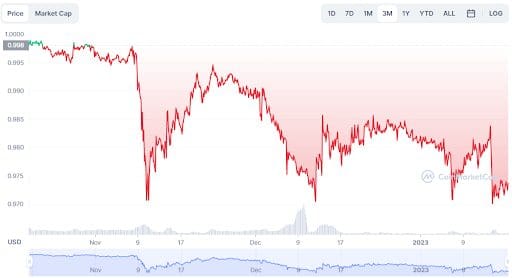

The recent fall of Terra-Luna and its stablecoin TerraUSD(UST) was a catastrophic event in the world of crypto, bringing with it doubts about the stability of stablecoins. Based on recent trends, Justin Sun’s stablecoin, USDD, has come under doubt and suspicion. For instance, the token has been trading between $0.97 and $0.98 since the beginning of December. This shows that USDD needs help to return to and maintain its 1:1 peg to the US dollar.

A deeper delve into the USDD stablecoin and its issuer, Tron DAO Reserve, has uncovered concerns related to the Reserve’s reporting on the token’s standing. The causes of worry are discussed below:

The Extended Depegging of the USDD Stablecoin

USDD has been trading below the $1 value for over three months. Based on CoinMarketCap reports, the token last changed for $1 on Oct 18 and has been on a downward trend since then, with a value of $0.97 at the time of writing.

This continued drop of the token below the pegged value is firing alarms. USDD token holders who used other stablecoins to acquire their USDD tokens have begun to inquire whether they can redeem them for the exact value of stablecoins. They fear the token’s value may continue to fall if they cannot.

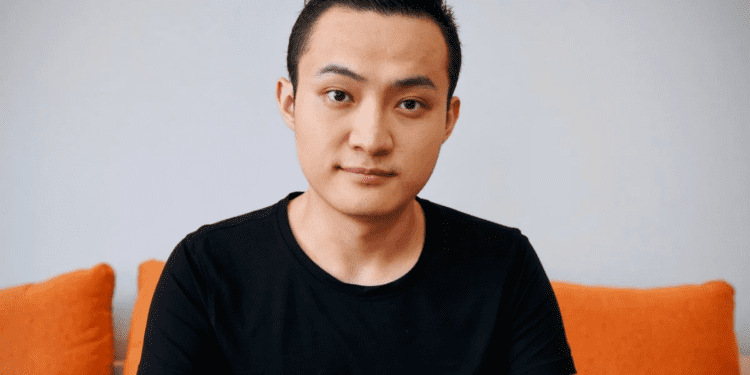

Attempts by the founder of the Tron Ecosystem, Justin Sun, to assure holders failed to raise their confidence. Some even shared a very similar tweet by Do Kwon, founder of Terra-Luna, while others expressed their prediction that Tron and the USDD stablecoin would soon suffer the same fate.

Justin Sun affirmed that the USDD collateralized ratio was 200%, and anyone could check the live data on their 24/7 blockchain site. However, this fact is different from what on-chain data depicts.

Misreported Reserves

Both the Tron DAO reserve and the USDD website state that the USDD stablecoins have a collateral ratio of over 200%,211.5% at the time of writing. This interprets every USDD stablecoin as having twice the number of other tokens as collateral.

In July 2022, Sun stated that the stability of the USDD stablecoin was not tied to the price of TRX. He said:

“The stability of USDD is backed by the reserve assets of @trondaoreserve, not the price of TRX. USDD’s price stability is maintained by monetary policies adopted by TDR and backed by its reserve assets. As long as the TDR holds a sufficient reserve, USDD will be stable.”

However, based on on-chain data, TRX forms over 40% of the collateral reserve. Therefore, if TRX were to fall, the value of the collateral would be affected, thus affecting the stability of USDD. This then shows an inaccuracy in the data displayed on the Reserves and USDD sites.

When USSD announced on Twitter that the reserves were over 200%, a Twitter user expressed that there were inconsistencies between the said value and the actual value of the collateral.

Within the collateral details on the Tron DAO Reserve site is the TRX burning details, where a burning contract holds almost 9 billion TRX, whose value is $725 million. However, based on the value of a TRX token, $0.06, their value is around $560 million at the time of writing. This value is reported correctly by Tronscan but needs to be written on the official sites. This lowers the collateral ratio and raises further concerns about what else Tron could hide.

A Burn Wallet that Does not Burn Tokens

The purpose of a burning wallet is to be able to receive coins but not send them out. This enables coins to be taken out of circulation, thus, regulating their supply and stabilizing the coin’s prices. Aside from allowing the stablecoins to maintain their pegged value, burn wallets also enable holders of currencies to offer one token to receive another of the same value. For instance, USDD has a burning wallet that allows traders to burn TRX tokens to get an equal value of USDD.

Once tokens are in the burn wallet, they should not be able to be returned into circulation. However, the smart contract to the Tron multi-signature burn wallet shows the possibility of returning the TRX tokens into circulation using a redeem function.

The redeem function is accessed through a multi-signature key which, according to Tron, “makes it possible to achieve multi-person joint control of accounts.”The USDD site states the TRX in this burn wallet, which equates to the mentioned $560 million mentioned as part of the collateral amounting to over 40%.

While there is no information on who holds parts of the multi-signature key and how many people there are, it still means that an unknown group can still access these tokens.

All of these misreports and inaccuracies, along with ultra-high yields above the market rate, hint towards the possible instability of the entire Tron ecosystem. The trend shares a lot of similarities with Terra-Luna before its collapse.