- Injective now supports Chainlink Data Streams, bringing sub-second market data to its mainnet.

- Developers gain faster time-to-market, customizable data feeds, and stronger financial tooling.

- Helix Markets is the first dApp to adopt the integration, signaling a broader shift toward high-performance DeFi on Injective.

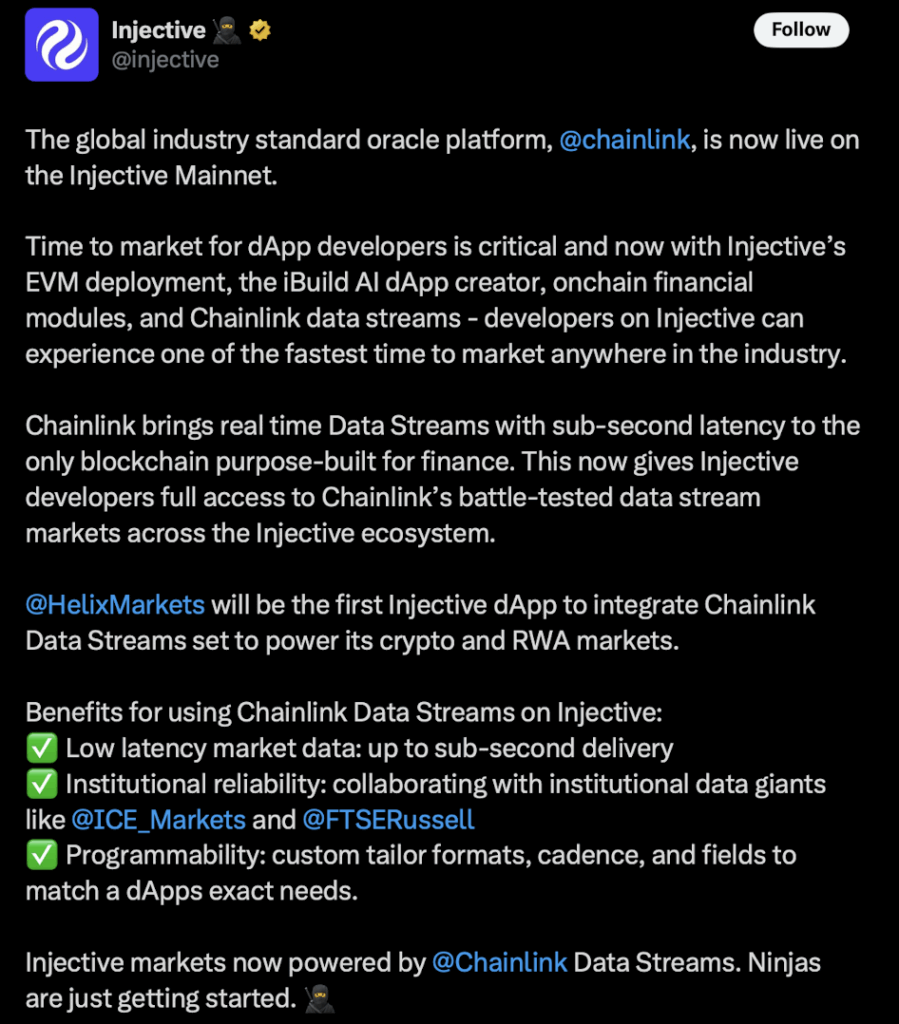

Injective, the finance-focused blockchain built for speed and precision, just flipped a huge switch on its mainnet: full integration of Chainlink’s Data Streams. For a platform obsessed with fast, reliable financial tooling, this is a milestone that’s been a long time coming. And honestly, it changes a lot.

Injective has always positioned itself as the chain where DeFi apps can launch quickly and run without hiccups. Now, with Chainlink’s low-latency feeds plugged directly into the network—plus Injective’s own EVM support—developers get a smoother, faster path from idea to live market. In an industry where time-to-market often decides who wins and who gets forgotten, this is a serious upgrade.

Faster data, tighter execution, and tools that feel like TradFi on-chain

For dApp builders, speed isn’t a luxury. It’s survival. And this integration gives them access to one of the fastest data infrastructures in all of Web3. Chainlink’s Data Streams push real-time market info with sub-second updates, which means price-sensitive applications—like high-frequency trading bots, derivatives platforms, and instant settlement systems—get the kind of accuracy that used to only exist in traditional finance.

Developers can also customize their data streams—format, cadence, granularity, extra metadata—basically fine-tuning the feed to match exactly what their dApp needs. In financial markets, those tiny details often determine whether a product succeeds or falls flat. With Injective + Chainlink, those details become easier to control.

Helix Markets becomes the first dApp to plug into Chainlink Streams on Injective

Helix Markets, one of Injective’s flagship DeFi applications, is already tapping into Chainlink Data Streams—and the combination is pretty powerful. Helix can now access high-throughput, real-time, institution-grade data for both crypto assets and traditional markets. That means traders get more accurate information, tighter execution, and less lag during volatile moments.

This kind of upgrade doesn’t just help Helix—it shows what’s possible for every future finance-oriented dApp that chooses Injective as its home. With Chainlink’s infrastructure doing the heavy lifting behind the scenes, builders can focus on improving products instead of wrestling with unreliable data inputs.

A stronger, faster, more competitive Injective ecosystem

The integration of Chainlink Data Streams is already making Injective more attractive to developers—especially those in high-performance sectors like derivatives, structured products, trading protocols, and synthetic asset markets. As more apps integrate Chainlink tech, Injective’s reputation as a DeFi-optimized blockchain gets stronger, while the overall ecosystem becomes more fluid, more efficient, and more vibrant.

And looking forward? It’s hard not to see the potential. Real-time, reliable data is the backbone of any financial system, and Injective now has direct access to some of the best infrastructure available in Web3. For developers building the next wave of DeFi innovation, Injective is shaping up to be one of the sharpest tools in the box.