- Hyperliquid DEX volume dropped from June highs, but token trading still climbed past $1.93B YTD.

- Derivatives-fueled growth slowed after liquidations, while PancakeSwap and spot DEXes gained steam.

- HYPE surged 390% in Q2, but signals now point to possible pullback—though high network activity might soften the fall.

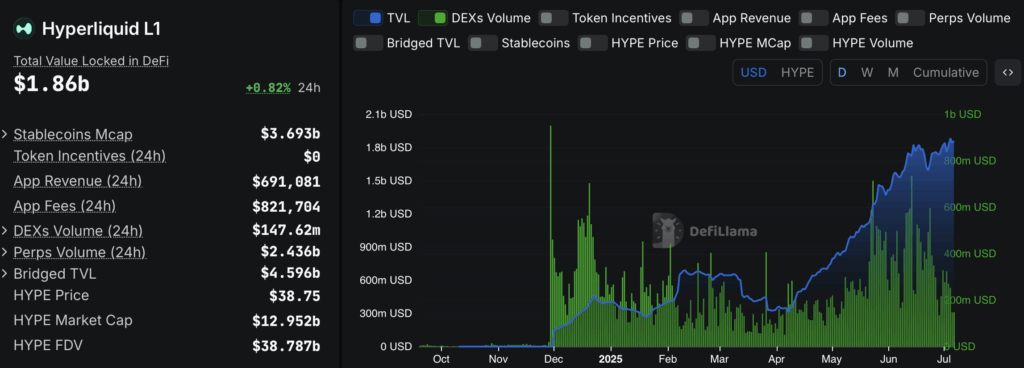

Hyperliquid really made waves earlier this year. No doubt. Its DEX volumes in May and June were off the charts. But lately? Things have cooled down a bit—and not in a subtle way either.

Even as DeFi seemed to bounce back across the board, Hyperliquid’s DEX volumes slipped. According to DeFiLlama, the platform saw highs above $714M in May and even managed to push past $735M mid-June. Fast-forward to the end of June and—boom—daily volume tumbled down to just $134.8M.

Yeah, that’s a steep drop.

Volume over the last two days has been hovering around $270M, which, while still decent, is a far cry from those record numbers. That’s about a third off its peak, if you’re counting. Meanwhile, legacy DEXes like PancakeSwap started picking up steam again, pulling more traders back their way. It’s like Hyperliquid lost a bit of its edge in the shuffle.

Token Volume’s Still Flexing

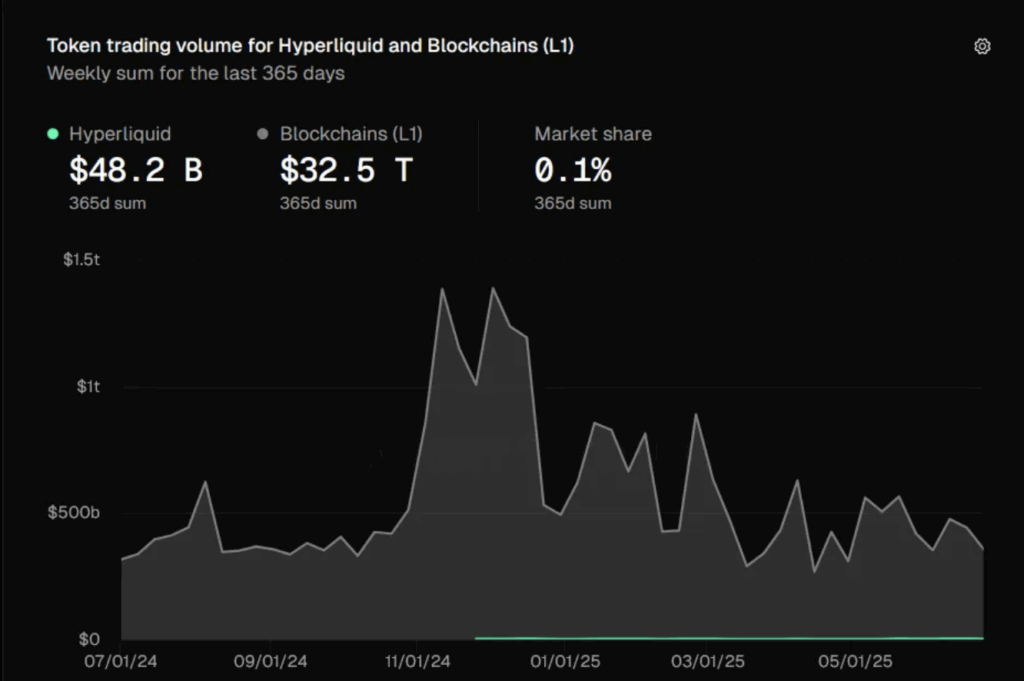

Despite the drop in DEX traffic, the Hyperliquid token itself is telling a different story. TokenTerminal data shows trading volume climbed from $1.5B in Dec 2024 to nearly $1.93B—so that’s a $430M jump year-to-date. Not bad, right?

This growth in token volume mirrors the network’s broader trend since December. But here’s the twist: the recent slowdown? It actually kinda makes sense.

Turns out, Hyperliquid’s volumes have been heavily tied to derivatives trading—particularly when whales were feeling spicy with leveraged bets. But that appetite for risk took a hit lately, thanks to wild price swings and liquidations (yeah, even whales like James Wynn felt the sting).

And with more users chasing spot trades over on PancakeSwap and other OG DEXes, it looks like some folks are shifting focus toward long-term holds instead of high-stakes leverage plays.

Still, even with all this, Hyperliquid holds just 0.1% of the total DeFi pie. That puts it 31st in the rankings by token volume. Not tiny—but not exactly dominating either.

Is HYPE Set for a Nasty Pullback?

HYPE, the native token, had a killer run in Q2. From bottom to top, it pumped 390%—which is kinda insane. But since mid-June, that rocket fuel’s been running low. The RSI is sagging, hinting that maybe the bulls are running on fumes.

That said, there’s a plot twist. The Money Flow Index (MFI) just ticked up over the last few days—suggesting fresh liquidity is coming in. Could be a second wind? Or just hopeful buyers catching falling knives, we’ll see.

Now, it’s also worth noting: a lot of HYPE holders are deep in profit. So yeah, some of them might start cashing out. But volume’s still strong, and that network activity? It’s not just speculation—it’s legit demand. That could put a bit of a floor under the price, even if a pullback starts to form.

Of course, July’s full of unknowns. Market sentiment, macro stuff, you name it. Still, HYPE seems like one of those assets where what’s happening on-chain could make or break what happens next.