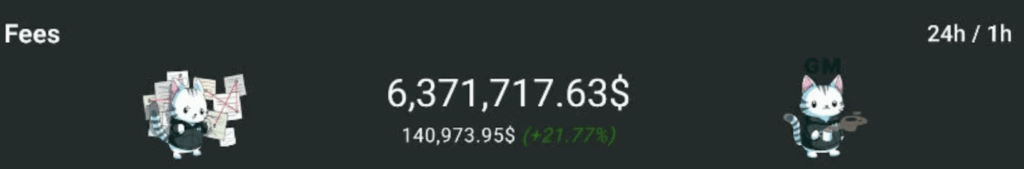

- Hyperliquid absorbed 140K HYPE in a day, with buyback volume jumping 21%.

- $40–$41 is the key support zone; $48 remains the breakout level.

- Harmonic AB=CD pattern projects targets between $52–$54 if bulls push through resistance.

Hyperliquid’s HYPE token is holding steady near $40 support while traders watch for a breakout above $48. Momentum has been picking up again, largely thanks to the platform’s fee-driven buyback program, which absorbed over 140,000 tokens in just a day—more than $6.3M worth. That kind of recurring demand has given bulls fresh confidence that HYPE may be setting up for another leg higher.

Buybacks Create a Strong Floor

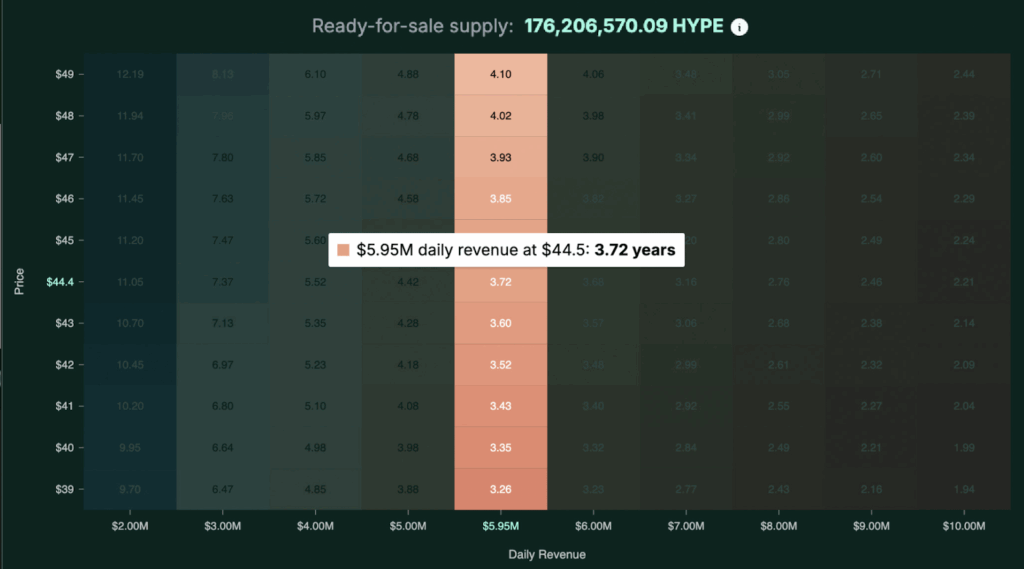

The latest buyback marked a 21% surge in volume, underscoring how tightly HYPE’s demand is linked to platform usage. Unlike one-off burns or hype-driven pumps, these buybacks are baked into Hyperliquid’s mechanics: more trading activity means more fees, which means more HYPE taken off the market. Analyst HYPEconomist even suggested that at the current pace—roughly $5.95M absorbed daily—it would take just under 4 years for the platform to buy back its entire ready-for-sale supply. That math highlights how powerful the feedback loop is when usage and liquidity remain strong.

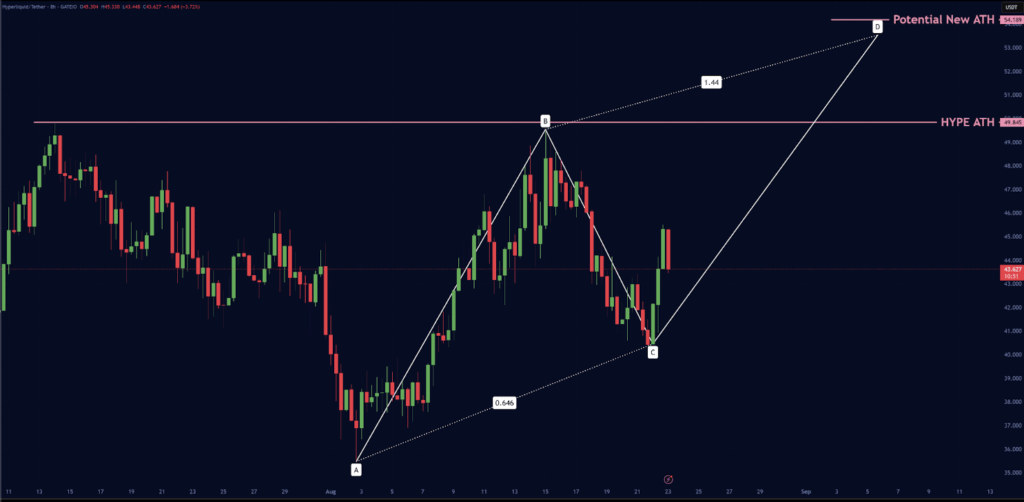

Technicals Point to Breakout

From a chart perspective, HYPE is respecting its levels cleanly. The token bounced off the 0.5 Fibonacci retracement zone, holding firm above $40 support. Analyst Greeny notes that this mid-range pivot often decides the next trend direction, and right now, structure favors continuation higher. With price consolidating between $40 and $48, repeated tests of resistance suggest mounting pressure for a breakout. A push above $48 could quickly unlock targets in the $52–$55 zone, where the next band of resistance sits.

Harmonic Pattern Targets $54

Adding to the bullish picture, analyst Jesse Peralta highlighted an AB=CD harmonic pattern, projecting a move toward $54 if the breakout holds. The retracement from $38 to $39 lined up perfectly with the pattern’s structure, and the recovery leg now points straight at the mid-$50s. Of course, bulls need a strong daily close above $48 to confirm it. If support at $42 were to give way instead, downside risk opens back into the mid-$30s.

Outlook for HYPE

Right now, the bias leans bullish. Support between $40–$41 has been defended multiple times, while $48 remains the ceiling to watch. Break above it, and the harmonic pattern likely carries HYPE into new highs. Fail to hold it, and traders could be looking at another round of chop. But with buybacks running strong and technicals aligning, bulls seem to have the upper hand—for now.