- Jump Crypto’s president pleaded the Fifth Amendment when questioned by the SEC about a secret $1 billion deal with Terraform Labs’ Do Kwon to prop up UST.

- The deal allowed Jump Crypto to purchase LUNA coins at a heavy discount in exchange for amending a LUNA loan agreement.

- The SEC alleges Kwon and Terraform misled investors, leading to billions in losses, but Kwon’s defense argues no laws were broken.

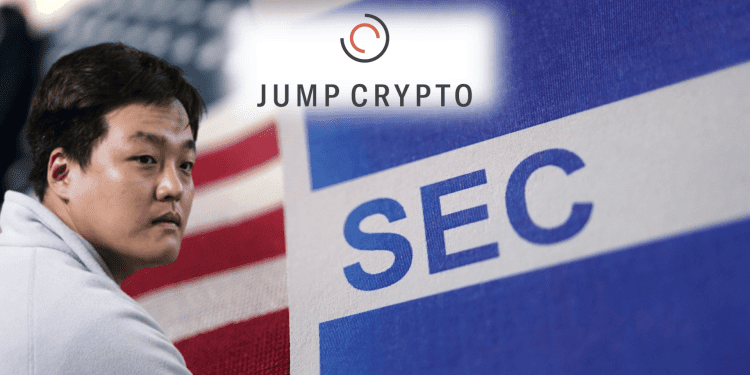

Jump Crypto‘s president, Kanav Kariya, pleaded the Fifth Amendment while being questioned by the SEC over an alleged hidden market-making scheme with Terraform Labs founder Do Kwon. This deal allowed Jump Crypto to pocket over $1 billion.

The Secret Deal

When asked whether he made an agreement with Kwon to buy up massive amounts of UST to restore the token’s value, Kariya refused to answer and invoked his Fifth Amendment rights.

The deal, established on May 23, 2021, saw Jump Crypto purchase large amounts of LUNA in exchange for an amendment to Jump’s LUNA loan agreement. Jump purchased LUNA coins valued at $0.90 for just $0.40 each.

Kariya served on the governing council for Luna Foundation Guard, which claimed to promote transparency and governance.

The Aftermath

In February 2023, the SEC filed a civil fraud lawsuit against Kwon and Terraform Labs for misleading investors.

The SEC alleges that Terraform and Kwon’s actions led to the loss of at least $40 billion in market value, including devastating losses for US investors.

Moreover, the SEC claims Kwon and Terraform touted the restoration of the UST peg as a triumph of decentralization, while omitting the actual reason – Jump Crypto’s intervention.

What’s Next

US regulators have requested a summary judgment of the case. Kwon’s defense argues the SEC has failed to prove any securities laws were violated.

If extradited to the US, Kwon would likely join FTX’s Sam Bankman-Fried at the Metropolitan Detention Center in Brooklyn.