- Bitwise’s Chainlink ETF (CLNK) is now listed on DTCC, signaling progress toward trading approval.

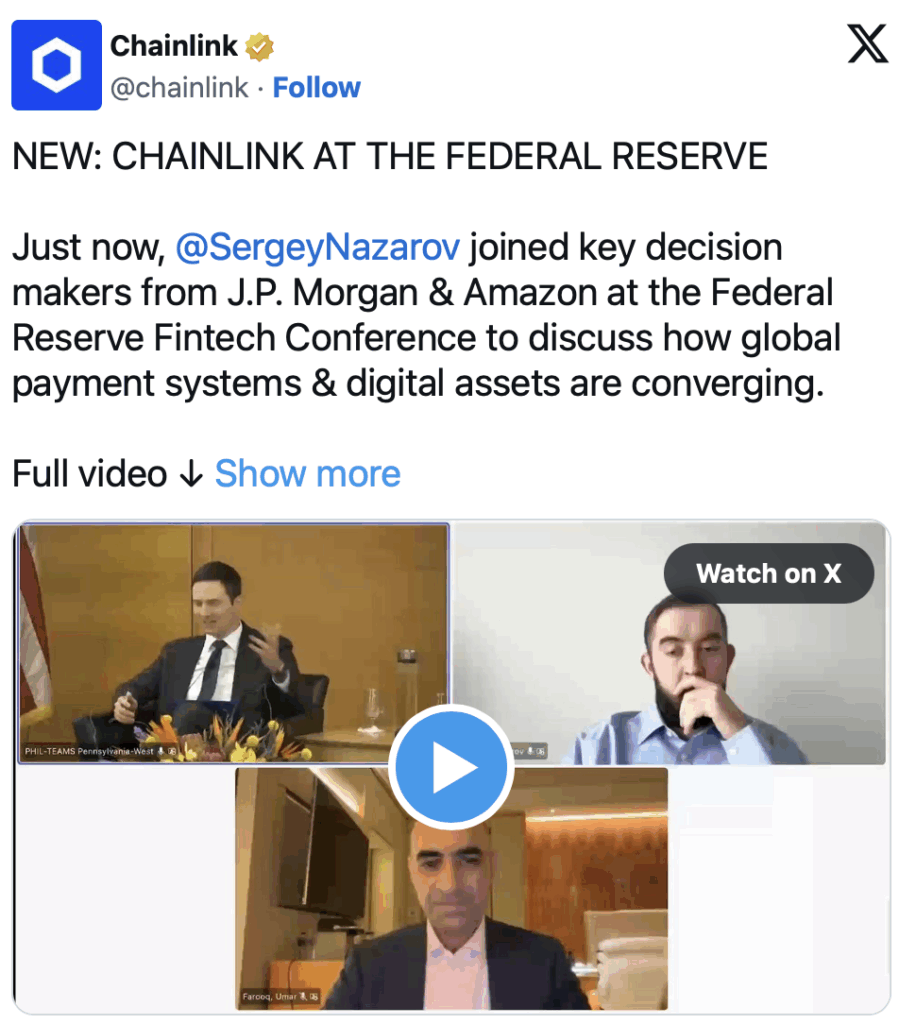

- Sergey Nazarov appeared at a U.S. Federal Reserve fintech panel alongside JP Morgan and Amazon leaders.

- Retail LINK holders continue selling, but whales accumulated 4M+ LINK in two weeks.

Chainlink just took a major step toward mainstream exposure. The long-anticipated Bitwise Chainlink ETF, now listed on the DTCC platform under ticker CLNK, has officially entered the final stages of its pre-approval process. Even though this doesn’t mean the SEC has given the green light yet, it signals the ETF is being positioned for eventual trading — and that institutions are getting serious about LINK.

Chainlink’s ETF inches closer to reality

DTCC’s listing is part of the routine clearing and settlement preparation process, but the timing is interesting. The infrastructure giant recently integrated Chainlink’s CCIP (Cross-Chain Interoperability Protocol) and CRE(Chainlink’s tokenization rail), hinting that Chainlink is slowly embedding itself deeper into the plumbing of global finance.

This isn’t just a “crypto project getting noticed.” It’s a signal that LINK is becoming a structural component in how financial systems might transfer data and assets in the future. The CLNK listing simply adds one more brick to that foundation.

Chainlink steps into the Fed’s policy circle

Chainlink co-founder Sergey Nazarov recently appeared alongside executives from JP Morgan and Amazon at the Federal Reserve’s Fintech Conference, where the discussion centered around digital asset interoperability and the future of global payment rails.

Events like this matter more than people admit. When a project starts appearing in high-level policy conversations, it usually marks a shift in how institutions perceive its long-term relevance. Chainlink’s presence there suggests it’s becoming part of the “serious players” category — not just another blockchain project.

But despite bullish signals… LINK holders keep selling

Here’s the twist: while institutional confidence builds, on-chain data shows that regular LINK holders have been selling consistently for the past month. Sentiment is weird right now — a mix of frustration, boredom, and “why isn’t LINK pumping yet?” vibes.

Analysts note this kind of behavior is common during long accumulation phases, where price stays sideways, sloppy, or even bearish despite strong fundamentals. ClairHawk Capital summed it up perfectly:

“They all do the same exact behavior during accumulation… big money can’t buy all at once. They raise capital by pumping distractions, memes, and rotate profits quietly into asymmetric plays while retail stays oblivious. After enough accumulation? That’s when price breaks out and enters discovery.”

In other words: retail sells from exhaustion, whales accumulate, and the breakout comes after everyone stops expecting it.

Whales ramp up buying as exchange supply hits record low

While smaller holders offload their bags, whales are doing the exact opposite. According to on-chain analyst Ali, large wallets accumulated over 4 million LINK in the last two weeks alone. This pushed the Exchange Supply Ratio to its lowest level ever.

Arca Research also confirmed that LINK balances on exchanges are in freefall, dropping to a fresh 2-year low — a classic sign that long-term holders are positioning for higher prices. When tokens leave exchanges like this, it usually means they’re being moved into cold storage, not prepping for a selloff.

LINK price trends upward as accumulation builds

At the moment, LINK is trading around $15.93, up nearly 3% in the past 24 hours. That uptick may look small, but paired with the record-low exchange supply and the upcoming ETF catalyst, the setup is starting to look… tight. Pressure builds quietly before it explodes.

With the Bitwise Chainlink ETF already listed on DTCC and institutional integration accelerating, sentiment could shift fast — especially if whales continue draining supply.

Right now, it feels like two worlds are colliding: retail confusion and institutional confidence. And historically, the latter tends to win the long game.