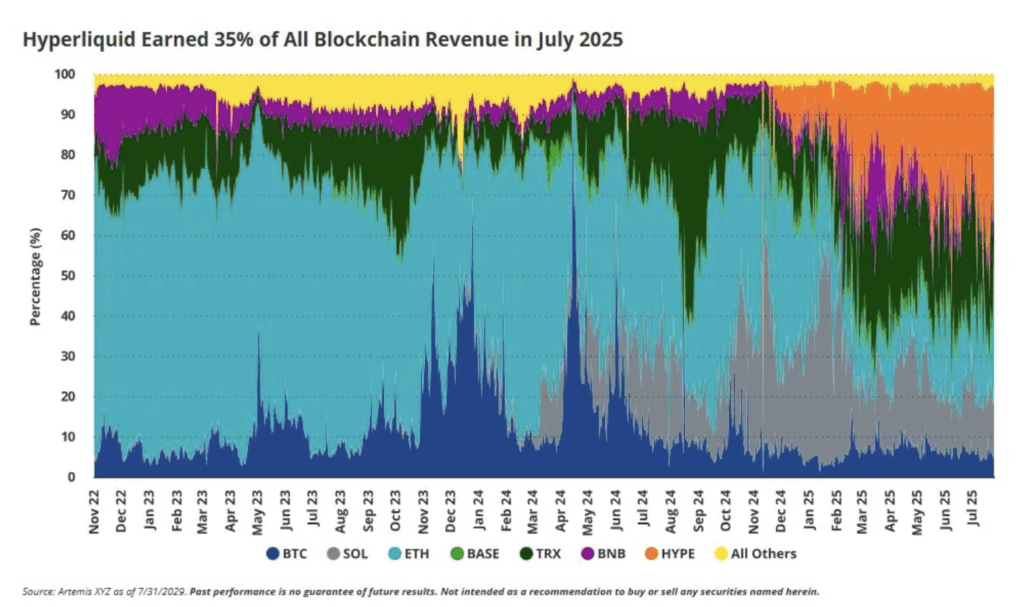

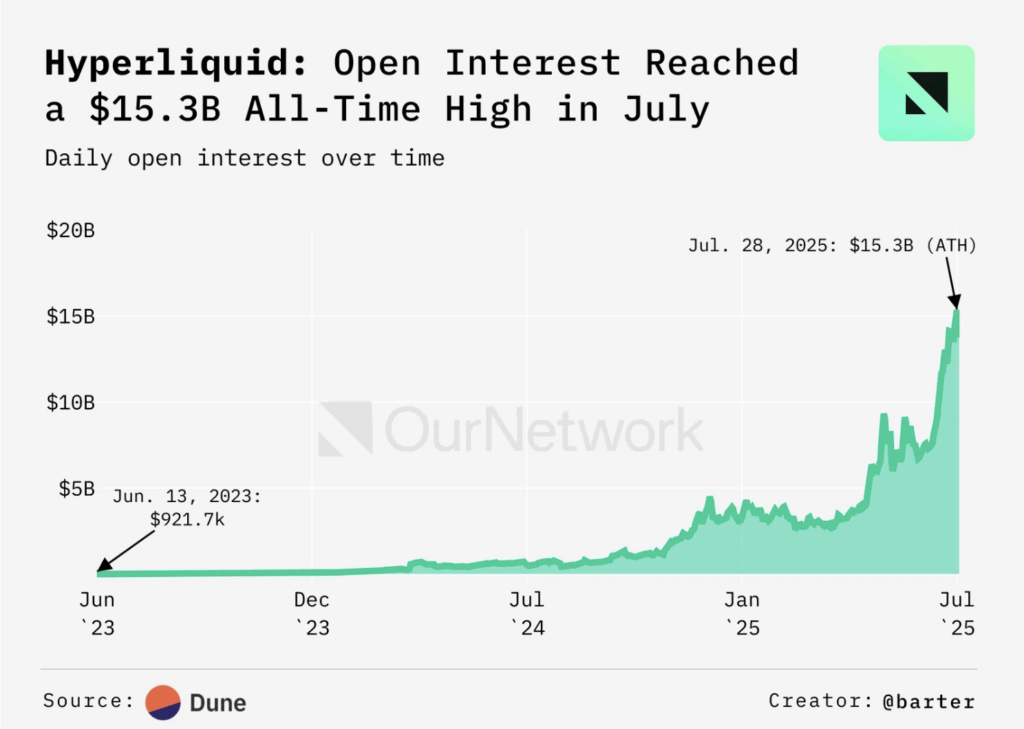

- Hyperliquid captured 35% of all blockchain revenue in July, dominating 74% of the perpetual contracts market and posting a 369% year-to-date surge in open interest to $15.3B.

- The upcoming HIP-3 upgrade aims to transform Hyperliquid from a DEX into a full Web3 infrastructure platform, expanding into staking, lending, and custom derivatives.

- Rumors suggest Paradigm may hold up to $765M in HYPE tokens, signaling strong institutional confidence despite recent network outages.

Hyperliquid (HYPE) just pulled off a major win, raking in around 35% of all blockchain-generated revenue in July. That’s not just a big number — it’s a statement. And with its much-hyped HIP-3 upgrade on the horizon, the platform’s aiming to cement itself as a core pillar in the DeFi landscape.

Record Numbers, Relentless Momentum

Matthew Sigel, VanEck’s head of digital assets research, says Hyperliquid’s ability to scoop up a big chunk of Solana’s recent growth comes down to one thing — a product that just works. No fuss, no fluff, just solid perpetuals trading with a killer UX.

Right now, the platform dominates 63% of daily trading volume and an eye-watering 74% of the perpetual contracts market. That’s huge. And it’s not just trading activity — open interest surged to $15.3 billion in July, marking a 369% jump year-to-date. Meanwhile, over $5.1 billion in USDC has flowed through its bridge, with inflows speeding up ahead of native USDC and CCTP V2 going live.

For a market that’s still side-eyeing centralized exchanges after repeated regulatory headaches, Hyperliquid’s growth feels like a well-timed pivot toward non-custodial and transparent DeFi solutions.

HIP-3: From Trading Hub to Web3 Powerhouse

Then there’s HIP-3 — the next big step. It’s being pitched as an “X-Factor” upgrade, one that could morph Hyperliquid from a high-performance DEX into a full-scale Web3 infrastructure platform.

Think beyond trading — staking, lending, custom-built derivatives, and more. The idea is to create an ecosystem where traders, builders, and even institutional players can operate without leaving the Hyperliquid umbrella. Some in the community are betting that, if done right, this could push its market dominance above 50%.

But here’s the thing — no one’s seen the full playbook yet. HIP-3 details are still light, and the project’s rocket-speed growth comes with its own risks. Case in point: a recent outage froze withdrawals, sparking a few debates about whether the network can keep up with the load as it scales.

Big Money Backs the Bet

Adding a twist to the story, word is that Paradigm — one of the most influential VCs in crypto — might be holding as much as $765 million in HYPE tokens. If true, that’s not just a bag, it’s a conviction play from an institutional heavyweight.

Whether HIP-3 delivers on its promise or not, one thing’s clear — Hyperliquid isn’t just nibbling at the edges of the DeFi market anymore. It’s going for the main course.