- Exchange reserves fall to $60.8B, lowest in 2025 — signaling a potential supply squeeze.

- Whales accumulate heavily, while Open Interest steadies around $19B.

- ETH consolidates between $3,800–$4,000, with cautious bullish sentiment building.

Ethereum (ETH) might be inching toward another supply crunch — and this time, the signs look eerily familiar to the early stages of its 2020 bull run. Exchange reserves are falling fast, whales are quietly stacking, and derivatives data hint at a cautious but growing bullish bias. It’s one of those setups that creeps up on the market before the crowd catches on.

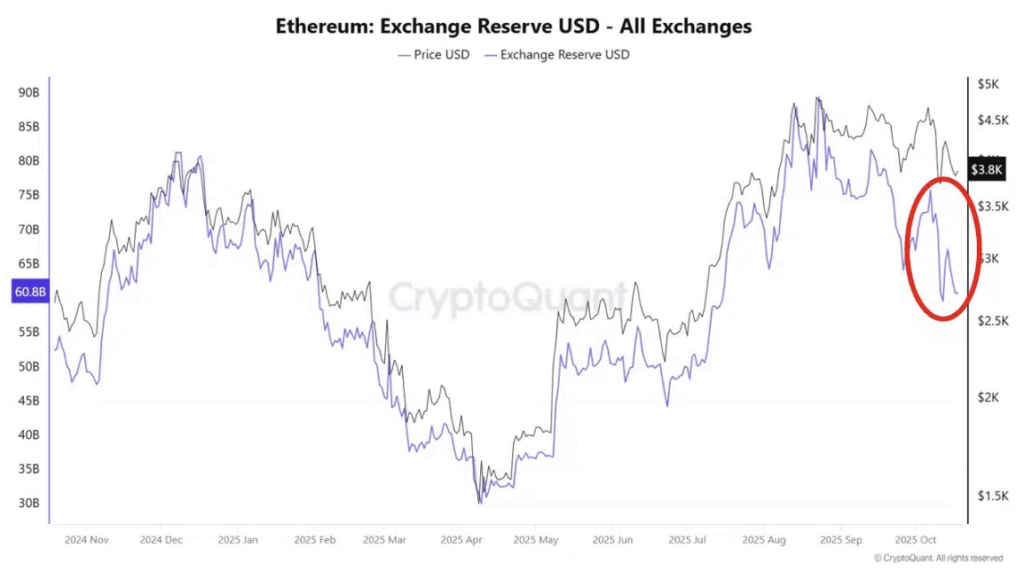

Exchange Reserves Hit New 2025 Lows

According to fresh data from CryptoQuant, Ethereum’s exchange reserves have slipped to their lowest level this year, now sitting near $60.8 billion. Fewer coins on exchanges typically mean fewer tokens ready to sell — and when liquidity thins while demand starts heating up, things can move fast.

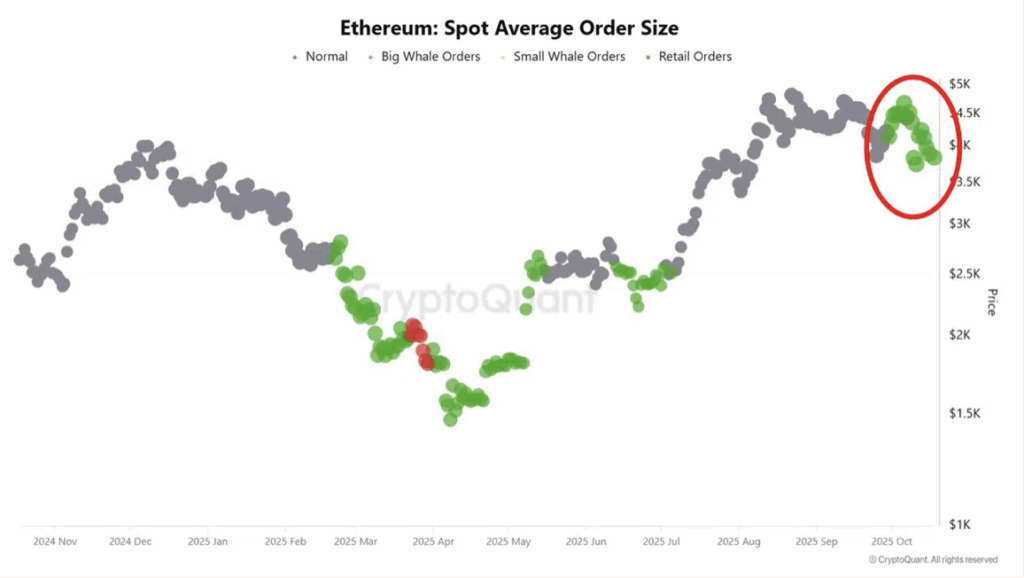

Whales have been scooping up ETH in large chunks across spot markets, suggesting accumulation is well underway. This kind of quiet, steady buying often flies under the radar until price begins to react. Historically, Ethereum has seen similar accumulation patterns before big upside moves — most notably during its 2020 to 2021 rally.

When you combine lower supply with fresh demand, even modest inflows can cause exaggerated price reactions. That’s what makes setups like this so interesting — they build slowly, then move all at once.

Derivatives Show Early Signs of Confidence Returning

After a round of heavy liquidations earlier this week, Ethereum’s aggregated Open Interest has stabilized around $19 billion. That signals traders are gradually reopening positions after the shakeout.

Funding rates have also turned slightly positive, hovering near 0.008%, which usually implies a mildly bullish bias. In plain terms: traders are paying small premiums to hold longs again — a decent sign of returning confidence, even if it’s still cautious.

This blend of steady OI and modest positive funding often marks the beginning of speculative re-entry phases, where conviction is still shaky but improving. The backdrop of whale accumulation makes it all the more compelling — it’s not hype driving this, it’s accumulation and patience.

ETH Stabilizes, But Momentum Still Feels Soft

At the time of writing, ETH trades around $3,900, showing small but steady gains after last week’s correction. The RSI sits near 42, suggesting that momentum remains neutral-to-weak for now. Trading volume has cooled off too, and On-Balance Volume (OBV) shows muted accumulation — slow and quiet, rather than a rush of inflows.

The short-term range remains tight between $3,800 and $4,000. That’s the battle zone to watch. A break above $4,200could confirm a bullish continuation, while a slip below $3,800 risks reopening the door toward $3,600 or even lower supports.

Still, with shrinking exchange reserves and whales loading up, it feels like pressure is quietly building. Momentum may look soft on the surface, but underneath — supply’s drying up, and demand’s creeping in. Sometimes, that’s all it takes.