- Invesco filed to register a Solana ETF in Delaware, aiming to offer regulated exposure to the growing Solana ecosystem.

- The ETF could simplify access to SOL for traditional investors, helping bridge crypto and mainstream finance.

- Regulatory uncertainty remains a roadblock, as the SEC still hasn’t clarified the status of altcoins like Solana.

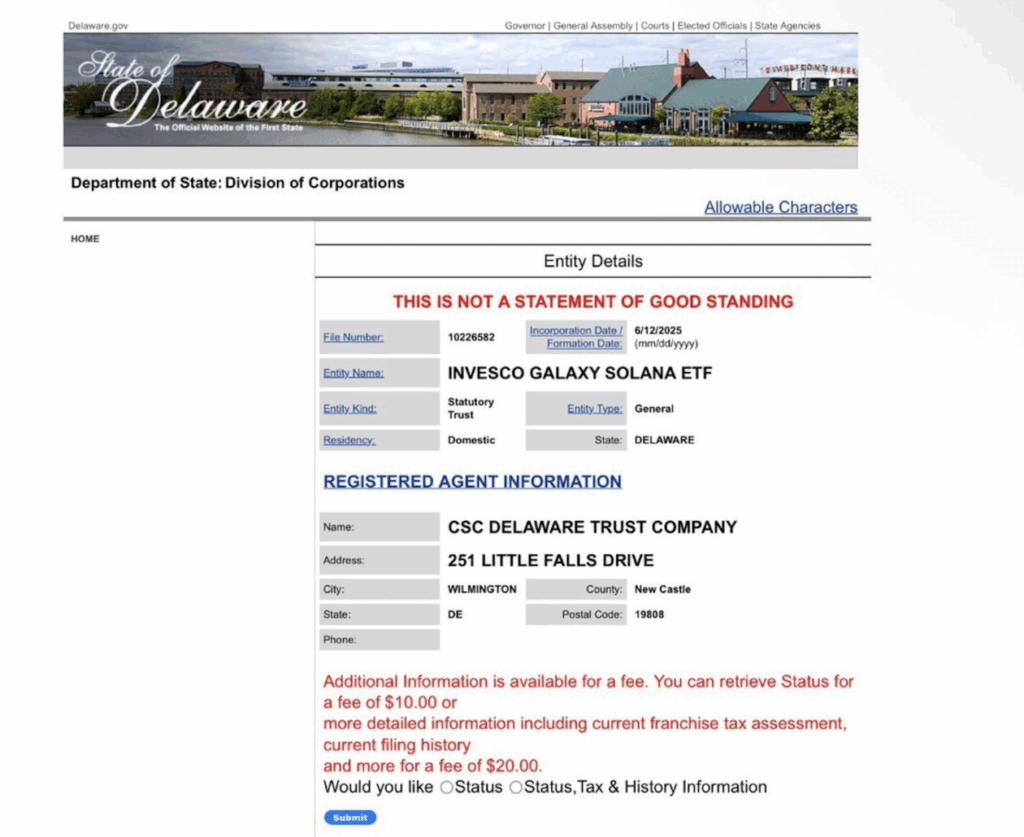

In a bold move that might shake things up, Invesco just filed to register its Galaxy Solana ETF in Delaware on June 13, 2025. That’s right—after focusing heavily on Bitcoin and Ethereum, the firm’s officially setting its sights on Solana. It’s a pretty strong sign they believe altcoins like SOL are ready for the big leagues.

This isn’t just another crypto filing either. It reflects a broader shift happening in traditional finance. Investors are no longer just curious about Bitcoin or Ether—they’re starting to look harder at newer blockchains with real utility. Solana, with its blazing-fast speeds and growing DeFi scene, is definitely one of those chains catching serious attention.

Why Solana, and Why Now?

Solana’s been on a roll. Developers love it, transactions are fast and cheap, and its ecosystem is expanding quicker than most expected. That momentum has helped it position itself as a legit rival to Ethereum when it comes to powering smart contracts and DeFi platforms. For institutions, that makes it a pretty attractive opportunity.

This ETF, if it gets the green light, could open the doors for investors who don’t want to mess with wallets and keys. Just like buying stocks, they’d be able to get exposure to SOL straight from their brokerage accounts. That kind of access could be a huge leap for Solana adoption, especially in traditional finance circles.

Still Some Hurdles Ahead

Now, let’s not get ahead of ourselves. Just because Invesco filed doesn’t mean the SEC’s going to rubber-stamp this. Regulatory uncertainty around altcoins is still very real, especially with questions about whether some of them—Solana included—might be classified as securities.

The SEC’s been flooded with crypto ETF proposals lately (more than 70, in fact), and they’ve been slow-rolling approvals outside of BTC and ETH. Still, the fact that big players like Invesco are pushing forward says a lot about how serious they think this market’s getting.