• LINK is up 5.4% this week, rebounding to $17.60 after a 20% October drop.

• Whale wallets have accumulated over $20M in LINK in recent months.

• Analysts see potential for a move toward $25 in 2025 and as high as $100 by 2026 — here is why whales are betting big.

Chainlink (LINK) is finally showing signs of recovery after a turbulent October. The token is up about 5.4% this week, trading around $17.60, supported by heavy whale accumulation and improving sentiment. Data from Lookonchain reveals that two major wallets — “0xf386” and “0xe8aa” — have withdrawn millions in LINK from centralized exchanges OKX and Kraken. The first wallet alone has accumulated 1.1 million LINK (roughly $19 million) over the past five months, while the second has added over 307,000 LINK in just the past month.

Whale Accumulation Sparks Optimism

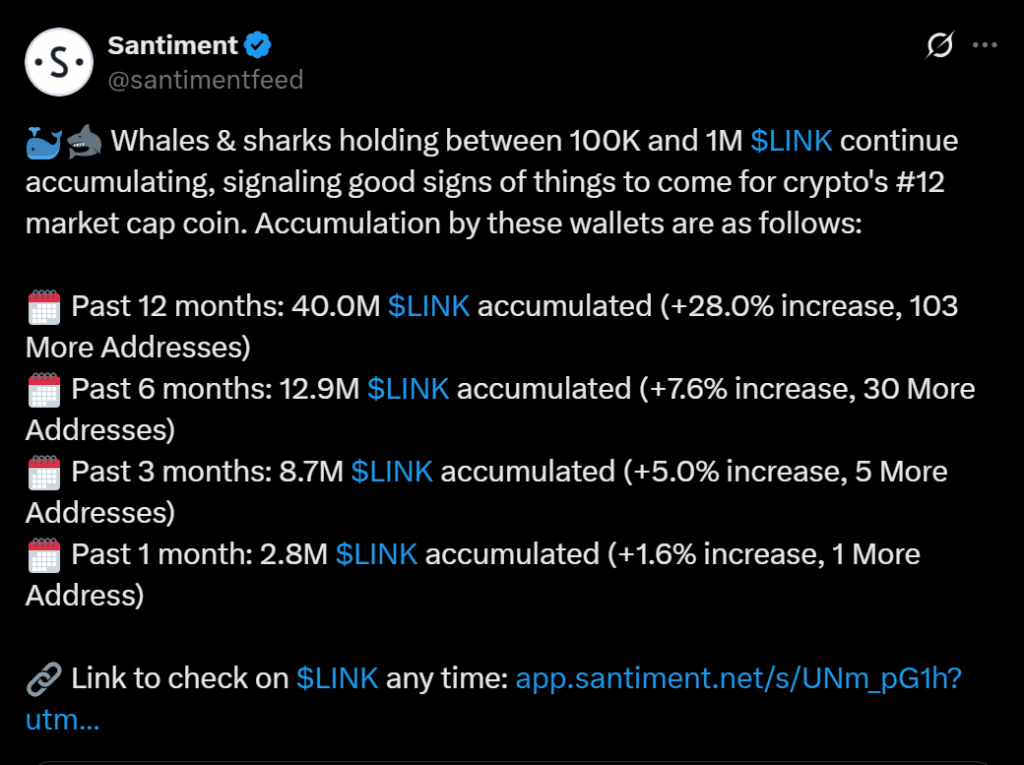

According to Santiment, wallets holding between 100,000 and 1 million LINK have steadily increased their holdings throughout October’s price dip. This kind of accumulation often signals smart-money positioning before a broader rally. Chainlink’s on-chain data also shows that its treasury recently added 63,481 LINK (about $1.1 million), effectively reducing selling pressure. The combination of whale buying and treasury reinforcement has helped LINK rebound from its $17 resistance zone, closing last week at $17.58.

Price Outlook: Eyes on $20 and Beyond

Analysts from CoinCodex expect the bullish momentum to continue, projecting LINK to climb another 9.3% to reach $19.48 by late November. If buying pressure holds, a test of the $20 level could come before year-end. Looking further out, some models forecast LINK reaching between $50 and $100 by 2026 — especially if Chainlink’s first ETF proposal moves forward. A green 2025 finish would put LINK in a strong position to lead DeFi-focused assets into the next crypto cycle.

The Bigger Picture

While short-term volatility remains high, the fundamentals behind Chainlink’s rebound are strong. Whale accumulation, active treasury management, and rising on-chain engagement all point toward renewed investor confidence. If macro conditions stabilize and institutional demand increases, LINK’s recent move could be the start of a larger upward phase — not just another temporary bounce.