- XRP price remains under pressure, but steady institutional inflows continue to limit deeper downside.

- XRP ETFs have shown unusually strong demand, with no recorded net outflow days since launch.

- Weak retail participation and long-term holder selling could keep XRP range-bound into early 2026.

XRP has spent the past several weeks under steady pressure, with bounce attempts repeatedly failing to stick. As 2025 comes to a close, the token is wrapping up a mildly negative year, still leaning bearish and struggling to find momentum. Spot demand has been thin, retail participation cautious, and price action has reflected that hesitation pretty clearly.

Yet XRP hasn’t unraveled completely. The main reason is institutional support, which has quietly acted as a stabilizer. While sellers remain active, deeper drawdowns have been avoided, largely because bigger players continue to step in where retail has stepped back.

Institutions Keep Showing Up for XRP

Throughout 2025, institutional investors have been XRP’s most consistent backers. CoinShares data shows that XRP pulled in $70 million in inflows during the week ending December 27 alone. That pushed month-to-date inflows to roughly $424 million, a strong showing given the broader weakness in price.

What’s notable is how XRP stacked up against larger assets. Bitcoin saw $25 million in outflows during the same period, while Ethereum faced much heavier withdrawals totaling $241 million. On a full-year basis, XRP attracted around $3.3 billion in inflows, underlining sustained institutional confidence despite volatility and lingering legal uncertainty across the crypto market.

XRP ETFs Reinforce Long-Term Positioning

That support hasn’t been limited to traditional investment products. Since launching earlier this year, XRP ETFs have yet to record a single day of net outflows. Only one session closed flat, without inflows, which is rare consistency by ETF standards.

Ray Youssef, CEO of crypto app NoOnes, explained that this behavior reflects deliberate, long-term positioning rather than short-term speculation. He noted that early December accumulation appeared to be a strategic move aimed at capturing ETF-related momentum, similar to what played out during the early Bitcoin and Ethereum ETF cycles.

According to Youssef, XRP is increasingly being treated as a high-beta asset with a clearer value proposition, driven by rising institutional participation. Even with price under pressure, many traders still view current levels as reasonable entry zones, betting that price will eventually catch up to ETF-driven demand.

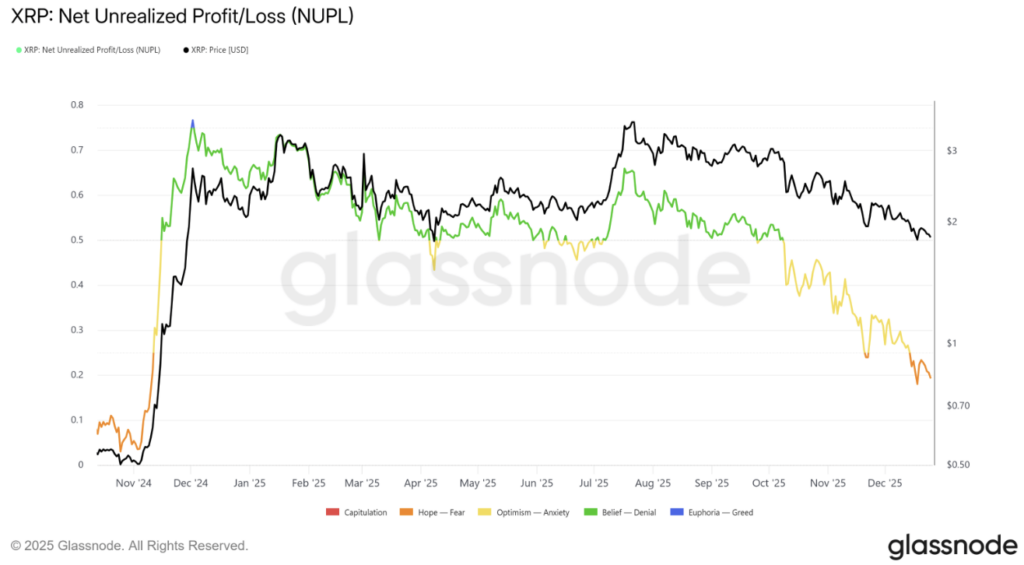

Long-Term Holders Begin to Waver

One group to watch closely heading into 2026 is long-term holders. Historically, they’ve played a stabilizing role during downturns, often accumulating when sentiment turns sour. Over the past year, however, their behavior has been mixed. Periods of accumulation alternated with distribution, reflecting uncertainty around XRP’s medium-term outlook.

By Q4 2025, selling activity had started to dominate. That shift suggests weakening conviction among investors who usually ride out volatility. If this trend continues into 2026, XRP could face increased downside risk, as sustained distribution from long-term holders often precedes extended consolidation or deeper pullbacks.

XRP Heads Into 2026 With Muted Expectations

At the time of writing, XRP was trading near $1.87 after sliding roughly 38% during Q4. Year-to-date, the token is down about 9.7%, and December failed to deliver any meaningful recovery. Bearish sentiment lingered as the year wrapped up.

Looking ahead, 2026 may not bring immediate relief. Youssef suggested that January, and potentially the entire first quarter, could remain relatively flat for XRP. In his view, the token may continue trading between $2 and $2.50 unless a clear macro catalyst emerges. Persistent volatility, geopolitical tension, and repeated risk-off episodes have made traders reluctant to take strong directional bets.

The bigger picture remains recovery. A sustained move above $3.00 would be needed to reestablish a bullish structure and reopen the path toward the $3.66 all-time high. Until then, downside risks can’t be ignored. A decisive break below the $1.79 support level would likely expose the $1.50 zone, firmly shifting the narrative back in favor of the bears.

Seasonality doesn’t offer much comfort either. XRP underperformed in December amid weak liquidity, reduced risk appetite, and broader sell-offs tied to macro stress and the fading AI hype trade. Historically, January has delivered modest average gains for XRP, but the median return tells a different story, with frequent underperformance.

Unless sentiment improves meaningfully and investor behavior shifts, XRP may struggle through the early months of 2026 before a clearer direction finally takes shape.