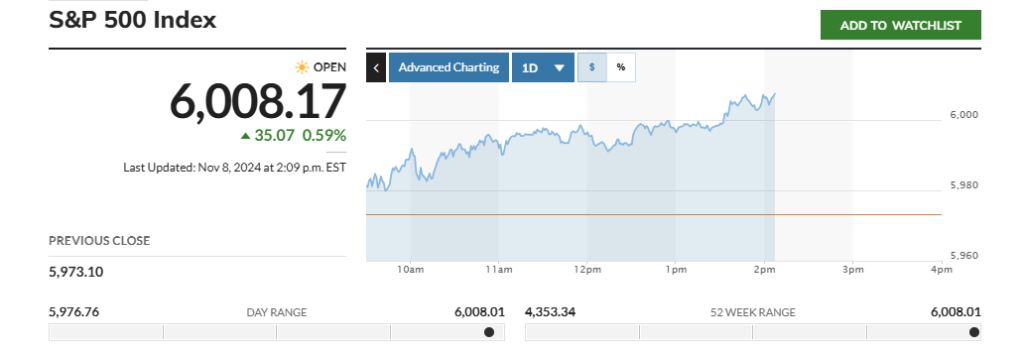

- The S&P 500 index crossed 6,000 for the first time ever on Friday, November 8, 2024.

- The S&P’s 4.7% rally this week was its best since November 2023, fueled by Donald Trump’s re-election as U.S. President.

- With a 25.8% year-to-date gain, the S&P 500 is on track for one of its best years since the turn of the millennium.

The S&P 500 index has reached a new milestone, crossing 6,000 for the first time ever. This reflects the benchmark index’s strong gains so far in 2024, further boosted by positive market reaction to President Donald Trump‘s reelection.

S&P 500 Hits Historic High

On Friday, the S&P 500 hit an intraday peak of 6,000.02. This week alone, the index has climbed 4.7%, which would be its best weekly performance since November 2023. The rally comes as Wall Street welcomes the prospects of tax cuts, deregulation, and other corporate-friendly policies expected under a Republican federal government over the next four years.

Strong Year-to-Date Performance

With Friday’s surge, the S&P 500 is now up 25.8% year-to-date excluding dividends. This would rank as the index’s fifth-best annual gain since 2000, trailing only 2013, 2019, 2021, and 2003. The milestone reflects the S&P 500’s standout performance through the first nine months of 2024, which was its strongest January-September period since 1997.

Post-Election Boost

This week’s gains have been driven by Trump’s defeat of Joe Biden in Tuesday’s presidential election. Stocks seen as potential winners under Trump have led the way higher, including electric vehicle maker Tesla, pharmaceutical firm Eli Lilly, and retailer Costco. Shares of each company rose at least 4% on Friday. Other market leaders like Amazon, Nvidia, and JPMorgan Chase enjoyed post-election rallies exceeding 5%.

Historical Context

The S&P 500 has repeatedly reached new 1,000-point milestones over the past two decades. It first closed above 1,000 in 1998, then broke through 2,000 in 2014, 3,000 in 2019, 4,000 in 2021, and 5,000 this past February. The index tracks 500 of the largest U.S. public companies and has served as a benchmark for American equities since 1957.