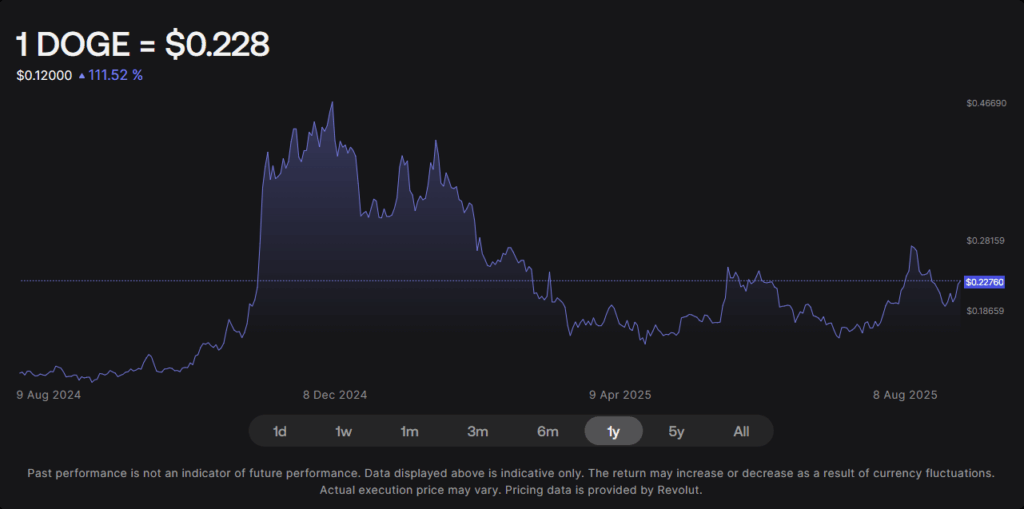

- DOGE is up triple digits since August 2024, fueled by policy shifts and bullish sentiment.

- A likely September rate cut could boost risk assets, including Dogecoin.

- Economic uncertainty still clouds the path to a sustained rally toward $0.50.

Dogecoin has been on a tear lately—up 8.4% on the daily chart, 9.1% over the week, 30.1% in the last month, and more than 120% since August 2024. Still, it’s not been a straight shot up. CoinGecko data shows a 1.7% dip over the past two weeks, a reminder that even strong rallies stumble now and then. With September’s possible interest rate cut looming, traders are already asking the big question—can DOGE really push to $0.50?

Policy Moves Fueling the Rally

A big spark came from President Trump’s decision to allow retirement funds to invest in crypto assets. For DOGE, that’s not just news—it’s the kind of shift that could, down the line, place it inside 401(k) portfolios. The move plays right into a growing appetite among institutions for digital asset exposure, and for the broader crypto space, it feels like one more domino falling toward mainstream adoption. When you pair that with bullish sentiment building across the market, it’s not hard to see why DOGE’s price found fresh legs.

Interest Rate Cuts in Play

Another driver? The near-90% probability, according to CME’s FedWatch tool, that the Federal Reserve will cut rates by 25 basis points in September. Risk assets—from tech stocks to meme coins—often thrive when borrowing costs drop, and Dogecoin tends to move with that tide. The last Fed meeting left rates unchanged, a decision that hit crypto prices hard. This time, with President Trump pressing for cuts, the odds are tilted toward a softer stance—and potentially another leg up for DOGE if traders smell easier money ahead.

The Caution Flag Still Flies

But it’s not all clear skies. The global economy remains shaky—trade wars, tariffs, and sluggish growth are still lurking in the background. Even with a rate cut, any sharp downturn in the broader market could hit DOGE just as hard as anything else. While short-term momentum is strong, an all-out bull run may still be a stretch without more stability in macro conditions. For now, the $0.50 target isn’t out of the conversation, but it’s not locked in either—Dogecoin will need the perfect mix of policy tailwinds and market confidence to get there.