- XRP faces a critical January 2026 as escrow releases and regulation converge.

- Analyst targets range from $1.77 to $3.40, with extreme cases near $8.

- Holding $1.85 is key to avoiding deeper downside risk.

January 2026 is quickly becoming a decisive stretch for XRP, as regulatory momentum, technical pressure, and a scheduled escrow release all collide at once. Analyst forecasts for XRP in January range widely, from conservative targets near $1.77 to more optimistic calls pushing toward $3.40. A handful of aggressive scenarios even stretch as high as $8, though those rely on multiple catalysts aligning perfectly. The next few weeks will likely determine whether XRP can break its downward structure or whether fresh supply weighs on price as the new year begins.

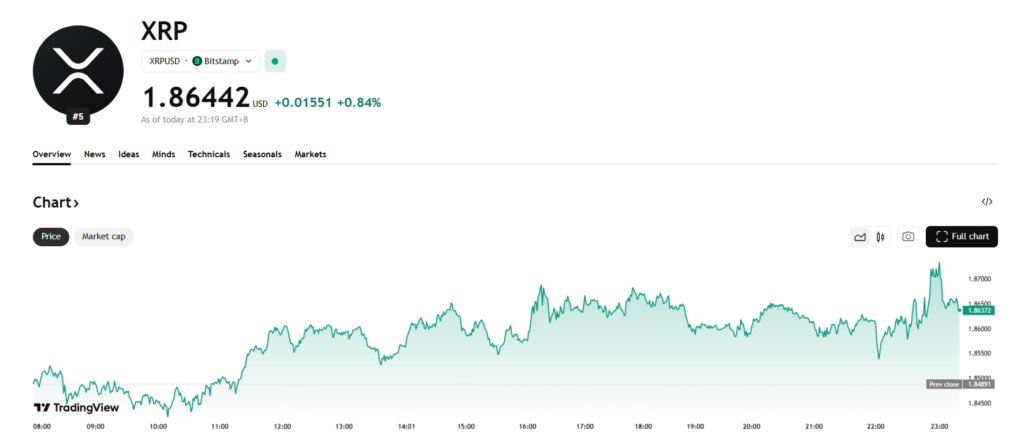

At the moment, XRP is trading near $1.87, hovering just above a long-tested support trendline that has held through December. Regulatory developments may also play a role. The CLARITY Act is expected to face confirmation this month, potentially setting clearer rules for how financial institutions engage with digital assets. While that could support long-term adoption, near-term supply dynamics remain the bigger concern traders are watching closely.

Analyst Forecasts Span From Cautious to Aggressive

Predictions for XRP in 2026 remain sharply divided. Standard Chartered analyst Geoffrey Kendrick has floated one of the boldest projections, suggesting XRP could reach $8 by 2026 if regulatory clarity improves and ETF adoption accelerates. That view hinges on XRP gaining broader institutional relevance, particularly through regulated investment vehicles.

Other forecasts are far more restrained. MEXC projects a January trading range between $1.77 and $2.11, while Bitget estimates a broader band from $1.80 to $3.40. CoinCodex places XRP around $1.96 by January 25, 2026. The spread between these estimates highlights how uncertain the outlook remains, even among experienced analysts.

Ripple CEO Brad Garlinghouse has also fueled long-term optimism, recently stating that the XRP Ledger could capture 14% of SWIFT’s payment volume within five years. If realized, that would represent trillions in transaction value, though some market observers remain skeptical about how quickly such adoption could materialize.

Escrow Release Adds Immediate Supply Risk

One of the most pressing variables is the January 1 escrow unlock, which will release 1 billion XRP. Historically, Ripple has re-locked between 60% and 80% of released tokens, with December seeing roughly 70% returned to escrow. Still, timing matters. XRP is already trading near sensitive support, and even temporary supply pressure could tip sentiment if buyers hesitate.

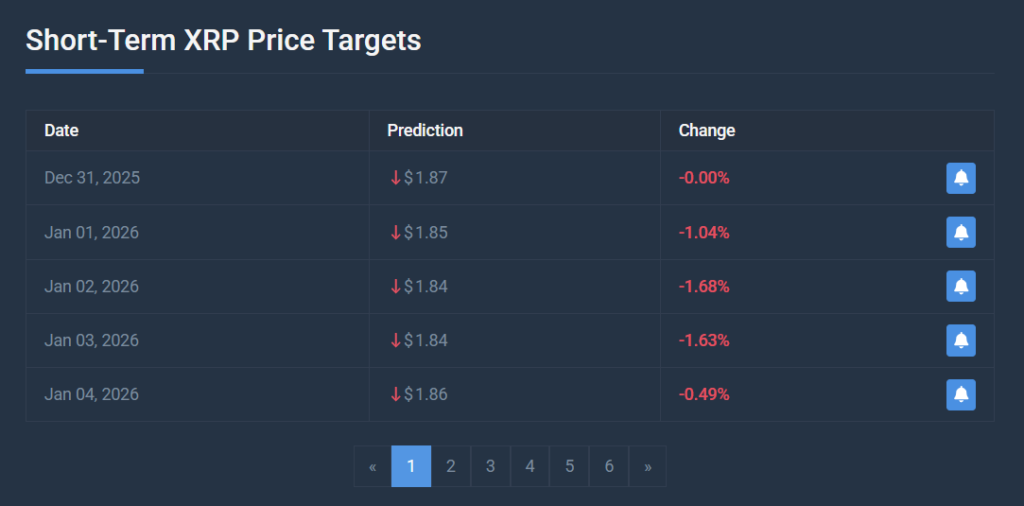

Technically, XRP remains trapped in a descending channel. The Supertrend indicator is flashing red near $2.08, while price continues to bounce between $1.85 and $1.87. Buyers appear defensive rather than aggressive, and RSI readings in the upper 50s suggest stability, but not building momentum.

ETF Momentum and Bull Run Possibilities

Spot XRP ETFs launched in November 2025 and accumulated roughly $1 billion in assets within their first month, exceeding some expectations. While extreme price targets remain speculative, ETF approvals represent a meaningful structural shift. Bitcoin’s price climbed roughly 90% in the year following spot ETF approvals in early 2024, a comparison that keeps longer-term XRP bull cases alive.

Broader macro conditions could also influence outcomes. The Federal Reserve began cutting rates in late 2025, and markets expect further easing in 2026. Lower yields tend to push capital toward risk assets, including crypto, which could support an XRP breakout if technical and supply conditions align.

What Bulls and Bears Are Watching Now

For bulls, the roadmap is clear but narrow. First, $1.85 must hold convincingly. Next, XRP needs to reclaim $2.00 with real volume, not just a brief spike. A break above $2.08 would invalidate the current downtrend and potentially shift momentum. That said, XRP remains closely tied to broader market moves, particularly Bitcoin’s direction.

For bears, a breakdown below $1.85 before January 1 would significantly weaken the bullish thesis. Below that, support sits near $1.77, with a deeper slide toward $1.60 possible if selling accelerates during the escrow release. Weak technicals combined with fresh supply could quickly sour sentiment.

For now, XRP is stuck in consolidation, moving sideways in a tight range as traders wait for clarity. Whether regulatory progress and ETF demand can overpower supply pressure will likely decide how the XRP story unfolds in early 2026.