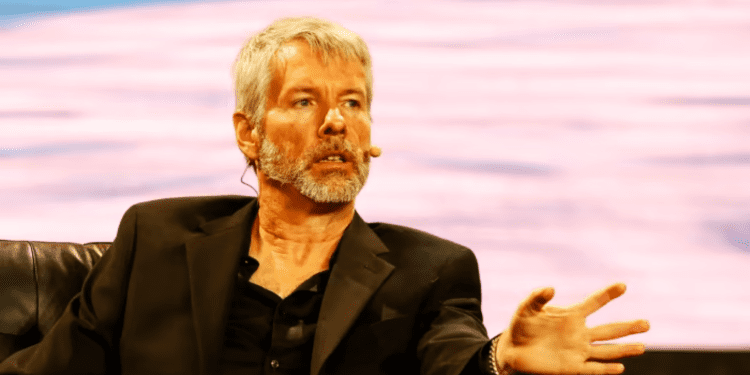

- Michael Saylor is still a Bitcoin Maxi

- In the last week of 2022, Michael Saylor adds more Bitcoin. Is this a moon strategy to influence prices and collect profit?

- Microstrategy to launch Bitcoin Lightning Network in 2023.

Purchasing about 2,395 bitcoins for $42.8 million between November 1 and December 21 through its MicroStrategy subsidiary, MicroStrategy (MSTR), the business software provider that crypto enthusiast Michael Saylor co-founded, increased its bitcoin (BTC) stockpile, according to a filing with the Securities and Exchange Commission on Wednesday.

The business sold around 704 bitcoins for $11.8 million last Thursday, reasoning that a loss on the deal would balance out earlier capital gains.

The company’s total assets now stand at 132,500 bitcoins after purchasing an extra 810 for $13.6 million on Saturday. In contrast to MicroStrategy’s $4 billion acquisition cost, which is currently worth roughly $2.25 billion.

Since it started purchasing bitcoin in 2020, MicroStrategy has just sold it this week.

The corporation has spent a net $44.6 million since November 1, adding around 2,501 bitcoins to its holdings.

While the price of bitcoin stayed stable at around $16,700 in premarket trade, shares of MicroStrategy were only slightly higher.

The recent decline of Bitcoin [BTC] to a low of $16k has devastated many individuals. The bear market, however, appeared to be advantageous for investors trying to increase their reserves. The market is routinely avoided by retail investors when bears strengthen their positions.

However, despite having a significant position, most institutional investors continue to add to their coin collections. Every time the price of BTC declines, MicroStrategy typically joins the market. The business has once more taken advantage of the recent decrease in BTC by buying more Bitcoin for $41 million.

MicroStrategy’s creator, Michael Saylor, recently tweeted about the purchase of 2,500 bitcoin.

MicroStrategy Now Holds 132,500 BTC

According to information from the SEC, MicroStrategy increased its reserves by 2,500 BTC for $41 million. The company had 132,500 Bitcoin as of December 27, 2022, which it purchased for $4.03 billion, or an average price of $30,397 per BTC.

Despite the ups and downs and a loss, Saylor still seems adamant about his BTC decision. The company has no imminent intentions to sell its BTC because it is long-term focused.

At the time of publication, BTC is down 1.11% in value over the last 24 hours, trading at $16,650. BTC has been the least volatile cryptocurrency overall in comparison.

However, MicroStrategy’s choice to invest in BTC could have been more logical. Despite the volatile last 12 months, the largest crypto asset has been performing well on the macro front. The dashboard’s maker claims that:

“Of course, hindsight is 20/20, and his decision to convert his company cash (and more) into Bitcoin could have been (and still can be) the greatest decision ever. But saying “there is no second-best crypto asset” is a bit of a stretch if you ask me and the currently available data. “

MicroStrategy To Offer Bitcoin Lightning Solutions In 2023

According to Michael Saylor, executive chairman of MicroStrategy, his company intends to introduce software and solutions powered by the Bitcoin Lightning Network in 2023.

On December 28, 2022, Saylor revealed during a Twitter Spaces event that the business is investigating software and Lightning Network-based solutions, including those that “assist” enterprise marketing and a cybersecurity solution for business websites.

A layer-2 payment mechanism called the Lightning Network sits on top of the blockchain of Bitcoin and permits off-chain transactions, increasing throughput and cutting fees.