- HYPE broke out of a descending triangle and is trading near $30, with volume rising over 14% in 24 hours.

- Arthur Hayes predicted a potential move to $150 by July 2026, fueling bullish sentiment.

- Growing DEX volume, rising revenue, and leveraged long positions suggest strengthening upside momentum above $29 support.

As the broader crypto market begins to stabilize, Hyperliquid (HYPE) has flashed a strong reversal signal. The token pushed through resistance with what looks like a clean bullish breakout, and traders noticed almost immediately. At press time, HYPE is trading around $30.30, up roughly 4.75% in the past 24 hours. Not a small move, especially in a market that only recently looked shaky.

Volume tells part of the story. Trading activity climbed 14.5% to about $207.95 million, suggesting this isn’t just a thin bounce. There’s real participation behind it. When price and volume rise together, that usually means interest is building, not fading.

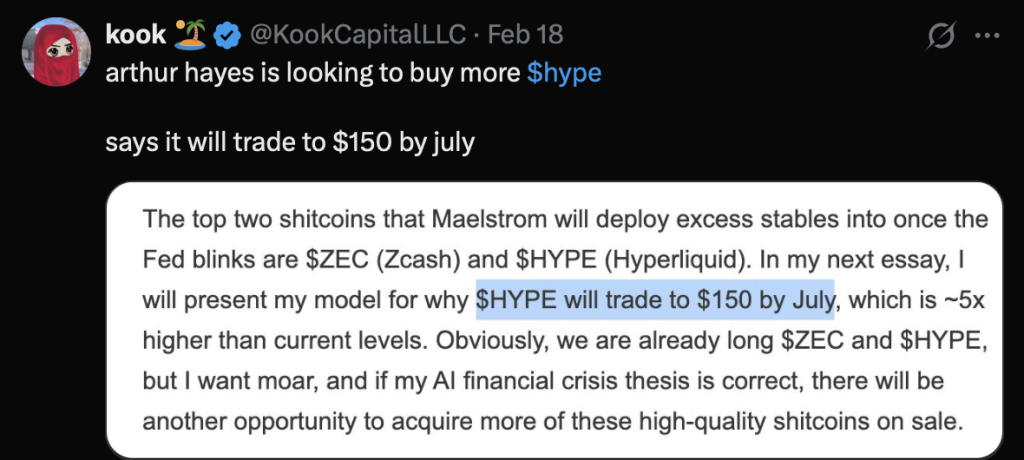

Arthur Hayes Drops a $150 Prediction

The rally gained even more traction after a post on X highlighted a bold call from Arthur Hayes, former BitMEX CEO. Hayes reportedly plans to accumulate more HYPE, with a long-term target of $150 by July 2026. That kind of projection doesn’t stay quiet for long, and it quickly spread across crypto Twitter.

Whether you see it as visionary or aggressive, the number grabbed attention. A move to $150 from current levels would imply massive upside. It also reinforces the idea that some heavyweight players view HYPE as more than just a short-term trade.

On the four-hour chart, HYPE appears to have broken out of a descending triangle pattern, a setup often associated with trend reversals when breached to the upside. As long as price holds above the $29 support zone, analysts suggest a potential 20% move toward $36 in the near term. However, if HYPE slips below $28 and closes a four-hour candle there, the bullish case weakens quickly. That would likely invite sharp selling.

Indicators Show Momentum, But Not Overheating

The technical indicators are supportive, though not screaming euphoria. The Average Directional Index (ADX) currently sits at 12.26, well below the 25 threshold typically associated with strong trends. That suggests the breakout is still developing and hasn’t fully matured into a powerful directional move.

Meanwhile, the Relative Strength Index (RSI) is around 57.97. That places it comfortably below overbought territory, leaving room for further upside if buying pressure continues. In other words, momentum is building, but it’s not stretched. Not yet.

Leverage and On-Chain Activity Add Fuel

Derivatives data from CoinGlass shows traders leaning bullish. Over-leveraged positions cluster around $28.32 on the downside and $30.92 on the upside. At those levels, roughly $14.49 million in long positions outweigh about $4.70 million in shorts. That imbalance indicates bulls are currently in control, at least in the short term.

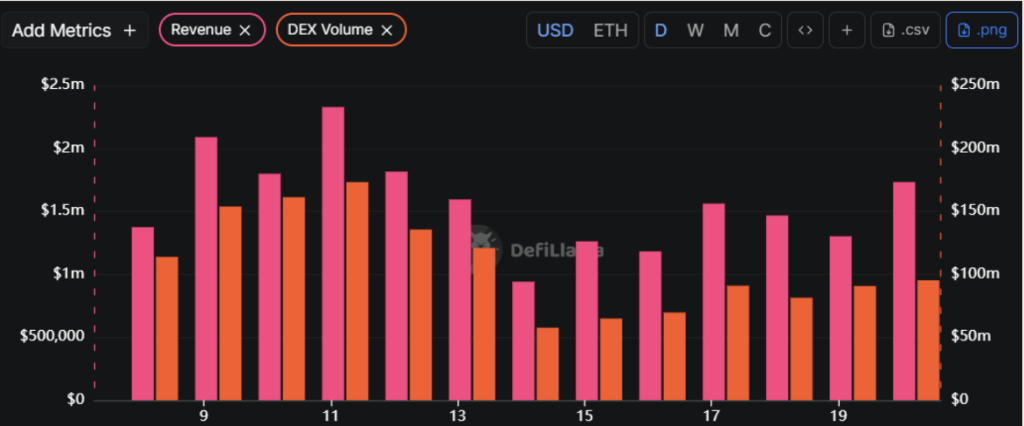

On-chain metrics strengthen the narrative. According to DeFiLlama, Hyperliquid’s revenue has climbed from $941.78K to $1.73 million since February 14, 2026. DEX volume jumped from $57.59 million to $95.31 million in the same period. That’s not marginal growth. It reflects rising engagement and deeper liquidity flowing through the protocol.

Taken together, HYPE’s breakout, leveraged positioning, and expanding on-chain activity paint a constructive picture. The trend is still young. The conviction isn’t extreme. But the structure is tilting bullish, and if momentum holds above key support, the next leg higher could arrive faster than many expect.