- Strategy faces index-removal risk as JPMorgan warns of shrinking premium and rising balance-sheet stress.

- Bitcoin’s plunge pushed Strategy’s market-implied NAV to parity, weakening its ability to issue stock to buy more BTC.

- Saylor rejects the criticism, calling Strategy a Bitcoin-backed structured finance company rather than a passive BTC holder.

Strategy’s founder Michael Saylor is pushing back hard after JPMorgan warned that the company may be removed from major stock indexes like the MSCI USA Index. JPMorgan argues that Strategy’s premium has collapsed, its balance-sheet risk has surged, and its structure now resembles a leveraged Bitcoin wrapper rather than a diversified operating company. Because the MSCI USA Index covers roughly 85% of the U.S. market, getting expelled would trigger automatic selling from billions in index-tracking funds, amplifying the pressure already mounting on Strategy’s stock.

Bitcoin’s Decline Hits Strategy’s Balance Sheet

At the center of the concern is Bitcoin’s steep decline. After Strategy spent years converting cash and debt into BTC, the company now holds 649,870 coins at an average cost of $74,433. Bitcoin’s drop from its $126,000 peak to roughly $82,000 has pushed Strategy into one of its most fragile positions yet. MSTR shares are down 40% in the past month and 68% below their all-time high, and the company’s market-implied NAV has slipped to nearly 1x. That shift is critical because Strategy’s ability to issue high-premium stock to buy more Bitcoin has historically powered what Saylor calls its “accumulation flywheel.” With the premium gone, issuing new shares becomes dilutive, removing a core advantage.

Saylor Rejects Market Fears, Defends Strategy’s Identity

Saylor insists JPMorgan is misrepresenting the company. He said Strategy is not a fund or a passive Bitcoin holder but an operating software firm with a Bitcoin-powered structured finance strategy. In 2025 alone, the company launched more than $7.7 billion worth of digital credit instruments across products like STRK, STRF, STRD, STRC, and STRE. He positioned Stretch (STRC) in particular as a Bitcoin-backed treasury credit instrument offering a monthly USD yield. Saylor’s point is that Strategy is building the world’s first Bitcoin-backed structured finance institution, not a simple balance-sheet play dependent on index inclusion.

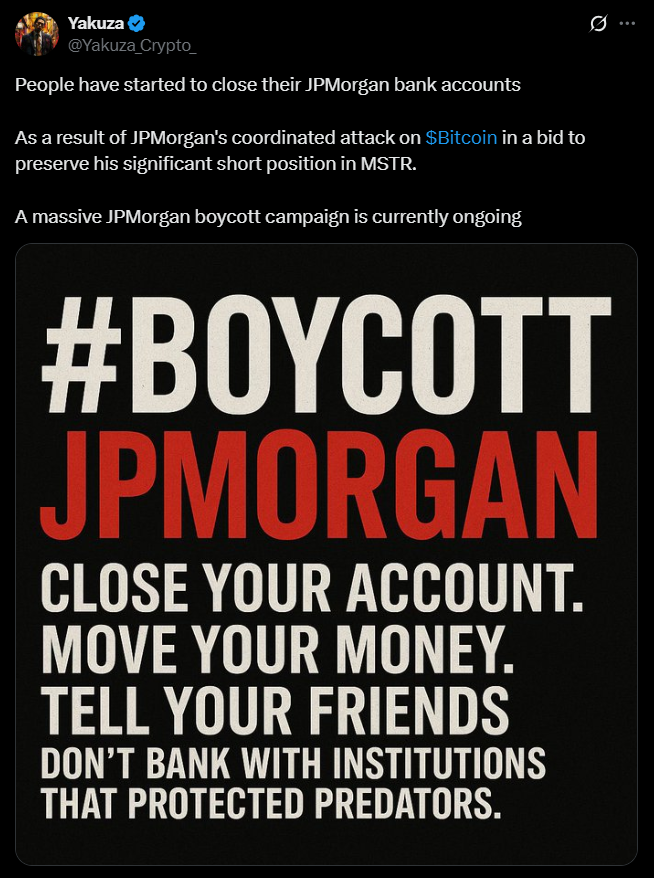

Bitcoin Community Responds With Outrage

Meanwhile, JPMorgan’s report has ignited a backlash in the Bitcoin community. Influential voices like Grant Cardone and Max Keiser called for boycotts of JPMorgan after the bank circulated MSCI’s proposal to remove crypto-treasury corporations from indexes starting in January 2026. Investors fear that if major firms are forced out, passive funds could dump millions of shares into already volatile markets, deepening both the stock and crypto downturns. With Strategy having joined the Nasdaq 100 in December 2024, the potential reversal of that passive-fund inflow adds even more urgency to the debate.

What Comes Next for Strategy?

As Saylor reiterates, Strategy will not adjust its Bitcoin-first strategy to maintain index status, arguing that labels don’t define the company’s mission. Whether regulators and index providers accept that view will shape not only Strategy’s future but the path for every crypto-heavy public company navigating traditional markets.