- Hyperliquid is redefining decentralized derivatives with CEX-grade speed and a fully on-chain order book, aiming to capture 50% of new DeFi volume.

- The $HYPE token powers the ecosystem, serving as the currency for fees, staking, and governance, with a capped supply of 1 billion tokens.

- With 200,000 orders per second and a roadmap focused on attracting billion-dollar protocols, Hyperliquid is positioned for rapid DeFi expansion.

Hyperliquid, a high-performance Layer 1 blockchain, is reshaping decentralized derivatives by delivering CEX-grade speed with on-chain transparency. Built for capital markets, it fuses ultra-low latency infrastructure with a fully public, permissionless order book — quickly emerging as one of the hottest DeFi solutions in the space. So, let us dive in and take a closer look at the project.

What is Hyperliquid?

Hyperliquid is a purpose-built blockchain designed to create a fully on-chain open financial system. Unlike traditional decentralized exchanges (DEXs) that rely on Automated Market Makers (AMMs) or off-chain order books, Hyperliquid employs a fully on-chain order book model, ensuring instant trade execution, deep liquidity, and transparency.

What sets Hyperliquid apart is its commitment to complete on-chain transparency — no off-chain matching, no AMMs, no private investors. Every order, trade, and liquidation is executed fully on-chain with sub-second finality. It is a platform where traders, builders, and capital meet on neutral ground, underpinned by performance that rivals top-tier CEXs while retaining DeFi’s core values.

How Does it Work?

At its core, Hyperliquid operates on a dual-state execution model:

- HyperCore – Handles perpetual futures and spot order books, processing 200,000 orders per second with one-block finality.

- HyperEVM – A general-purpose smart contract platform, enabling DeFi applications, lending protocols, and NFT marketplaces to leverage Hyperliquid’s liquidity.

All in all, this dual-layer system ensures seamless interaction between liquidity pools and decentralized applications, creating a unified infrastructure for efficient capital movement.

$HYPE and Its Utility

The $HYPE token is the backbone of the Hyperliquid ecosystem, serving multiple functions:

- Transaction Fees – Used for paying trading fees, with discounts available.

- Staking – Supports network security and incentivizes participation.

- Governance – Grants voting rights for Hyperliquid Improvement Proposals (HIPs).

Tokenomics and Distribution

The total supply of $HYPE is capped at 1 billion tokens, with a well-structured distribution plan to ensure long-term sustainability and community involvement. This includes:

- 31% (310 million) for airdrops to early users, incentivizing community participation.

- 38.9% (389 million) for staking rewards and incentives, encouraging network security and growth.

- 23.8% (238 million) for contributors, with a 1-year lockup and linear release.

- 6.3% (63 million) for team and advisors, with a vesting period.

Roadmap and Future Plans

Looking ahead, Hyperliquid’s roadmap is designed for rapid scaling and long-term sustainability. Key milestones include:

- Incentivizing Builders – Expanding builder codes to decentralize access and attract billion-dollar protocols to the ecosystem.

- Liquidity Leadership – Positioning Hyperliquid to capture 50% of new DeFi volume, offering CEX-level liquidity while remaining fully decentralized.

Final Thoughts

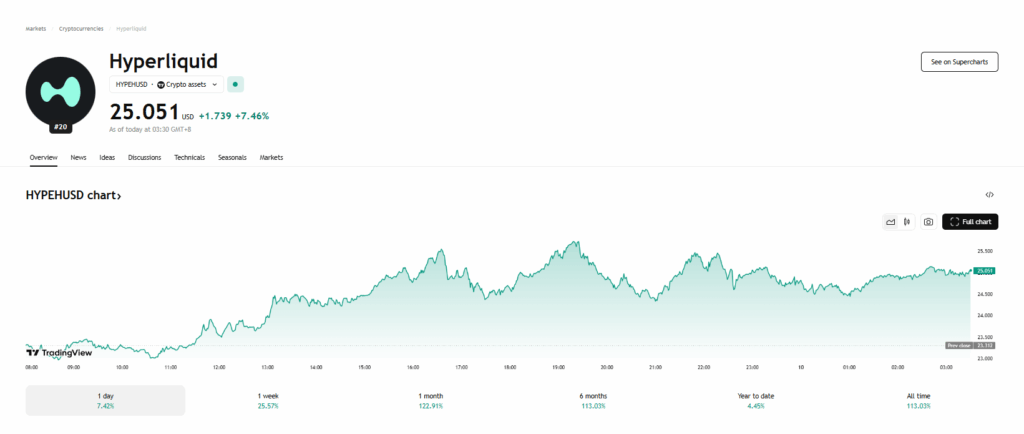

In conclusion, Hyperliquid’s unmatched speed, transparency, and efficiency are positioning it to reshape the future of DeFi. And with daily trading volumes in the billions and cumulative trading volume nearing $1 trillion, it is rapidly establishing itself as a leading force in the space. So, as it continues to scale, it will be interesting to see how Hyperliquid drives mass adoption of DeFi.

Explore more about Hyperliquid through its Twitter.