- Meme coin dominance has fallen to multi-year lows as DOGE and SHIB lose momentum

- Technical indicators for both tokens point to continued downside risk

- The sector faces a test of whether it can evolve beyond hype-driven speculation

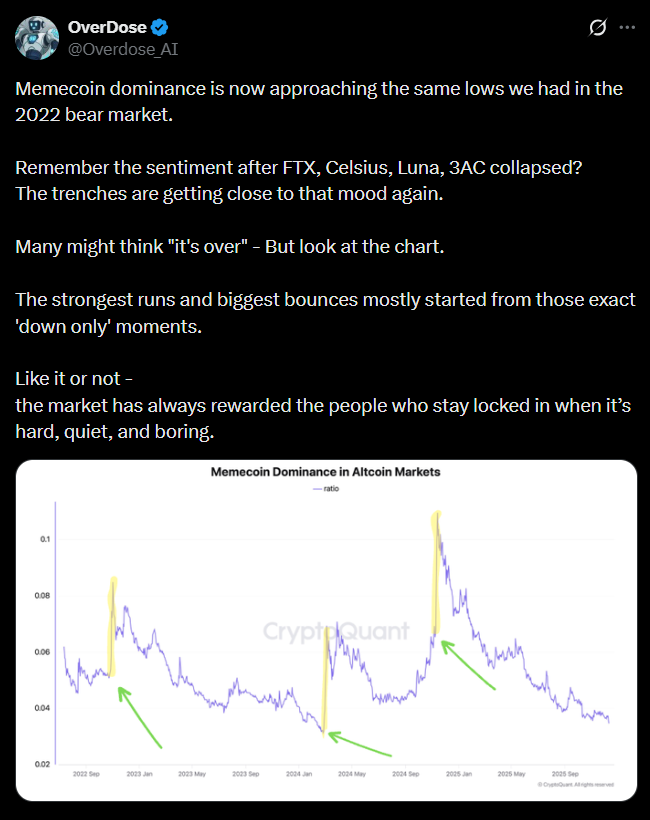

Meme coins, once the loudest corner of the crypto market, are entering a much quieter phase. As of November 2025, the sector’s dominance has slipped to levels last seen in late 2022, with Dogecoin and Shiba Inu both struggling to hold relevance in a market that is increasingly selective about risk. What once thrived on hype and retail energy is now facing a test of endurance as macro pressure and weak technicals take center stage.

Market Dominance Is Fading Across the Meme Coin Sector

Dogecoin remains the largest meme coin by market capitalization, sitting near $23.9 billion, but its grip on dominance is weakening. Shiba Inu, which once rivaled DOGE during the 2021 cycle, has fallen to roughly $5.1 billion and is down more than 90% from its all-time high despite ecosystem efforts like Shibarium and ShibaSwap.

Beyond the top two, the broader memecoin category is seeing declining liquidity and participation. Sector-wide dominance has dropped to multi-year lows, suggesting investors are rotating away from high-beta speculative assets and toward areas perceived as more defensible during uncertain macro conditions.

Technical Charts Paint a Bearish Picture

Dogecoin’s chart structure has deteriorated notably. The price recently lost support near $0.195, with RSI sitting around 40 and MACD confirming a bearish crossover. Trading volume and open interest have also fallen, signaling fading trader engagement. Analysts warn that a break below $0.181 could expose DOGE to deeper downside, potentially toward the $0.13 zone if momentum fails to recover.

Shiba Inu’s setup is similarly weak. SHIB continues to trade below its 20-day EMA, while remaining under its 50-day, 100-day, and 200-day moving averages. RSI hovering in the 40–45 range reflects hesitation rather than accumulation, and without a decisive move above long-term resistance, the token risks extended consolidation or further downside.

Analysts Grow More Cautious as Macro Pressure Builds

Delayed rate cuts and tighter financial conditions have reduced appetite for speculative trades, hitting meme coins particularly hard. While some analysts still point to possible DOGE ETF narratives or surprise retail revivals, the prevailing tone is cautious. Shiba Inu has drawn sharper criticism, with analysts questioning whether its ecosystem has delivered enough real-world adoption to justify renewed interest in a risk-off environment.

Long-term forecasts remain divided. Some models outline extreme upside scenarios if sentiment flips, while others warn that meme coins may underperform for an extended period unless broader liquidity conditions improve. What’s clear is that easy hype alone is no longer enough to sustain valuations.

A Sector Being Forced to Grow Up

The memecoin market appears to be transitioning from pure speculation toward a tougher reality where fundamentals, liquidity, and macro context matter more than viral momentum. Dogecoin and Shiba Inu still command attention, but their declining dominance suggests the sector is no longer the market’s primary outlet for risk.

Whether this period becomes a reset or the start of a longer decline will depend on broader market conditions and whether meme coins can evolve beyond their original narratives. For now, caution dominates, and investors are watching closely to see if this freeze is temporary—or structural.