- President Trump recently considered firing Fed Chair Jerome Powell but backed off, amid increasing tensions.

- Powell is set to speak tomorrow at 8:30 AM EST, with speculation growing about his long-term position.

- Treasury Secretary Scott Bessent criticized the Fed for “mandate creep,” suggesting an internal review of its operations.

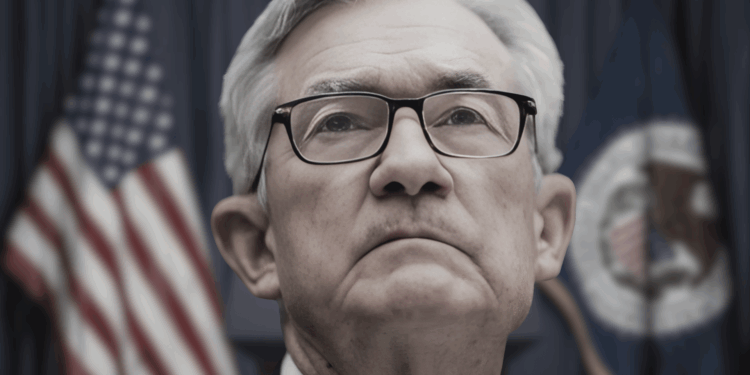

Federal Reserve Chair Jerome Powell is once again in the political spotlight after recent reports suggested President Donald Trump considered firing him—though ultimately did not follow through. This development comes just ahead of a major speech Powell is set to deliver tomorrow at 8:30 AM EST, one that many are watching closely for clues on the central bank’s direction amid growing political tension.

The speculation around Powell’s future intensified after William John Pulte, director of Federal Housing, posted on X (formerly Twitter) that Powell’s “resignation speech” is on the horizon—though he clarified that tomorrow’s remarks likely won’t be that moment. Still, his post has fueled chatter about the Fed chair’s stability in a politically charged environment.

Mounting Clashes With Trump’s Team

Powell’s tenure has grown increasingly rocky under President Trump’s leadership. While the Fed has tried to navigate monetary policy amid inflation concerns and a cooling economy, it’s also come under fire from within the administration. U.S. Treasury Secretary Scott Bessent recently criticized the Fed for what he called “mandate creep”—accusing the central bank of extending beyond its traditional monetary policy remit into regulatory and even social governance arenas.

Bessent’s call for an exhaustive internal review of the Fed’s non-core activities marks one of the most direct confrontations with central bank independence in recent history. It also reflects a broader shift in the administration’s stance—one that seems poised to assert more political influence over a historically autonomous institution.

Powell’s Upcoming Speech: What to Watch

While Powell’s upcoming speech is officially billed as a routine policy update, the context has changed dramatically. Market analysts and political observers alike will be dissecting every word for signs of either defiance or concession. Will he double down on Fed independence? Or strike a more conciliatory tone to ease tensions with the White House?

With inflation still a concern and the 2025 election cycle heating up, Powell’s message could shape more than just interest rate expectations—it may also reveal whether the Fed can maintain its independence under increasing political fire.