- Bitcoin fell below $100,000 as fears of a U.S.-led trade war caused a global crypto market sell-off.

- Trump’s meme coin dropped 75% from its peak, while Melania Trump’s coin plunged nearly 90%.

- Despite the volatility, cryptocurrencies have surged since Trump’s election, with bitcoin near its all-time high.

Cryptocurrency markets took a nosedive amid fears of a trade war sparked by U.S. President Donald Trump‘s announcement of steep tariffs on imports from Canada, Mexico, and China. Bitcoin, along with Ethereum and Dogecoin, saw sharp declines, with some digital assets dropping more than 10%.

Bitcoin fell below the $100,000 mark, briefly hitting $92,000 Sunday night before recovering to $99,000 by Monday morning after Trump announced a temporary pause on tariffs targeting Mexican goods. Meanwhile, Ethereum, dogecoin, and even Trump’s own meme coin tumbled in value, reflecting heightened market volatility.

Market Reactions and Analysis

Garrick Hileman, a cryptocurrency analyst, commented that while riskier assets tend to see bigger swings, the extent of these drops was “a little surprising.” The sell-off coincided with broader declines across global financial markets as the tariffs loomed. Trump warned Americans to brace for short-term economic pain, insisting it was “worth the price” to restore U.S. economic dominance.

Trump also hinted at forthcoming tariffs on the European Union and possibly the United Kingdom, adding further uncertainty to global trade and investment sentiment.

Meme Coins Crater

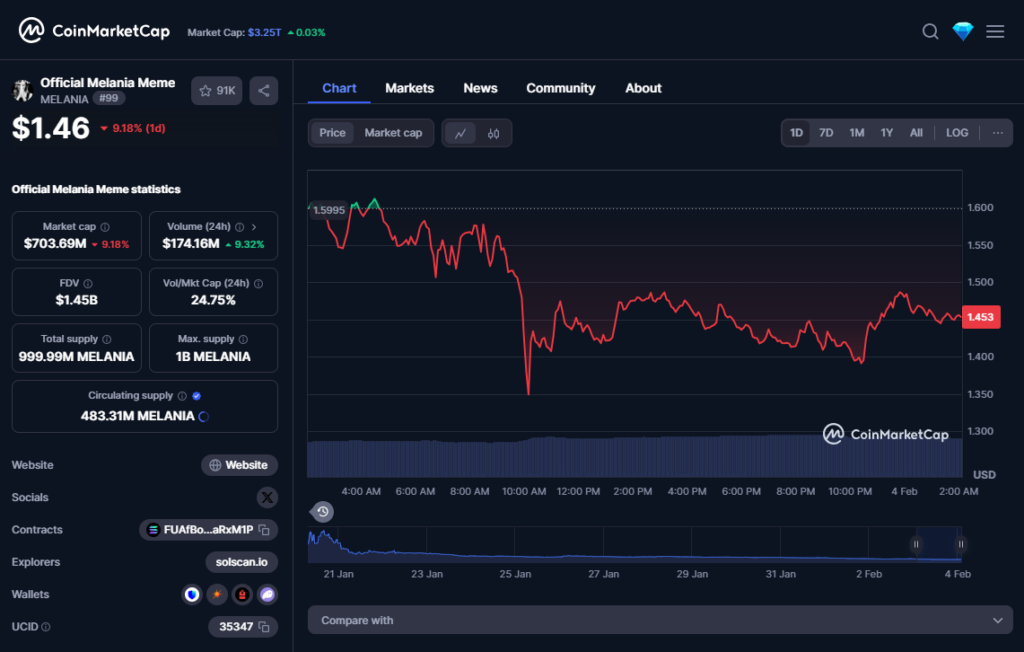

Trump’s meme coin, launched just before his second inauguration, saw a steep decline—trading around $19 on Monday, roughly 75% off its peak. First Lady Melania Trump’s meme coin fared even worse, plunging nearly 90% from its all-time high to $1.50.

Meme coins, notorious for their volatility, often begin as jokes but can experience explosive price surges when hype drives demand. However, they remain particularly sensitive to shifts in market sentiment.

Crypto Policy Under Trump

Once a vocal crypto skeptic, Trump has become a major proponent of digital assets. His administration has embraced crypto both as an economic priority and a personal business venture. Trump appointed several pro-crypto officials to key government roles and has pledged to make the U.S. a global leader in digital finance.

Despite recent turbulence, cryptocurrencies have surged in value since Trump’s election, with bitcoin still trading near its record high of $109,000. As the markets grapple with uncertainty, eyes remain on how U.S. crypto policies will evolve in the face of new global trade tensions.