- Matrixport report controversially predicts SEC will reject all spot bitcoin ETF applications in January, conflicting with more optimistic analysts.

- Report faced skepticism from industry analysts like Eric Balchunas who question its accuracy and claim SEC sources indicate progress towards approvals.

- Outlook for bitcoin ETF approval in early 2023 remains uncertain until SEC makes official decisions on pending product filings.

The approval of a spot bitcoin exchange-traded fund (ETF) in the U.S. has long been an eagerly anticipated milestone for the crypto industry. However, a controversial new report from Matrixport predicts the Securities and Exchange Commission (SEC) will reject all spot bitcoin ETF applications in January. The report prompted backlash from analysts who claim it is speculative and conflicts with insider information.

Matrixport Report Predicts ETF Rejections

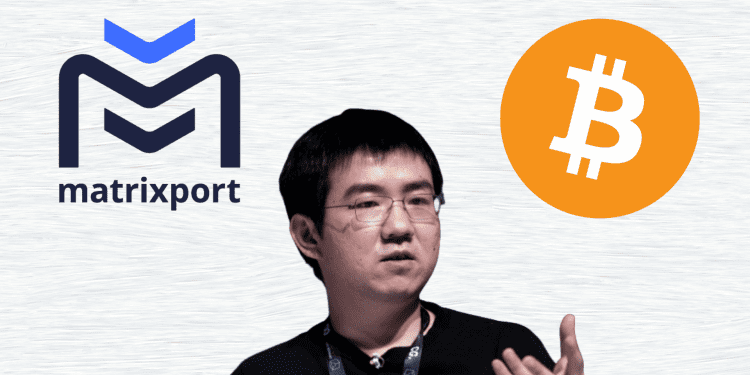

Earlier this week, crypto lending firm Matrixport released a report titled “Matrixport Analysis: SEC to Reject ETF Applications in January with Final Approval Pushed to Q2 2024.” The report forecasted the SEC would reject proposed rule changes for spot bitcoin ETFs in January.

The report’s release coincided with a 7% drop in bitcoin’s price, falling from above $45,000 to below $42,100 within hours. According to the report, factors influencing bitcoin’s price include the SEC’s rejection of spot bitcoin ETFs in the short-term, with potential approval delayed until Q2 2024.

Industry Analysts Question Report’s Accuracy

The rejection forecast was met with skepticism from industry analysts like Eric Balchunas of Bloomberg. Balchunas asked report author Markus Thielen to confirm his sources, given the claim conflicts with information from analysts like James Seyffart who have contacts within the SEC.

Balchunas argued it would be counterproductive for the SEC to continue meeting with ETF applicants over their filings if rejections were imminent. Other analysts agreed, stating their SEC sources indicated continued progress towards ETF approvals.

Matrixport Defends Report, But Questions Remain

In response to the backlash, Matrixport co-founder Jihan Wu emphasized the report represented the independent views of the company’s analysts. However, Wu acknowledged his own limited involvement with the report, having only briefly reviewed the title.

While Matrixport maintains its analysts acted independently, the lack of verifiable sources for the rejection forecast leaves its accuracy in doubt. With the SEC facing a late January deadline to approve or reject spot bitcoin ETFs, the coming weeks will prove whether the report’s speculation was on target or widely off base. For now, the outlook for bitcoin ETF approval in early 2023 remains uncertain.

Conclusion

The crypto industry had high hopes that 2023 would finally bring SEC approval for spot bitcoin ETFs in the U.S. However, Matrixport’s controversial report predicting rejections shows the ETF approval process still faces hurdles. While the SEC has made progress in meetings with ETF issuers, doubts remain on whether product filings will satisfy the regulators concerns. Until official decisions emerge, uncertainty persists around the eagerly awaited bitcoin ETF milestone.