- Japan is increasingly positioning XRPL as financial infrastructure, with SBI reportedly investing across XRP, identity, compliance, and lending layers.

- Decentralized identity and zk-credential systems like XDNA could become critical for regulated adoption beyond simple payments.

- XRP’s bridge-asset design remains central, especially as stablecoin swaps and tokenized FX narratives grow around on-chain settlement.

Japan is starting to look like one of the most serious countries when it comes to building the next version of finance on-chain. The mix is pretty unique: a relatively strong regulatory environment, proactive institutional participation, and a growing appetite for blockchain-based financial infrastructure. And in that bigger picture, the XRP Ledger is increasingly being positioned as more than just a payments network. It’s being framed as core infrastructure.

Crypto analyst Stellar Rippler claimed on X that a senior banker from the Bank of Japan, Kazuo Ueda, reportedly stated that SBI Holdings has invested in XRP, XRPL-native identity protocols, compliance tooling, and lending-related projects. That’s already a big statement, but the context got even louder when SBI Holdings CEO Yoshitaka Kitao said the firm holds hidden assets worth more than its officially disclosed 9% stake, which is valued at over $10 billion.

Whether you’re bullish or skeptical, the message is clear: Japan, and SBI specifically, is not treating XRPL like a side experiment. They’re treating it like a platform.

Japan’s XRPL Interest Is Moving Beyond Payments

The strategic direction becomes a lot clearer when you view it through the identity lens. Ripple president Monica Long has described decentralized identity on XRPL as a way to turn personal information into a secure, portable digital token, something users can carry globally and selectively share. The idea is to replace the old model, where identity data sits in centralized databases and gets leaked every few years like clockwork.

This isn’t just a “nice-to-have” concept. For institutions, identity is basically the foundation of compliance. You can’t do lending, regulated transfers, or serious financial products without it. So if XRPL can support identity and compliance layers in a way that’s private but verifiable, that becomes a real infrastructure advantage.

One example mentioned is DNAOnChain’s XDNA, which applies zero-knowledge proofs to convert identity and compliance data into verifiable zk-credentials. These credentials can confirm eligibility and regulatory status without exposing sensitive personal information. In other words, institutions can verify “yes, this user qualifies” without seeing everything about them. That’s the kind of tooling that actually makes regulated blockchain finance possible.

And if SBI’s hidden asset exposure extends beyond XRP itself, it suggests the firm may be positioning around that identity + compliance layer too, not just the token.

XRP’s Role as a Bridge Asset Is Still the Core Mechanism

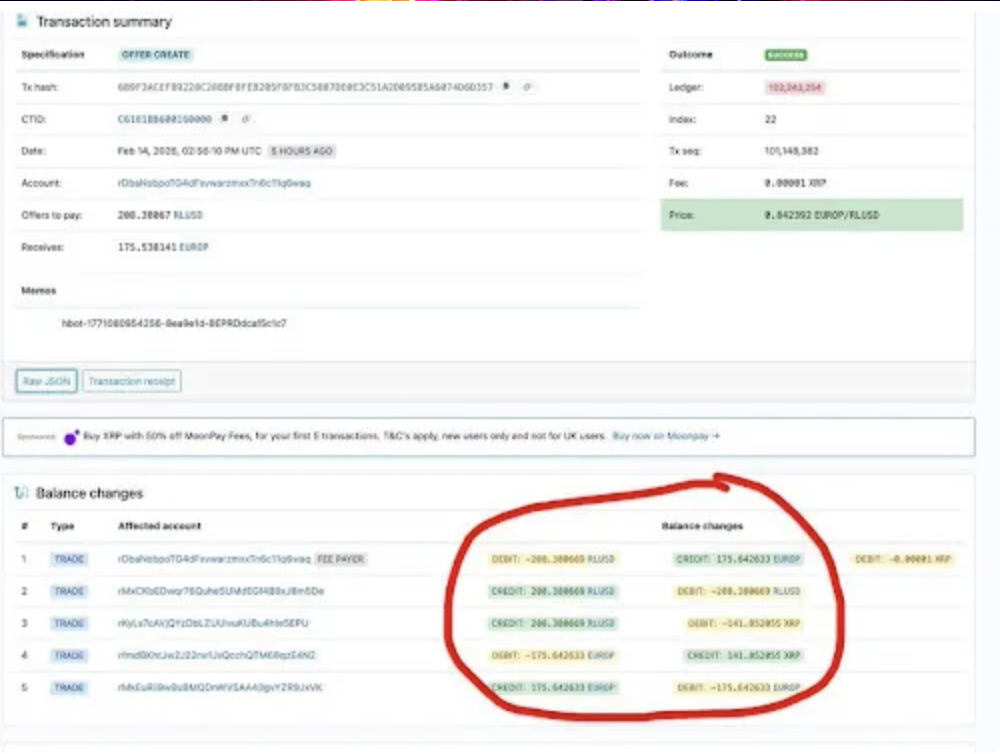

Even with the identity narrative growing, XRP still plays its original role inside the network. It’s actively used as a bridge currency for liquidity on XRPL, alongside stablecoins that act as issued assets. An analyst known as Vet on X pointed to recent XRPL DEX activity showing RLUSD being exchanged for EUROP, a euro-denominated stablecoin, with XRP functioning as the intermediary bridge asset.

That’s important, because it shows how liquidity actually moves. Instead of needing a direct market between every pair of stablecoins, XRP can sit in the middle, improving capital efficiency and reducing fragmentation. It’s basically the “connector” that lets issued assets swap more smoothly across the network.

This design also benefits market makers. They can make markets between XRP pairs while holding an asset that’s counterparty-free, which in theory makes it one of the most efficient ways to provide liquidity. It’s not a perfect system, but the logic is coherent. And institutions tend to care about coherent.

The Tokenized FX Future Is Where This Gets Big

RippleBullWinkle, founder of Lux Lions NFT, highlighted that the global foreign exchange market moves roughly $9.6 trillion in daily volume. That number is massive, and it’s one of the reasons people keep bringing up tokenized FX as the “real” long-term use case for blockchain.

The idea being discussed by insiders is an on-chain FX system where local currency stablecoins from different countries can settle directly against dollar stablecoins on-chain. If that model expands, you suddenly have a world where cross-border currency exchange becomes a programmable settlement layer, not a slow banking process.

And this is where XRP’s original design becomes relevant again. XRP was built specifically to act as a bridge asset between currencies. So if tokenized FX becomes a real thing, and not just a conference slide, XRP’s role stops being theoretical and starts being functional.

Japan’s positioning, SBI’s involvement, and the growing focus on identity and compliance all point toward the same theme: XRPL isn’t just being treated as a payments chain. It’s being treated as infrastructure for regulated, tokenized finance. Whether the market prices that in soon or not is another question entirely.