- Canary Funds’ Litecoin ETF filing, coupled with SEC feedback, boosts its chances of approval.

- Litecoin’s Bitcoin fork status and non-security classification give it an edge over XRP and Solana.

- Incoming SEC Chair Paul Atkins may usher in a friendlier regulatory approach for crypto ETFs.

With U.S. President-elect Donald Trump just days away from his inauguration and a leadership shake-up looming at the SEC, the crypto ETF space could be about to heat up. Analysts Eric Balchunas and James Seyffart from Bloomberg Intelligence believe Litecoin (LTC) could be next in line for spot ETF approval, joining Bitcoin (BTC) and Ether (ETH).

SEC Engagement Boosts Litecoin’s Chances

Earlier this week, Canary Funds filed an amended S-1 form for their Litecoin ETF, signaling active dialogue with the SEC. Bloomberg analyst James Seyffart highlighted this development on X, noting, “No guarantees — but this might be indicative of SEC engagement.”

Eric Balchunas echoed the sentiment, adding that feedback from the SEC on the S-1 filing “bodes well” for Litecoin’s chances of approval. To further solidify its position, the Nasdaq exchange submitted a 19b-4 form for the ETF on Thursday. This filing forces the SEC to either approve or reject the ETF within the year, giving the application a definitive timeline.

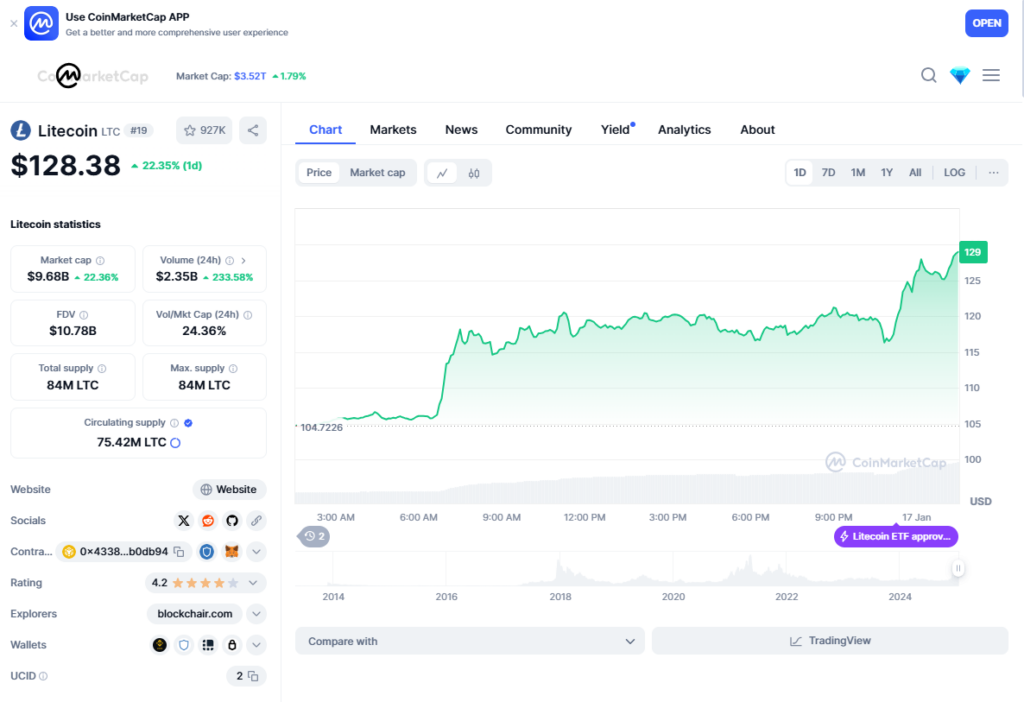

Following the news, Litecoin’s price surged by 18% in the last 24 hours, demonstrating heightened investor interest in anticipation of the ETF’s potential approval.

Why Litecoin?

Litecoin’s candidacy for a spot ETF is unique. Despite being the 11th largest cryptocurrency by market capitalization, with a valuation of $8.8 billion, Litecoin is often overshadowed by larger players like Solana (SOL) and Ripple (XRP).

What sets Litecoin apart is its Bitcoin lineage—it’s a fork of Bitcoin, following similar rules like using Proof-of-Work for consensus. Crucially, the SEC has never classified Litecoin as a security, a distinction that gives it an edge over coins like XRP and Solana, which are embroiled in legal battles over their regulatory status.

A New Regulatory Era

The SEC’s leadership transition could be a game-changer. Gary Gensler, known for his stringent approach to crypto regulation, will step down as SEC Chair this week. His replacement, Paul Atkins, is expected to adopt a more crypto-friendly stance. Balchunas described this shift as a “huge variable” that could significantly alter the trajectory of ETF approvals.

Analysts are predicting a wave of crypto ETFs in 2025, but not all at once. According to Balchunas, the rollout will likely begin with Bitcoin and Ether combo ETFs, followed by Litecoin due to its classification as a commodity rather than a security. Other assets, like HBAR, XRP, and Solana, may face longer timelines due to their more complex regulatory histories.

What’s Next?

Litecoin’s growing momentum, coupled with regulatory changes, positions it as a front-runner in the ETF race. Whether the SEC’s new leadership will expedite approvals remains to be seen, but the signs suggest a significant shift is on the horizon. For now, Litecoin investors are riding the wave, and the crypto community is watching closely to see how this regulatory drama unfolds.