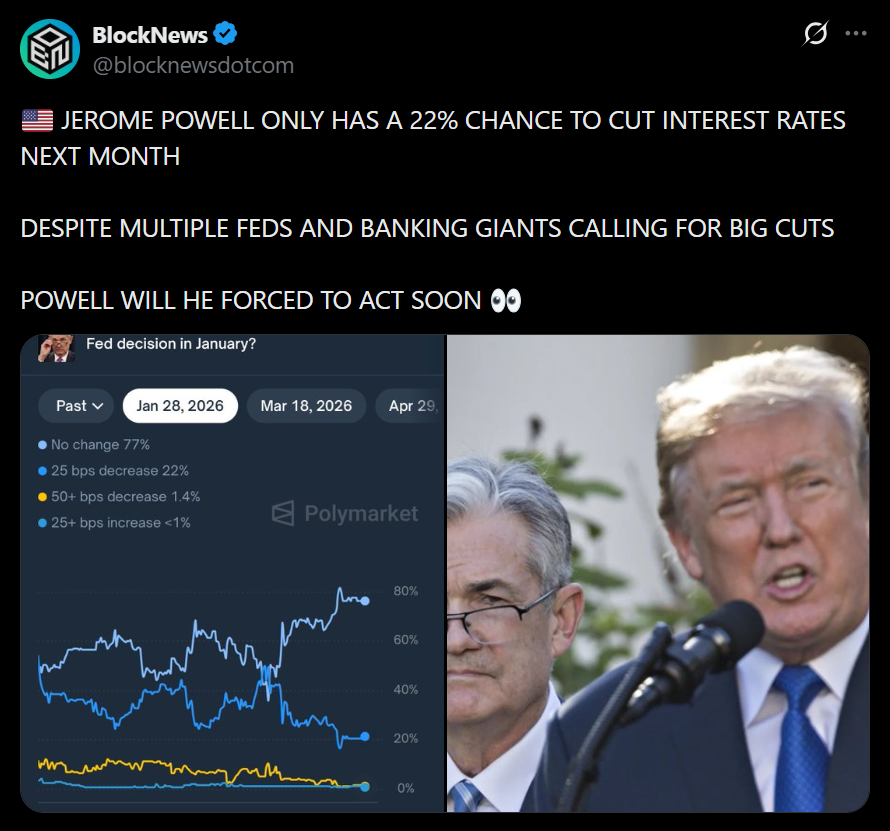

- Markets see only a 22% chance Jerome Powell cuts rates at the January Fed meeting.

- Inflation cooled more than expected, but Powell remains cautious.

- Traders still expect two cuts next year, but not immediately.

Despite fresh signs that inflation is cooling, markets remain largely unconvinced that Federal Reserve Chair Jerome Powell will move quickly on interest rates. Traders are currently pricing in only a 22% chance of a quarter-point rate cut at the Fed’s January meeting, underscoring how cautious expectations remain. Even after softer inflation data, Powell appears committed to patience rather than rushing into further easing.

Inflation Cools, But Powell Stays in Wait-and-See Mode

New data from the Bureau of Labor Statistics showed U.S. inflation rising just 2.7% year over year in November, well below forecasts calling for 3.1%. Core inflation also slowed to its weakest pace since early 2021. The data sparked a rally in Treasuries, with the two-year yield dropping to 3.45% and the 10-year sliding to 4.12%. Still, the reaction in rate expectations was muted, suggesting markets believe Powell needs more confirmation before acting.

Markets Price Only Limited Near-Term Easing

Interest-rate swaps now reflect roughly six basis points of easing for January, translating to that 22% probability of a rate cut. While traders continue to expect two quarter-point cuts next year, they don’t see Powell moving immediately. In fact, a full rate reduction isn’t priced in until mid-2026, highlighting how slowly the market expects policy to unwind from restrictive levels.

Powell Overshadows Dovish Voices Inside the Fed

The restrained outlook persists even as other Fed officials lean dovish. Fed Governor Christopher Waller recently reiterated that rates may be higher than neutral, while global central banks like the Bank of England have already begun easing. Yet Powell’s leadership continues to anchor expectations, particularly after last week’s Fed meeting revealed internal divisions, including dissents both for no cut and for a larger one.

What Powell’s Caution Means for Markets

For now, Powell’s cautious stance suggests monetary policy will remain a headwind rather than a tailwind in the near term. Bonds may benefit from cooling inflation, but risk assets looking for rapid relief may be disappointed. Until Powell sees clearer labor market weakness or sustained disinflation, January looks more like a pause than a pivot.