- Ethereum is setting up for a potential short squeeze, with massive short positions stacked above the $3,600 zone and over $10 billion in liquidity clustered between $3,600 and $4,500.

- Whales and institutions are going long on ETH, including a 40,000 ETH 5x leveraged position (~$138M) and BlackRock reportedly buying $35M worth of Ethereum, hinting ETH could outperform Bitcoin in the short term.

- If momentum holds and key resistance levels at $3,460, $3,900, and $4,200 are cleared, a squeeze could push ETH toward or even beyond the $4,500 mark.

Ethereum’s been moving, but not in a crazy way just yet. After the latest market bounce, ETH only managed about a 5% push higher, even though a bunch of late shorts got wiped out near the bottom. Under the surface though, things are starting to look a lot more interesting – especially for anyone watching liquidity, leverage, and sentiment all at once.

Right now, there’s a big pocket of short positions stacked above price, while whales and institutions quietly load up on the long side. When you mix that kind of setup with rising optimism, you get one word floating around a lot: squeeze.

Is Ethereum’s short squeeze actually close? And more importantly – can it really punch through $4,500 if it fires?

Huge Short Positions Sitting Above Price

At the time of writing, Ethereum has already flushed out a lot of late short sellers who jumped in below the $3,600 level after price briefly dumped to around $3,200. Those reactive shorts? Mostly gone.

But here’s where it gets spicy:

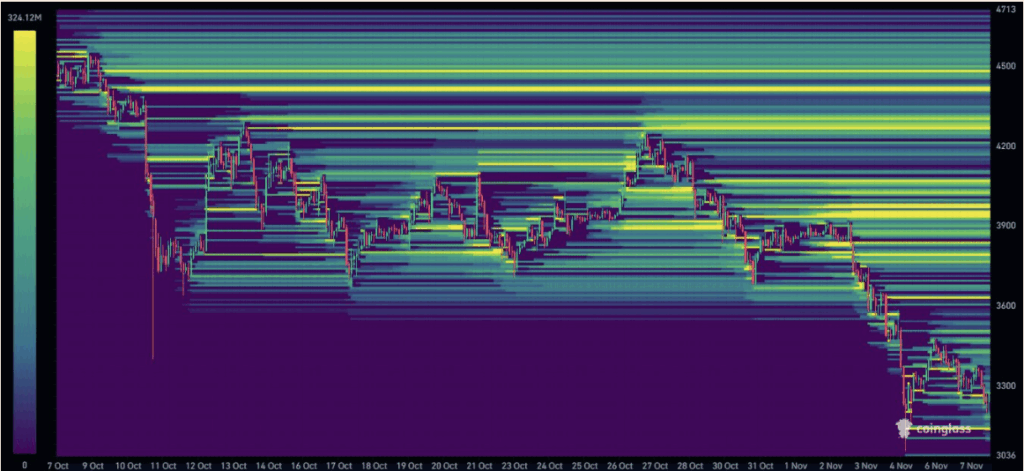

Large short positions have been building just above that $3,600 area, and on top of that, there’s around $10 billion in ETH liquidity clustered between roughly $3,600 and $4,500. In other words, there’s a big wall of positions and liquidity sitting right above where price is now.

If buy orders manage to push price cleanly through the $3,600 zone, that’s where things could really accelerate. Shorts caught offside may be forced to close in a hurry, which just adds more buying pressure on the way up. With liquidity packed tightly in that band, a move could happen faster than many traders are prepared for.

If the squeeze really kicks off, a fast drive toward, or even beyond, $4,500 isn’t off the table. But it needs follow-through, not just one good candle.

Whales And Institutions Quietly Loading Up

The squeeze setup isn’t just about shorts being trapped. It’s also about who’s on the other side.

Whales and institutional players have been taking advantage of the recent dip, accumulating ETH mostly in the $3,000 to $3,400 range. One example that stood out was a so-called “Bitcoin insider whale” who previously shorted BTC right before the tariff-driven dump. This time, instead of leaning into Bitcoin, they flipped and went long on Ethereum.

That whale opened a 5x leveraged long position on ETH – about 40,000 ETH, worth roughly $138 million. That’s not some tiny directional bet. It’s a statement. And closing the previous BTC long in favor of stacking ETH suggests they expect Ethereum to move faster than Bitcoin in the current environment.

They’re not alone, either. According to reports, BlackRock also picked up around $35 million worth of ETH, adding more weight to the idea that larger players see a rebound forming in Ethereum specifically, not just in the overall market.

Sentiment Turning Bullish – Especially From “Smart Money”

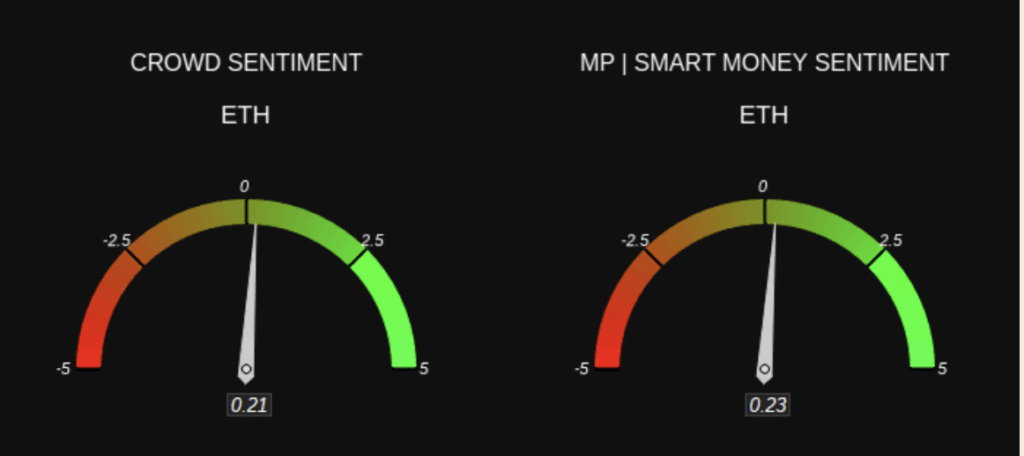

On the sentiment side, things are leaning green too. Both the crowd and so-called smart money are generally bullish on Ethereum – but interestingly, the informed money is slightly more optimistic than retail.

Sentiment gauges showed a reading of around 0.23 for smart money versus 0.21 for retail traders. It’s not a massive gap, but it does hint that bigger, more data-driven players are a bit more convinced about ETH’s upside than the average trader scrolling through price charts on their phone.

This shift isn’t happening in isolation either. The broader crypto market was up around 1.35% at the same time, showing that risk appetite in general is picking back up.

Can Ethereum Actually Push Past $4,500?

So, is all this enough to blast ETH beyond $4,500?

Maybe – but there are a few hurdles in the way.

On the charts, Ethereum still has to clear a series of shorter-term resistance levels before $4,500 becomes realistic. Key zones around $3,460, $3,900, and $4,200 will likely act as checkpoints. If price stalls or gets heavily sold at any of those levels, the move could fizzle into just a sharp bounce rather than a full-on breakout.

But if momentum holds, buy orders keep flowing, and ETF / institutional participation stays strong, those resistance levels could get taken out one by one. In that case, a short squeeze could very easily act as the fuel that sends ETH sprinting toward $4,500 and possibly beyond.

For now, all the ingredients are there:

- Shorts stacked above price and vulnerable

- Whales and institutions going long on ETH

- Sentiment turning bullish, especially from smarter capital

The only question left is whether the market pulls the trigger.