- Jim Cramer warns that crypto speculation is now influencing the S&P 500.

- Bitcoin and U.S. stocks both dropped amid trade tensions and Fed uncertainty.

- The “Inverse Cramer” meme resurfaces, with traders joking his bearish views could signal a crypto rebound.

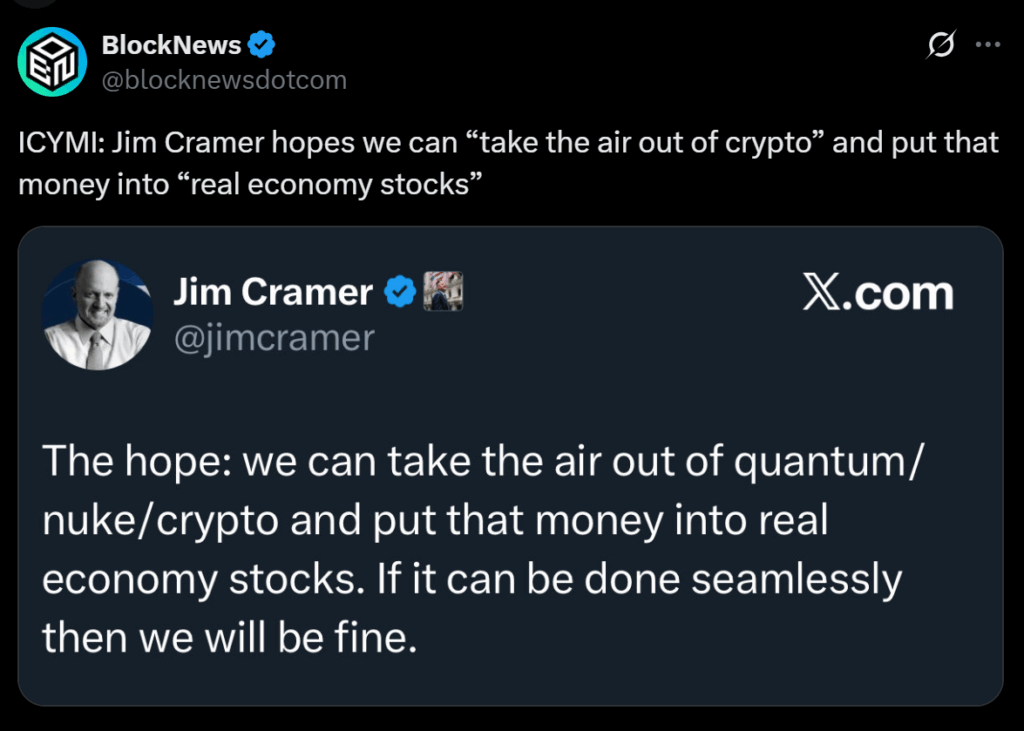

CNBC’s Mad Money host Jim Cramer has raised fresh concerns over what he calls the growing influence of cryptocurrency speculation on the traditional financial system. In a recent post on X, Cramer described the relationship between crypto and the S&P 500 as “the tail wagging the dog” — implying that volatile digital assets are now dictating the direction of U.S. equities, not the other way around.

Cramer suggested that when crypto prices surge, Wall Street follows with gains, and when the crypto market crashes, traditional stocks often tumble too. “I’ve been worried this would happen for weeks,” he wrote, highlighting how closely correlated the two markets have become. His comments come amid renewed turbulence triggered by U.S.-China trade tensions and growing uncertainty around the Federal Reserve’s next rate move.

Bitcoin and Stocks Fall in Sync

Cramer’s remarks coincided with a fresh market dip. Bitcoin fell more than 4%, sliding from $115,500 to $110,343, while the S&P 500 dropped 1.34% over the same period. Analysts attribute much of this weakness to escalating tariff threats between Washington and Beijing, which recently sent shockwaves through both crypto and traditional markets.

Still, Cramer argues that the connection between these declines is no coincidence. According to him, speculative enthusiasm — or panic — in the crypto sector is now strong enough to ripple through institutional portfolios and ETFs, influencing how major equity indices behave. “The tail is now wagging the dog,” he reiterated, suggesting that crypto sentiment may be steering the broader market narrative.

“Inverse Cramer” Meme Returns

Predictably, the internet had a field day. Within hours of his post, X users revived the “Inverse Cramer” meme, a long-running joke that market moves often go in the opposite direction of his predictions.

Commentators joked that Cramer’s warnings could actually be a bullish signal for digital assets. “Every time he calls for a crash, Bitcoin rallies,” one user quipped. Others urged him to make more bearish calls — like declaring that Bitcoin will never reach $200K or that Ethereum and XRP are doomed — hoping that the “Cramer effect” might once again spark the opposite outcome.

Crypto’s Growing Grip on Wall Street

Regardless of the memes, Cramer’s point taps into a real and growing concern: crypto markets are now deeply intertwined with traditional finance. With institutional funds, ETFs, and publicly traded firms holding significant exposure to Bitcoin and Ethereum, volatility in digital assets can quickly spill over into equities.

While Cramer remains skeptical about the influence of “speculative” crypto behavior, others see it as a sign of mainstream integration — a new era where digital assets no longer sit on the sidelines but actively shape Wall Street’s mood swings.