- The memecoin market plunged to its lowest level of 2025, wiping out over $5B in a single day as risk appetite collapsed.

- Broader crypto markets also fell sharply, with total market cap dropping $800B in three weeks and major assets like BTC and ETH sliding double digits.

- NFTs mirrored the decline, falling 43% in a month, with most top collections posting heavy losses except for a couple of outliers.

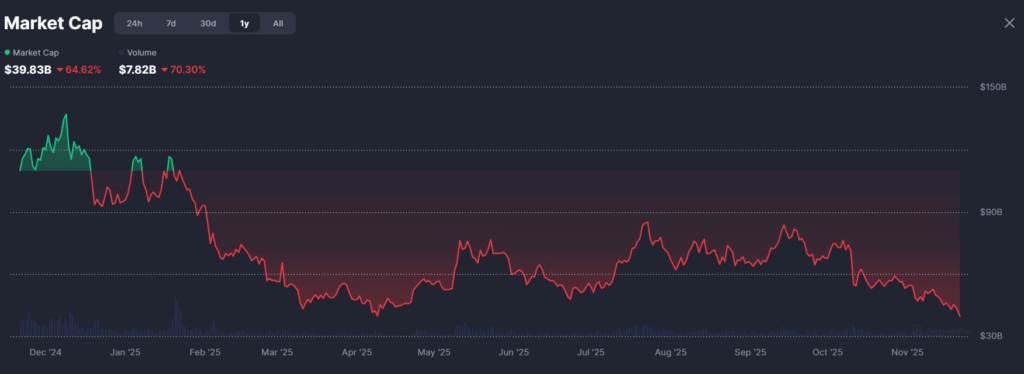

The memecoin market took a hard hit on Friday, sliding to its lowest point of 2025 as traders suddenly stepped away from speculative assets. According to CoinMarketCap, the entire sector fell to a combined value of about $39.4 billion — which is pretty wild considering it was sitting at $44 billion just a day earlier. That means more than $5 billion evaporated in 24 hours, even though trading volume actually jumped by 40%, which kinda shows panic more than interest. Compared to the high back on Jan. 5, when the market touched $116.7 billion, this drop marks a massive 66.2% drawdown and signals that sentiment around memecoins has cooled fast.

Broader Crypto Market Suffers Heavy Losses

This wasn’t an isolated meltdown either. The rest of the crypto market has been bleeding heavily over the past few weeks. CoinGecko data shows the global market cap tumbling from $3.77 trillion on Nov. 1 to $2.96 trillion by Friday — that’s roughly an $800 billion wipeout in just three weeks. Even the majors aren’t escaping the sell-off. Bitcoin, the market giant, traded around $82,778 after falling 14.7% over the week, and Ether followed with its own 16% decline down to $2,688. Risk appetite seems to have evaporated across the board, not just in memecoins.

Top Memecoins Record Steep Losses Across All Timeframes

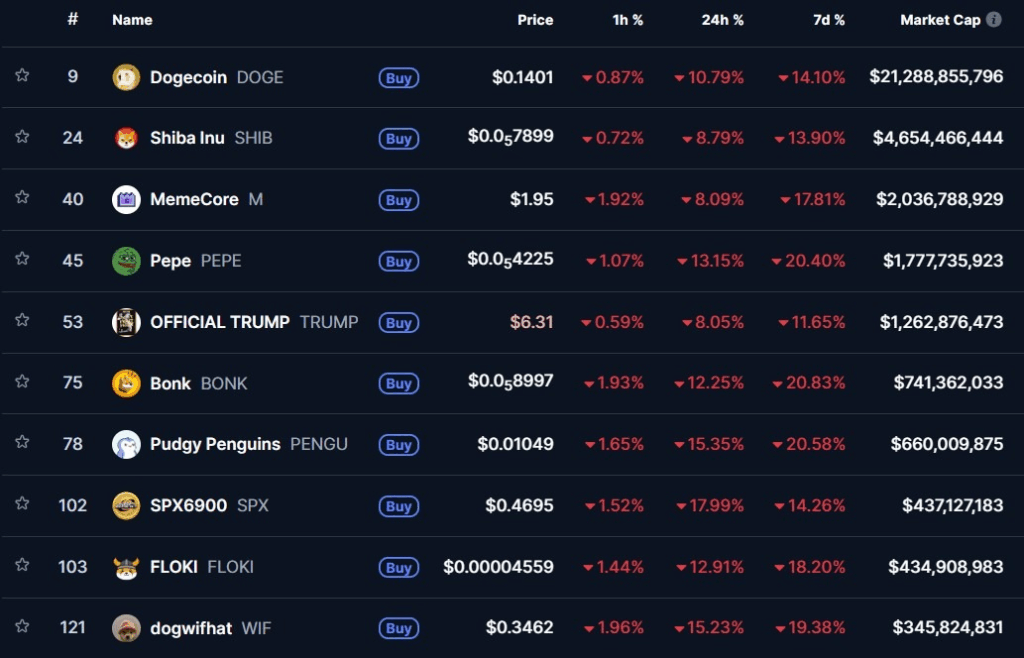

Looking at the sector’s top tokens, the picture doesn’t get any prettier. The top 10 memecoins are deep in the red across every major timeframe — the 1-hour, 24-hour, and seven-day charts — showing how broadly traders have stepped back from high-volatility assets. Dogecoin and Shiba Inu both posted double-digit drops, while tokens like Pepe, Bonk, and Floki sank even harder. Weekly losses ranged from around 11% at the best to more than 20% for those hit the worst, which is a pretty brutal week for such a speculative corner of the market.

Interestingly, Trump’s “Official Trump” memecoin was the least damaged, losing 11.65% — still rough, but lighter than others. Dogecoin followed with a 14.10% decline, and SPX6900 slipped 14.26%. On the other end, Bonk, Pudgy Penguins’ PENGU token, Pepe, and Dogwifhat all recorded heavy 20% drops, putting them among the worst performers of the week.

NFT Market Also Hits Multi-Month Lows

The NFT market wasn’t spared either, suffering another wave of steep valuation losses. CoinGecko data shows the NFT market cap tanking to $2.78 billion — down a massive 43% from $4.9 billion just 30 days ago. That’s its lowest level since April and pretty clearly reflects fading interest in digital collectibles as speculation cools down. Most of the top 10 NFT collections saw double-digit declines, with Hyperliquid’s Hypurr NFTs collapsing 41.1% in a single month. Moonbirds and CryptoPunks followed with declines of 32.7% and 27.1%, while Pudgy Penguins dropped about 26.6%.

Still, not everything was red. Two collections stood their ground: Infinex Patrons actually gained 11.3%, making it the lone standout performer, while Autoglyphs managed to slip only 1.9%, which — in this environment — is almost a win. Even so, the broader trend is clear: both memecoins and NFTs are now sitting at their weakest points of the year, with speculative appetite falling sharply as the entire market recalibrates.